Monthly Market Insight - November 2023

Markets staged a remarkable November rally

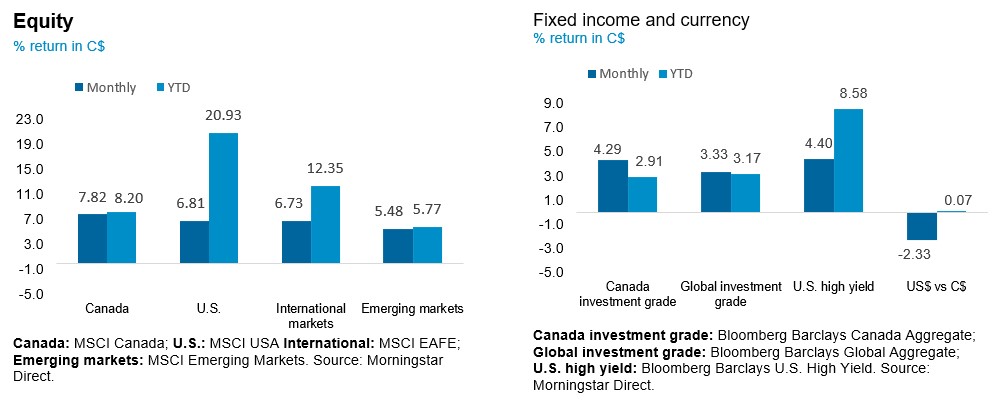

Markets rallied sharply in November, driven by falling inflation data and comments from Fed officials suggesting they may soon reach the end of this tightening cycle. Major stock indices, especially the S&P 500, saw solid gains returning 8.9% for the month, while Nasdaq also rallied by 10.7%. Bond yields declined on lower-than-expected inflation, with the US 10-year Treasury yield dropping below 4.4% by the end of the month after hitting a peak of 5% in late October. Fixed income investments rallied from lower yields and increased expectations for rate cuts in 2024. Global Bond Index returned 5.0%, and Canadian Bond Index returned 4.4% in the month. Investment grade credits gained 5.98% and rising hopes for a soft landing supported high yield bonds where spreads tightened, returning 4.53% in November. Emerging market debt instruments also had a positive month thanks to more accommodative local central bank policy and a weaker U.S. dollar.

The NEI perspective

The miraculous “soft landing” appears to be actually happening as the disinflationary trend continues to signal that underlying inflationary pressures are easing while economic growth continues in the U.S. amid a strong labour market.

Cracks starting to show in consumer spending as business inventory-to-sales ratios are rising despite strong retail sales data, while credit card delinquencies in the U.S. are also beginning to rise again as consumers spend the last of their pandemic savings.

Investors should move off the sidelines after piling a historic amount into money market funds over the last two years to take advantage of high interest rates, the return potential in risk assets should spur investors to redeploy their capital as rates are expected to fall.

From NEI’s Monthly Market Monitor for October. Read the full report for more insights.

As of November 30, 2023

The second strongest November in over 20 years

Even with November typically being the best month for equities historically, Christmas really came early for the stock market this year. The S&P 500 Index almost hit a new 2023 high, after seeing its strongest month this year and the second strongest November in over 20 years, only second to the rally in November 2020.

The key reason for the increase in risk appetite and market sentiment in November was the rising expectations of rate cuts in the first half of 2024, coupled with the continued strength in the economy, resulting in a goldilocks scenario. Bond yields fell sharply due to the combination of falling term premia and policy rate expectations. Equities surged as falling risk free rates supported valuations.

Seasonality also played a role in the strong returns in November. Year-end rallies actually occur more often than not, and those gains can be impactful. November 2023 was a stronger month than seasonality factor would suggest, likely creating a more subdued environment in December.

