Why start investing

To most Canadians, a savings account is something they started when they were young. You probably deposited that birthday cheque from your grandparents or set aside money from your weekly allowance to save for a future purchase. However, some are less familiar with the broader concept of “investing”. Both saving and investing are designed to help you accumulate money, but they serve different functions within your overall financial plan. Both are vital to ensuring your future financial health.

Saving versus investing

Saving is when you set aside money for future use. It could be in one lump sum, or smaller amounts set aside on a regular basis. You might save money for a variety of goals, such as a vacation, a car or a home down payment, or for longer-term goals, including your children’s education or your retirement.

Investing is when you put your money into a financial product that will yield a return, so the value grows over time. It is more focused on maximizing your return, your income, or your tax savings, depending on your needs and goals. Investment types include everything from a high-interest savings account or guaranteed investment certificate (GIC), to stocks, bonds, exchange-traded funds (ETFs) and mutual funds.

Learn more about how to start investing with A beginner’s guide to online investing.

Important concepts related to investing

Liquidity

Putting aside money in a bank account or money market account is usually good for short-term needs, to pay for your day-to-day expenses, or as an emergency fund to cover unexpected costs. In the short term, your main consideration is usually “liquidity” – or, how easily you can access your cash. The more liquid your money is, generally the lower your return will be. Conversely, if you can put aside money into an investment asset for a longer amount of time without accessing it, you’ll usually see a greater return on your investment.

Investment time horizon

This is the length of time you plan to invest your money and will change according to your goal. Whether you’re saving for the short term or the long term, your investment time horizon should be a key consideration when choosing investments. Generally, the longer your time horizon, the longer you have to ride out fluctuations in the market, and therefore, the more risk you may be able to take on.

Risk versus reward

Many investment types – stocks, bonds, ETFs, mutual funds, etc. – come with some level of risk, especially over the short term. The value of your investment can go up and down, fluctuating according to market conditions (interest rate environment, industry/sector events, geopolitical conflict, regulatory change, etc.) or asset fundamentals (a company’s financial performance or creditworthiness). If you sell the investment when its value is down, you lose money. If you sell when its value is up, you make a profit.

Historically, the asset classes that come with a bit more risk tend to produce better returns, better growth, more rewards over the long term. The longer you have to invest, generally the more risk you can take on in your investments as the returns tend to even out over time.

Take a look at the performance over time for the asset classes below. In the one-year period, the fluctuation in returns is striking, but over a longer time – five, 10 and 15 years down the road – the returns even out. As we see in the chart above, even global stocks, the asset class that tends to carry the most risk, had positive returns over the long term, and tended to beat the returns of lower-risk asset classes.

Source: NEI Investments

The risks associated with investing can lead some people to avoid investing all together. But there are some very good reasons to invest, and there are strategies you can employ to help lower your risk.

Why should I invest?

First, investing tends to give you better returns over the long term.

