Monthly Market Insight - July 2023

Growth continues to surprise on the upside

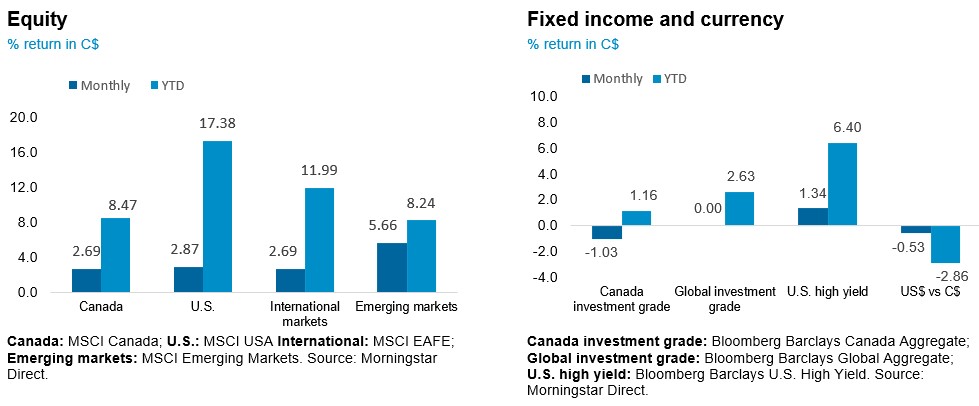

U.S. markets marched into bull market territory in July as economic data continues to show resilience with strong growth and key inflation indicators easing. Positive economic growth and strong labour market triggered a number of upward revisions in economic growth forecasts and even fuels speculation that the economy may avoid a recession. The market has seen a strong rally amid falling inflation, steady economy, strong employment, and better-than-expected Q2 corporate earnings reports. The S&P 500 returned 3.21% in July (USD), bringing its year-to-date returns to 20.64%. Equity markets were up across the board in Europe, Canada, Japan and Emerging Markets. While U.S. 10-year yields ended the month up 12 bps to 3.96%, while the Canadian 10yr rate closed at 3.50%, up 23 bps for the month. Most fixed income markets ended the month lower.

The NEI perspective

Inflation is softening and reaching the lowest levels since the peaking a year ago. In the U.S., Canada and U.K., inflation has surprised to the downside suggesting that the central banks’ policies may be starting to curtail the worst of inflation. Long-term inflation expectations have also returned close to the neutral rate between 2-3%.

Strong corporate earnings are extending the economic expansion with Q2 earnings widely beating consensus estimates. Of the 365 companies that have reported, profitability was also more resilient than expected, with 83% companies beating expectations on earnings, while only 55% companies beating expectations on revenues.

Economic growth remains resilient was U.S. real GDP growth surprises to the upside with the latest quarter-over-quarter growth at 2.4%. Growth momentum also continues to be strong based on the Atlanta Fed’s data predicting 3.9% growth in Q3 2023.

From NEI’s Monthly Market Monitor for July. Read the full report for more insights.

As of July 31, 2023

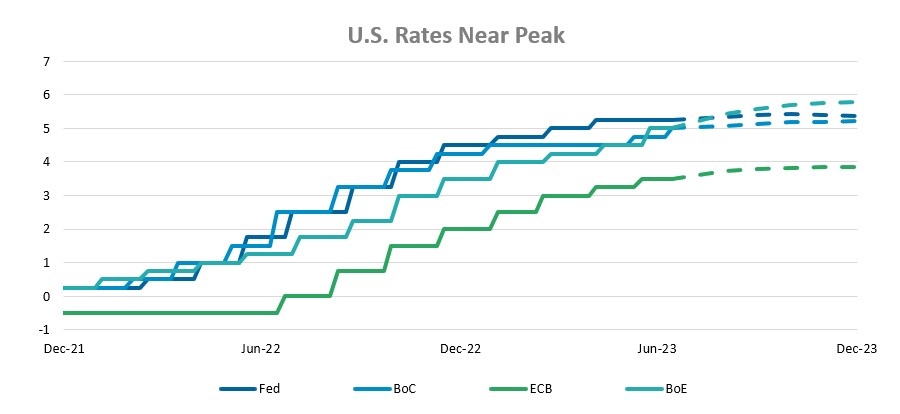

U.S. policy rates closer to peak than in Europe

While the news of improving inflation seems to have rekindled optimism, particularly on the stock markets, the battle to bring inflation back in line with the central banks' target is not over yet.

