Monthly Market Insights - Data and opinions as of September 30, 2020

Volatility arrives, right on schedule

It should come as no surprise to experienced market participants that equity market volatility increases around this time of year. September has historically been the weakest month for stocks, so from a seasonal perspective, the recent downturn has arrived right on cue. Of course, any decline in stocks must always be considered in the larger context. In this case, we’ve had an exceptionally strong run-up over the past few months, led by only a segment of the market (technology) and partly driven by retail investor euphoria.

We have in fact been anticipating a pullback, and in our view, the declines over the last couple of weeks are more technical in nature and not evidence of a fundamental shift. Although, there are reasons for near-term caution. Despite September’s weakness, the third quarter ended with a solid 7.17% gain for global stocks.

The NEI perspective

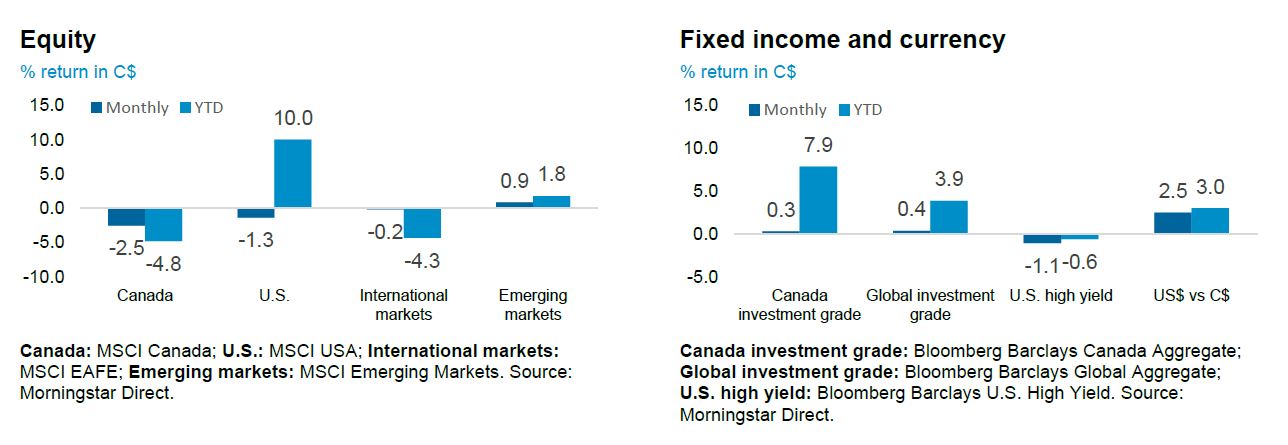

September volatility arrives. Equities saw their first monthly decline following consecutive gains since the March bottom. The downturn was driven primarily by weakness in the communication services, information technology, and consumer discretionary sectors.

Reasons for caution. As we have warned in previous months, the increase in global coronavirus cases and delays in the next U.S. fiscal package could delay the economic recovery, and uncertainty around upcoming U.S. elections is bound to create noisy markets.

Volatility likely to continue. We’ll likely continue to experience choppy markets until the next U.S. fiscal package is passed and we see clarity following the election. Over the longer-term we remain bullish on equities as the economic recovery continues to drive the start of the next business cycle.

As of October 2020

Markets and seasonality

Have you ever been told to “Sell in May and go away?” Or perhaps you’ve heard about the so-called “Santa Claus rally” toward year end? These phrases are often referenced in the financial media. On the previous page, we noted that September is typically a volatile month for the stock market. While there is no consistent explanation for why we would see such weakness specifically in September, it can often be attributed to some combination of politics and market dynamics, which include traders getting back to work after summer holidays, and/or quarter-end rebalancing.

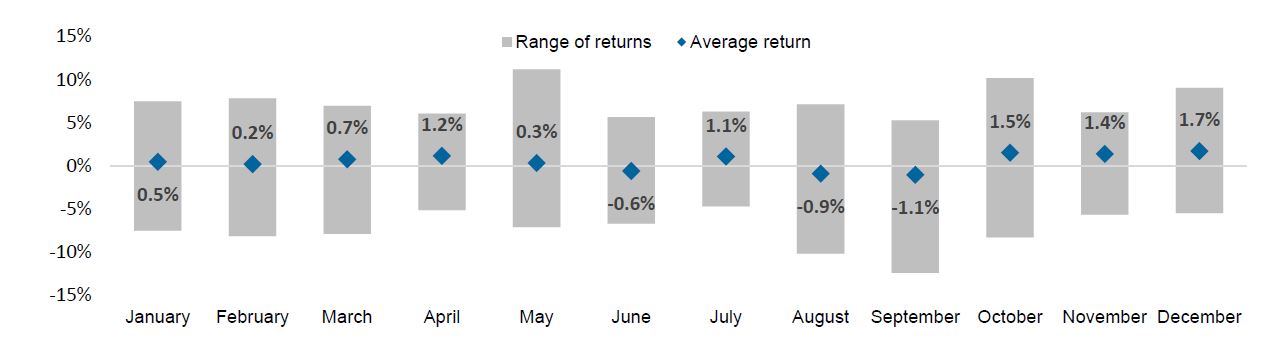

The seasonality effect could even be a self-fulfilling prophecy: If investors believe September is a month to avoid, then with enough sellers it will inevitably drive market prices lower, which then only goes to confirm investors’ initial beliefs. As the chart below shows, there is no doubt that on average, markets do seem to fall into some sort of seasonal pattern. The first half of a year generally starts out modestly positive, followed by a flat period in May and June, a strong July, weakness around August and September, then finally a strong rally into year-end.

Global equity returns by calendar month (1990 – 2019)

MSCI World (C$), price return

Source: Bloomberg. Data as of September 30, 2020.

At first glance it may be tempting to take advantage of this seasonal pattern and turn it into a trading strategy. But not so fast. The stats above show the average performance in each month for the last 30 years. Once we account for the dispersion of returns, about half the time in September we actually saw positive market performance. A 12.42% loss in September 2008 really skewed the average, and it happened to be the worst return in any month over the last 30 years.

So how do we know exactly which Septembers to avoid, and which ones to invest in? As always, markets are driven by a combination of factors whether thery are macroeconomic, fundamental, or technical in nature. Seasonality is merely an observation of market price dynamics, and not so much a determining factor. The best way to navigate through all the noise is to take the guesswork out and simply stay invested through all market conditions.