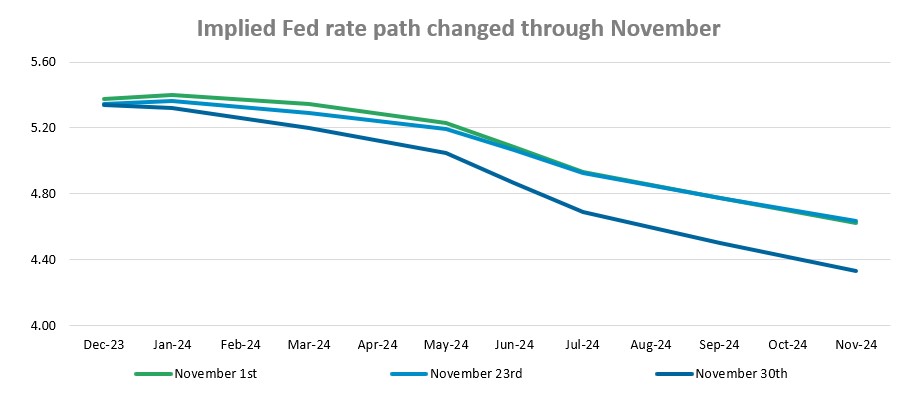

Markets expect deeper rate cuts in 2024

The subdued inflation figures triggered a change in sentiment over the last month, moving from believing that rates would need to be higher for longer, to believing that the tightening cycle might have already ended. The bond futures market had a drastic repricing of 10-year yields, falling by more than 30bps in a week, to reflect an implied first rate cut of 25bps by May 2024 and a total of 1% by November 2024.

Source: Bloomberg, data as of November 30, 2023

The bond market also reflected this change in sentiment with yields falling sharply in November after testing the 5% level in October. Rates have dropped sharply in the U.S. despite Moody’s downgrading U.S. sovereign debt outlook to negative.

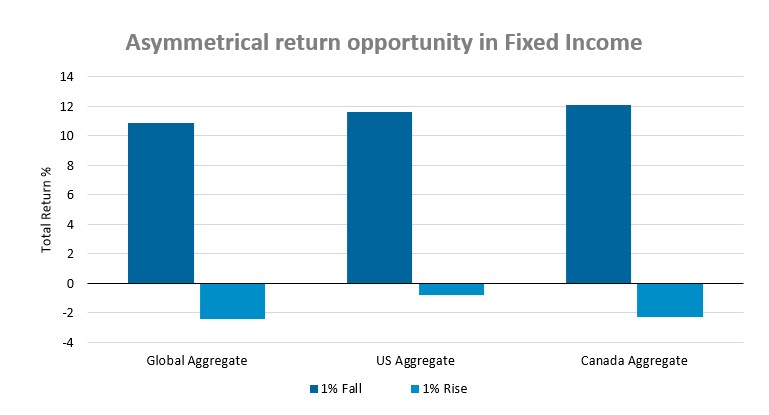

The opportunity in Fixed Income

This rise in yields as well as the rise in the volatility of yields has been the key driver of equity market movements over the last 2 months. Equities typically fare poorly when yields rise sharply. We saw a rise in yields of about 70 basis points from early September to early October, when the S&P 500 declined by about 6%, and later in October a 40-point rise when the S&P 500 declined again. When yields fell a bit in mid-October, we saw a short-lived S&P 500 rally until the rates resumed their upward movement.

Yields have already started to decline from their peaks since October. Although we may see some volatility in yields, expectations for lower inflation are contributing to expectations of rate cuts earlier in 2024 than previously expected. This has historically been very positive for bond returns, and for rate sensitive sectors, as we saw in November since yields rolled over.

Source: Bloomberg, data as of November 30, 2023

As fixed income and equity investments were being repriced due to rising interest rates in 2022 and 2023, cash and money market investments look relatively compelling. Investors seeking safe haven were rewarded with relatively higher yields. Money market inflow of assets reached record levels in 2023.

Although cash investments may still look compelling today, the relative attractiveness to risk assets may change dramatically over the next little while. As short-term rates fall, money market instruments will become increasingly less attractive compared to fixed income and equities. This is an opportune time for investors to get off the sidelines and to redeploy capital back to risky and growth assets, which may provide a strong technical boost to drive markets higher.