The Bank of Canada raised its policy rate by 25 bps to 5% in July. The Fed also hiked by 25 bps as expected, to the highest level in 22 years. In the latest announcement, however, Fed Chairman Powell did acknowledge the strength of the economy and the better-than-expected inflation data. In the press conference, Powell also revealed the Fed’s considerations and readiness to begin monetary easing if and when conditions warrants, indicating the central bank’s resolve in lowering inflation while trying to lower the damage to the economy in the process.

The ECB also hiked 25 bps as expected. Europe is farther behind on their tightening cycle as inflation rates are still much higher than tolerable levels, while interest rates in the US are likely near peak in this tightening cycle.

Source: Bloomberg data as of July 31, 2023

Inflation moderating and risks resurgence

Inflation is softening and reaching the lowest levels since the peak inflation a year ago. In the U.S., Canada and U.K., inflation has surprised to the downside suggesting that the central banks’ policies may be starting to curtail the worst of inflation. Long-term inflation expectations have also returned close to the neutral rate between 2-3%.

However, we’re not out of the woods yet and could see inflation rebound moderately higher in the near term:

- Oil has surged by 15.8% in July, which could push the year-of-year headline inflation higher

- The base-effect will no longer be a tailwind to the year-over-year comparison as the peak inflation levels reached last year will be rolled off

- Real income now exceeds inflation in the US, as inflation recedes. Real income growth could boost spending and pose addition inflation risks

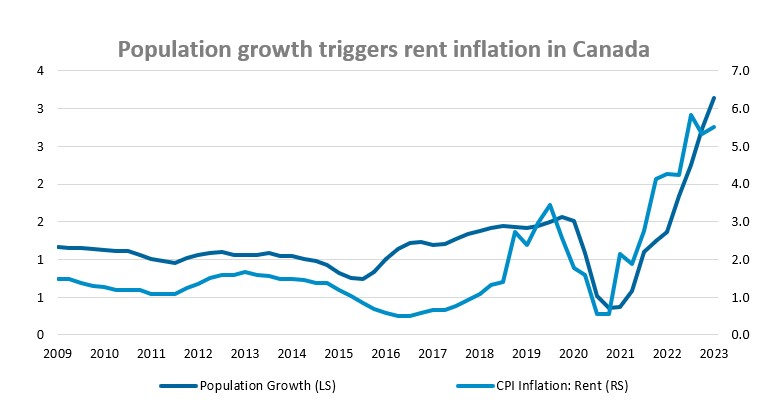

- The stickier components of inflation, like rent, are continuing to put pressure on inflation. Rent has shown signs of retreat in the U.S. The higher-than-expected growth in population in Canada, however, coupled with the undersupply in the Canadian housing market, is triggering a rebound in housing prices despite the rising mortgage rates.

Source: Bloomberg data as of July 31, 2023

Index valuation not representative of the market

The S&P 500 Index has hit the highest concentration level in recent history with top 10 companies surpassing 30% in weighting. With triple-digit year-to-date gains, these largest companies have contributed over 75% of the index’s YTD gains.

While the eye-popping returns of the mega cap companies are taking all the attention, what goes unnoticed is the significant dispersion in valuations between the top 7 companies and the remaining 493. The market as a whole may look expensive and stretched on a valuation basis, but this is mainly driven by the largest 7 stocks. Valuations of the remaining 493 companies are in line with historical average.