Weekly Market Pulse - Week ending June 3, 2022

Market developments

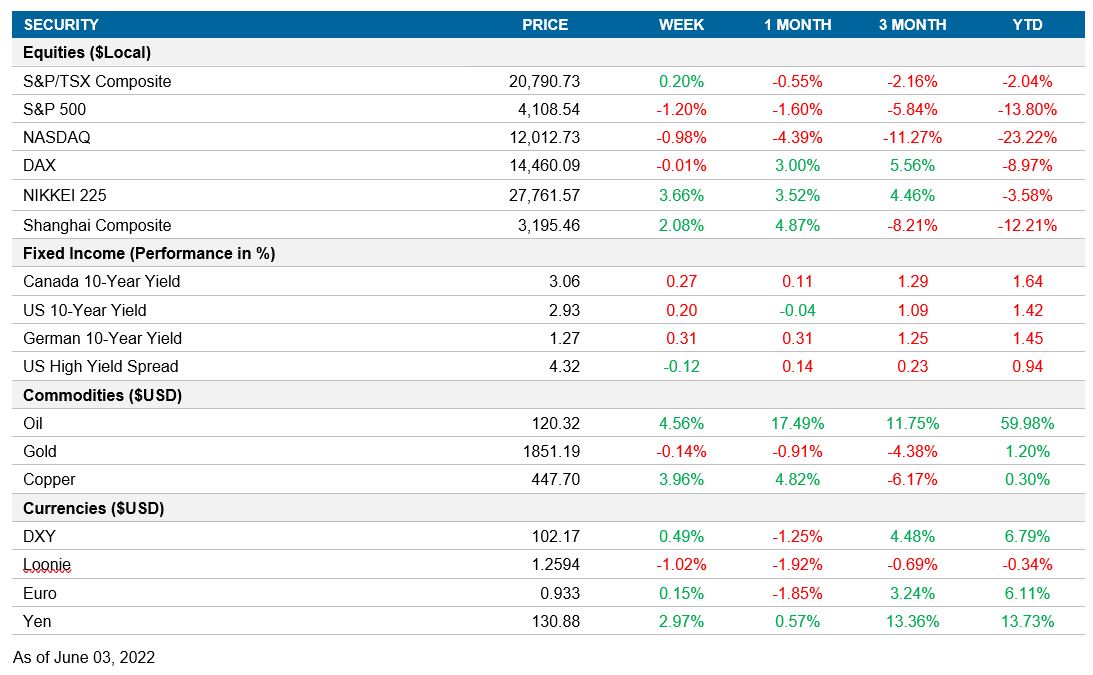

Equities

U.S. equity markets were down for the week. Rising yields driven by increasingly hawkish central bank statements focused on tempering inflation spurred concerns about greater tightening conditions. Canadian equities managed to remain relatively robust, driven by strength in the commodity complex.

Fixed income

Bond yields rose significantly during the week. Both the Bank of Canada and U.S. Federal Reserve articulated their more hawkish stances.

Commodities

Copper continues its upwards trend from the previous week. Increased demand stemmed from China as its economy starts to pick up speed coming out of stringent lockdowns. Oil saw a similar gain, recording its sixth consecutive win. China is the second largest consumer of oil globally and likely made up much of the increased demand this week. Gold saw muted performance in line with the higher movement in bond yields.

Performance (price return)

As of June 3, 2022

Macro developments

Canada – Q1 GDP growth slows and comes below estimates; BoC hikes policy rate by 50 bps

StatCan released GDP data for the first quarter and the month of March. Quarterly GDP growth fell to 3.1% annualized, below consensus estimates of 5.2%. International trade contracted, with a 9.4% decline in quarterly annualized exports contributing significantly to slowing GDP growth. Quarterly annualized imports declined 2.8%. The reason quarterly annualized GDP growth remained positive despite these losses was growth in household consumption and investment. Household consumption increased 3.4% and investment increased 11.0%. During March, monthly GDP growth fell by 0.7%. The contraction in wholesale trade (-0.7%) and retail trade (-0.6%) were the primary drivers of slowing monthly growth.

The Bank of Canada made its most recent interest rate announcement. Quantitative tightening has continued, and the overnight interest rate was increased by 50 basis points (0.5%), meeting consensus estimates. This is in line with what the BoC has consistently signaled since April. However, the announcement used much firmer language than previous statements. Specifically, the BoC announced that the “Governing Council is prepared to act more forcefully if needed” to meet the central bank’s 2% inflation target. This has two likely implications. Firstly, the BoC is possibly more than willing to bring interest rates back to the top end of the neutral range, estimated to be between 2.00%–3.00%. This means that we will likely see, at a minimum, another 50-bp increase at the next announcement on July 13. Secondly, this firmer tone sets up a possibility of an increase even larger than 50 bps. On June 2, Deputy BoC Governor Paul Beaudry reaffirmed the central bank’s convictions toward bringing inflation down and that there is currently a substantial risk of inflation becoming entrenched. To combat this, he mentioned that interest rates needed to be higher.