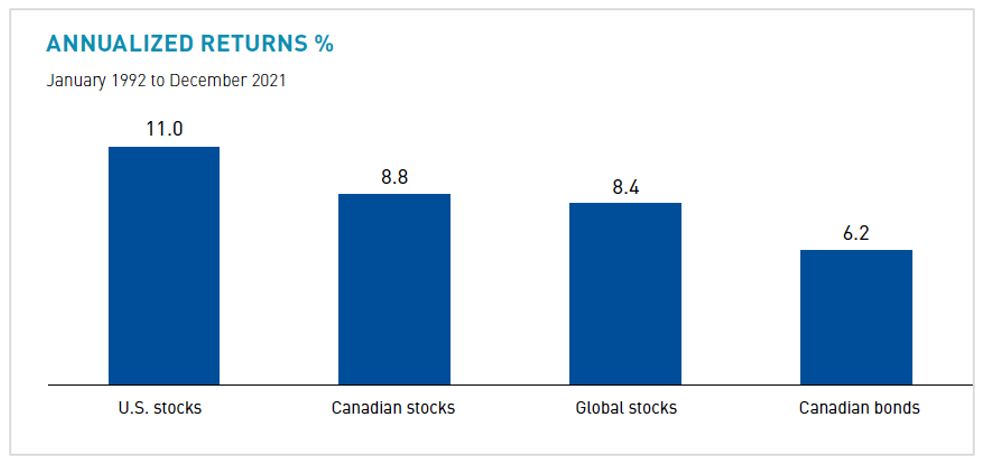

Historically, over the long term, investing is more likely to give you better growth in the value of your investments than keeping your money under your mattress or in a savings account. The chart below shows the annualized returns from 1992 to 2021 for some common asset classes. For the same period, the annualized return on a savings account was approximately 0.7%.

Source: NEI Investments

While returns of all asset classes fluctuate over time, it’s clear that the returns on stocks and bonds were significantly higher over the long term than a savings account. To illustrate, below is a table that shows what a $1,000 investment in 1992 in each of these asset classes would have been worth in 2021:

| Amount invested 1992 | Value of Investment 2021 | |

|---|---|---|

| U.S. Stocks | $1,000 | $20,623.69 |

| Canadian stocks | $1,000 | $11,540.85 |

| Global stocks | $1,000 | $30,371.68 |

| Canadian bonds | $1,000 | $5722.83 |

| Cash | $1,000 | $1,224.21 |

Sources: Annualized returns data from NEI Investments chart above. Bank of Canada investment calculator

Second, investing tends to give you better inflation protection.

Inflation, simply put, is the rise in the price of goods and services over time. As prices go up, your money doesn’t purchase as many goods and services as it used to because the cost of goods has increased. Inflation erodes the purchasing power of your money over time.

According to the Bank of Canada’s inflation calculator, the goods and services that $1,000 would have purchased in 1992 would have cost $1,136.90 in 2000, and $1,683.33 in 2021. The $1,000 invested in savings in 1992 would yield $1,224.21 in 2021 – which would certainly not have kept up with the rate of inflation.

As prices rise, you want your wage/salary to go up accordingly. The same applies to your investments – you want them to grow over the long term, and to keep pace with inflation. Investing can help you do that.

Third, investing can offer tax savings.

There are three types of investment income, and they are each taxed differently. Some investments earn more than one type of income.

Interest: This is what you earn in a savings account, a GIC or bond. The interest earned is fully taxable at the same tax rate as your income.

Dividends: This is a payment from a company to its shareholders, usually a portion of its profits. If you own that company’s stock, you’d be eligible to receive dividends. Dividends are taxable at preferred federal and provincial tax rates through tax credits.

Capital gains: These are earned when you sell an asset for more than you paid for it. Capital gains apply to stocks, bonds and real estate, among other assets. Capital gains have preferential tax treatment, with gains taxable at 50%. So, for example, if you made $300 in capital gains on your investment, only $150 of that would be taxable as income.

As you can see, saving and investing work in tandem, but they are different. Both are designed to help you accumulate money, but they tend to serve different functions within your overall financial plan. If you haven’t yet started to invest, what are you waiting for? Take the first step toward ensuring your financial future.

Online brokerage services are offered through Qtrade Direct Investing, a division of Aviso Financial Inc. Qtrade and Qtrade Direct Investing are trade names or trademarks of Aviso Wealth Inc. and/or its affiliates.

Aviso Wealth Inc. ('Aviso') is a wholly owned subsidiary of Aviso Wealth LP, which in turn is owned 50% by Desjardins Financial Holding Inc. and 50% by a limited partnership owned by the five Provincial Credit Union Centrals and The CUMIS Group Limited. The following entities are subsidiaries of Aviso: Aviso Financial Inc. (including divisions Aviso Wealth, Qtrade Direct Investing, Qtrade Guided Portfolios, Aviso Correspondent Partners), and Northwest & Ethical Investments L.P.

The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes, and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters. Information, figures, and charts are summarized for illustrative purposes only and are subject to change without notice. All investments are subject to risk, including the possible loss of principal.