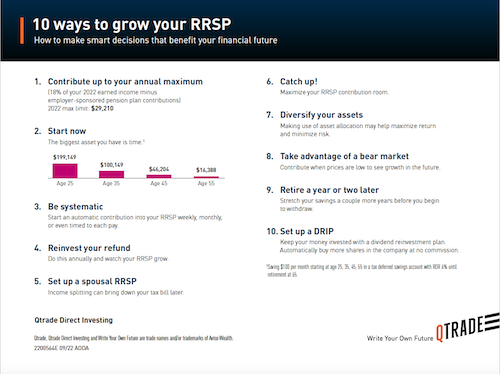

10 ways to grow your RRSP

You want to ensure your financial future, right? If you’re looking for ways to grow your registered retirement savings plan (RRSP), we have ten great tips below that can help.

1. Contribute up to your RRSP maximum

Your allowable RRSP contribution for the 2022 tax year is the lesser of:

- 18% of the earned income reported on your tax return for the previous year

- The maximum annual contribution limit for the year, which is set by the government (for the 2023 tax year, the maximum is $30,780)

- The remaining limit after any employer-sponsored pension plan contribution known as your “pension adjustment”, found on your T4 or T4A slip).

2. Start now

One of the biggest assets you have is time. The earlier you start investing, the more you benefit from the power of compounding. Compounding occurs when the returns that your investments earn begin to generate a return. In an RRSP account, compounding growth is unhindered. You can reinvest your gains, including your dividend and interest income, without paying any tax, as long as the funds remain within the plan. Learn more.

3. Be systematic

If you make something a habit, it makes it easier to remember and stick with it. Investing is like that. Consider starting an automatic contribution into your RRSP account on a regular basis – weekly, bi-weekly, monthly, or better yet, make it coincide with your payday. It’ll make it easier for you to maximize your RRSP contribution at tax time.

4. Reinvest your tax refund

Give your RRSP account balance a boost! At tax time, your RRSP contributions reduce your taxable income, which helps to lower your tax bill. Often, it can result in a larger refund. If you do receive a tax refund, consider putting it back into your RRSP and use it toward next year’s contribution room. It’ll make it easier to maximize your contributions when tax time comes around again.

5. If you have a spouse, set up a spousal RRSP

Income splitting can bring down your tax bill later. You can contribute to an RRSP account for your spouse (including common-law) to help them save for retirement and potentially reduce your combined tax bill. When you make a contribution to your spouse’s RRSP, you reduce your own contribution limit, but receive the deduction on your taxes. If your spouse earns a significantly lower income than you, that deduction could make a bigger difference on your tax return than on theirs.

6. Catch up on your contributions

Maximize your unused RRSP contribution room. If there are income-earning years in which you did not make an RRSP contribution, you can use that room to catch up on your contributions. Your excess RRSP contribution room is listed on your previous year’s Notice of Assessment, or by logging in to the Government of Canada’s My Account.

7. Diversify your assets

The practice of spreading your money among different investments is called diversification. Different kinds of assets tend to respond differently in various market cycles. For example, historically, rising equity prices have been associated with falling bond prices. By investing in more than one asset category, you can reduce volatility and give your portfolio a smoother ride. You can diversify your investments by industry sector, by geographical region, and by level of market capitalization (an indication of the size of a company).

An asset allocation strategy establishes the relative proportions of equities, fixed income and cash-based investments in your portfolio. Your asset mix is personal to you because it’s related to your tolerance for risk, investment time horizon and financial goals. Your aim is to choose an asset allocation strategy designed to meet your goals, while exposing you to a level of risk that you are comfortable with.

8. Take advantage of a bear market

The goal is always to buy low and sell high – you want to purchase your investment at the lowest possible price, and to hold the investment until its price rises, and you can sell it at a profit. If you contribute to your RRSP account and invest when we’re in a bear market (a market where prices are consistently trending downward), you’re purchasing when prices are low. You’ll see growth when the prices go up.

9. If you can, retire a year or two later

Although an RRSP must be collapsed (converted to a RRIF, an annuity or cash) by the end of the year you turn age 71, most Canadians retire before that. If you’re still earning income, you can still contribute to your RRSP. And if you can leave your investments in your RRSP longer, they have the potential to keep growing longer.

Also, keep in mind that if you make withdrawals from your RRSP, it is subject to withholding tax, and will be taxable as income in the year it is withdrawn. It’s best to withdraw funds when your tax rate is lower.

10. Reinvest your dividends by setting up a DRIP

Keep your money invested, re-invested and compounding, by setting up a dividend reinvestment plan (DRIP) for any dividend-paying stocks that you own. With a DRIP, stock dividend payments are automatically used to buy more shares in the company. No commissions are charged for DRIP share purchases.

For an enlarged view, download the infographic.