What is asset allocation?

Your investments need a plan to help you reach your financial goals. Asset allocation is a relatively straightforward investment strategy that can help you to balance investing risks and rewards.

An asset allocation strategy establishes the relative proportions of equities, fixed income, and cash-based investments in your portfolio. Each of these asset categories, or asset classes as they are also known, have different levels of risk and different return potential, so an asset allocation strategy helps to manage risk versus reward over the long term.

Your asset allocation mix is personal to you because it must be appropriate to your tolerance for risk, time horizon and objectives. Basically, you aim to choose an asset allocation model calibrated to meet your goals, while exposing you to a level of risk you’re comfortable with.

How to determine your asset allocation mix

Your asset allocation strategy should be based on your investing goals, risk tolerance, and investment time horizon. Once you’ve determined these elements, you can choose the most appropriate asset allocation model.

Investment goal

When considering your goals, there are a couple things to keep in mind. Each of your investing goals – and you probably have several – should be purposeful, specific, and achievable. Identify your goal(s), determine what you’re saving for, and how much you’ll need to put away.

Investment time horizon

This is the period of time you expect to hold your investment. The longer your goal’s time horizon, the longer you’ll be able to take advantage of the power of compounding, and the longer you’ll be able to recover from any market downturns. Because of this, generally speaking, the longer the investment time horizon, the more aggressive you can be with asset choices. However, that will depend on your tolerance for risk.

Risk tolerance

Risk tolerance is the level of risk you’re willing to accept for the possibility of higher returns. The value of many investments fluctuates over time, with some asset types being more volatile than others. Most stocks, for example, tend to be more volatile and carry more risk than most bonds. Both stocks and bonds are more volatile than holding cash. Your own risk tolerance could be a factor of your age, goals, profession and income level. Only you can decide what level of risk you’re willing to accept in your investments.

Assessing risk versus reward

Once you’ve established your goal, time horizon and risk tolerance, you need to determine your asset allocation (or investment mix) of equities, fixed income and cash-based investments in your portfolio.

Many investment types – stocks, bonds, exchange-traded funds (ETFs), mutual funds, etc. – come with some risk, especially over the short term. The further out your goal is, the longer you’ll have to recover from any downward fluctuations in your investments. Your aim is to choose an asset model calibrated to meet your goals, while exposing you to a level of risk that you are comfortable with.

For example, if you are 35 years old and your goal is to save for retirement at age 65, your investment time horizon is long. So, if you decided to invest in stocks, which generally carry more risk than other common investments, you would have the benefit of time to ride out any dips in the stock market.

Conversely, suppose you’re investing for a home you plan to purchase in the next few years. In that case, it might be prudent to avoid a higher-risk investment. If your investment value dips just when you need to access your money, you’d end up with less money than anticipated.

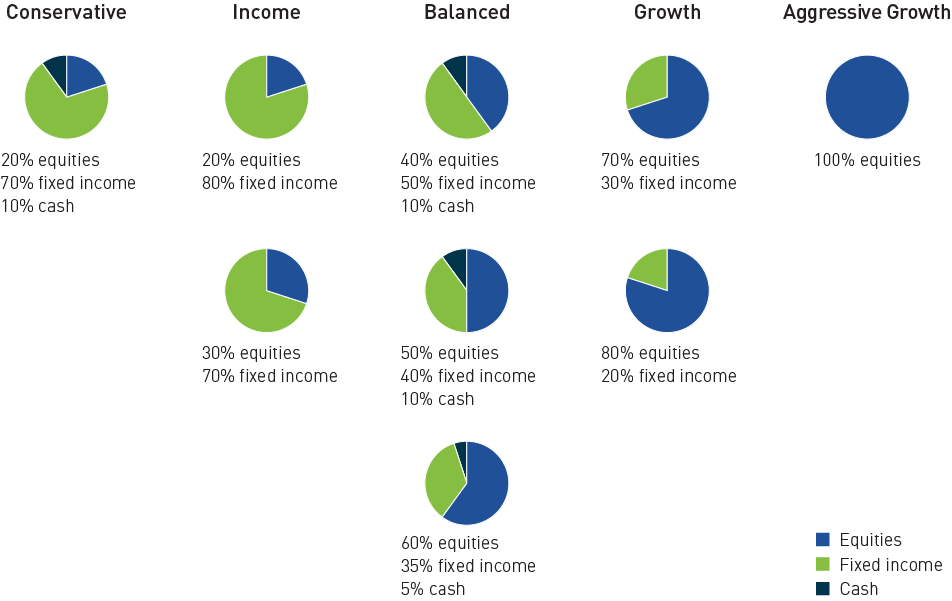

Sample asset allocation models

Once you’ve established the fundamentals, you’re ready to determine your ideal asset allocation mix. There are many variations, but we’ve provided some basic asset allocation models below that may suit different types of investors.

Investor profile descriptions

The above asset allocation models roughly correspond to investor profiles detailed below.

Conservative – Preserving the value of capital is the priority. The conservative investor is willing to accept lower growth prospects in exchange for low volatility in their portfolio. They hold relatively safe assets, such as cash-based and high-quality fixed income investments, in addition to a small percentage of equities.

Income – The objective is to generate regular, dependable income from the portfolio. The income investor is focused on achieving a consistent rate of return, with minimal fluctuations in the value of the underlying capital. High-quality fixed income investments comprise a majority of their portfolio.

Balanced – Comfortable with moderate short-term fluctuations in the value of their investments, the balanced investor seeks a combination of capital appreciation and income. Their assets are a balanced mix of equities for growth potential, fixed-income and/or dividend-paying stocks for income, and cash-based investments for stability.

Growth – Growth is the goal, and the growth investor is willing to take on more risk to get it. Their time horizon is long enough to give their portfolio a chance to recover from the impact of short-term market volatility. They have a high percentage of equity-based investments in their portfolio.

Aggressive Growth – The aggressive investor is looking to maximize growth. They are knowledgeable about investing in the stock market, trade frequently, closely monitor their positions, and have a high tolerance for market volatility. In fact, they seek to profit from short-term fluctuations in the market. Margin trading, short selling and options trading are among the strategies they could deploy.

The importance of rebalancing your portfolio

When you choose an asset allocation model, you create a portfolio with an asset mix appropriate to your goals, risk tolerance and investing time horizon. However, over time, that allocation mix will change as markets shift.

For example, let’s assume you originally set your asset allocation at a 60/40 split of equities and fixed income. If the stock market has performed well over the years or you’ve continued to invest regularly in one asset class, your original 60/40 allocation of equities and fixed income might end up closer to 70/30.

Rebalancing means selling some equities and taking those profits to buy more fixed income investments so that your portfolio gets back to that original 60/40 allocation that matches your risk tolerance. Unless you’re using a single asset allocation fund for your portfolio that automatically rebalances for you, this is likely something that you will have to do yourself.

Investors tend to look more closely at their portfolio during down markets, but it’s a good idea to rebalance your portfolio regularly regardless of market conditions.

The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This material is for informational and educational purposes and it is not intended to provide specific advice including, without limitation, investment, financial, tax or similar matters.