U.S. – Conference Board consumer confidence signals optimism; Unemployment stays flat, job creation beats estimates

The Conference Board released their Consumer Confidence Index for the month of May. A reading above 100 indicates that there is positive sentiment toward the economy. The index came in at 106 and beat consensus forecasts of 103.9. The Present Situation Index measures sentiment toward the current business climate and had a reading of 149.6, down from 152.9. The Expectations Index measures sentiment toward the business climate’s short-term outlook and had a reading of 77.5, down from 79.0. Consumers do not expect the business climate to get better in the short term. However, there is an optimistic outlook for the economy overall since the primary index remained above 100.

The U.S. Bureau of Labor Statistics released American unemployment data for the month of May. The unemployment rate remained flat at 3.6%. May is the third consecutive month that unemployment has remained at 3.6%. Also posted were changes in nonfarm payrolls, which beat estimates, increasing by 390K jobs. The manufacturing payrolls increase came in at 18K. The number of people taking on part-time work out of economic necessity (as second jobs or from an inability to find full-time work) increased by 295K. The Bureau reported a decreasing number of jobs in retail trade. There is a high likelihood that this is representative of the business climate slightly worsening as indicated by the consumer confidence survey.

International – Germany’s CPI close to 50-year high; China’s PMI rises, remains pessimistic; Japan’s industrial production declines; Eurozone CPI increases, retail sales contract

Destatis released Germany’s preliminary CPI data for May. Year-over-year inflation has reached a nearly 50-year high, at 7.9%, up from 7.4% in April. Month-over-month inflation came in at 0.9%, up from 0.6% from the prior month. Both inflation values were higher than consensus estimates for the month. The main contributors to inflation were energy (38.3%) and food (11.1%). Germany has been a major importer of Russian gas and, consequently, the price of energy in Germany steadily inflated after the Russia-Ukraine conflict started. The price of rent is also steadily creeping higher and is up 1.7% for the month of May. Surprisingly, services have become cheaper, with inflation falling from 3.2% in April to 2.9%.

During May, we saw a slight easing of lockdown restrictions in China. Consequently, China’s PMI survey ended up having better results in contrast to the previous month. The manufacturing index saw an increase to 49.6, beating consensus estimates of 48.0. Sentiment within non-manufacturing sectors saw a much larger increase, moving to 47.8. Even though both readings are under 50, which implies that the Chinese business environment is still contractionary, pessimism has almost reached a neutral state within the country. China called for an end to lockdowns on June 1, which should improve sentiment even further. However, it is important to note that supply chain issues remain within the country.

Japan’s preliminary industrial production data for the month of April came in at -1.3%, worse than consensus estimates. The main detractors were decreases in production of electronic parts, production machinery, and automobiles. These were offset by increases in the production of electrical equipment, general purpose machinery, and chemicals. The lower industrial production may have a contractionary effect on Japan’s GDP for the second quarter if this trend continues.

Germany and Spain’s recent CPI releases did not provide an encouraging outlook for the eurozone’s CPI. Eurostat’s preliminary CPI release for May saw an increase in inflation. Economists forecasted monthly inflation to remain flat at 0.6% and yearly inflation to slightly increase to 7.7%. In reality, monthly inflation increased to 0.8% and yearly inflation increased to 8.1%. Energy goods continue to be a large source of inflationary pressure with year-over-year growth increasing to 39.2%. Many countries in the eurozone are reliant on Russia for energy and the ongoing conflict has kept energy prices rising.

Eurostat also released retail sales data for May. Economists forecasted that monthly retail sales growth in the eurozone would remain flat at 0.3%. However, monthly growth declined by 1.3%. The eurozone experienced declining trade volumes for food/drinks/tobacco (-2.6%) and non-food products (-0.7%). This was mitigated by increasing trade volumes for gasoline (1.9%). Yearly retail sales growth also failed to meet estimates of 5.4%.

Quick look ahead

Canada – Employment data (June 10)

StatCan will release unemployment data for May. Consensus estimates are expecting the employment change to be positive, so it is likely that the unemployment rate will remain the same or decrease. Unemployment in April was 5.2%.

U.S. – CPI (June 10); University of Michigan Consumer Sentiment (June 10)

The Bureau of Labor Statistics will release CPI data for May. Economists are expecting inflation to slightly decrease, with a year-over-year forecast of 8.1%—down from 8.3%—and a month-over-month forecast of 0.2%—down from 0.3%. In April, the main drivers of U.S. inflation were shelter, food, and automobiles.

The University of Michigan Consumer Sentiment index for June will be released. Estimates are for it to remain relatively unchanged at 58.4. The sentiment indicator has been in a steep downtrend since April 2021 when inflation concerns first hit the U.S. consumer.

International – German industrial production (June 8); Chinese exports (June 8); China’s CPI (June 9); Eurozone interest rate decision (June 9)

Germany’s industrial production in April will be released. Estimates are for a month-over-month increase of 1.2%, which would translate to year-over-year contraction of -2.4%.

NBS will release Chinese export and CPI data for May. Economists are expecting the trade balance to decrease from US$51.12B to US$50.65B. This is likely due to supply chain issues and reduced manufacturing output during the month of April that arose from lockdowns. Chinese inflation is expected to decrease, with economists forecasting yearly inflation to move down 2.1% to 1.8%.

The ECB will be making an interest rate announcement on June 9. Markets are expecting the main refinancing rate to remain unchanged. However, comments on the outlook for inflation, which has risen sharply in many EU countries, will be keenly watched.