Weekly Market Pulse - Week ending April 5, 2024

Market developments

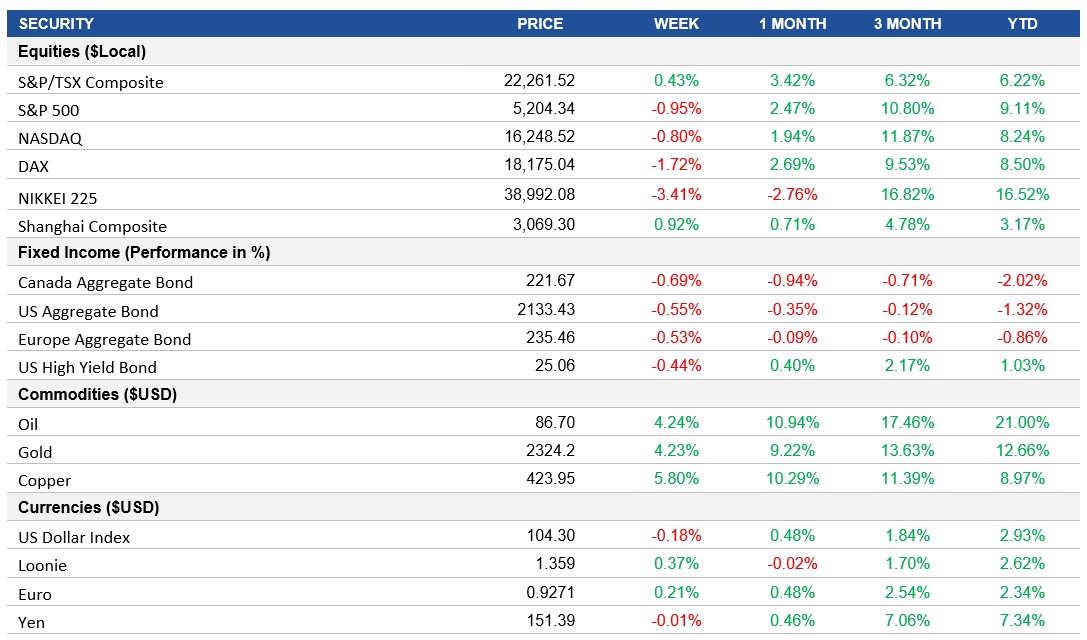

Equities: U.S. stocks climbed on Friday after a stronger-than-expected March jobs report, but the S&P 500 is still headed for its biggest weekly decline since the first week of the year amid rising geopolitical concerns and hawkish signals from Federal Reserve officials. The Philadelphia Stock Exchange Semiconductor Index recovered from Thursday's steep drop, with gains from chipmakers like Nvidia. However, the pullback has cast doubts over the fate of this year's record-breaking rally in the S&P 500, which was powered by confidence that the central bank would cut rates later in 2024.

Fixed Income: Wall Street decided to focus on the positive aspects of the strong jobs report on Friday, believing that if the economy remains robust, the Federal Reserve may not feel as much pressure to ease monetary policy. This triggered a hawkish repricing in the bond market, with Treasury yields climbing as traders trimmed bets on a rate cut in June or July. The current view is that the exact number of rate cuts this year is less important than whether the Fed is in a rate-cutting mode at all. As a result, global yields ended the week higher and bond prices fell.

Commodities: Gold prices have hit record highs, despite strong U.S. labour data and gains in the U.S. Dollar, highlighting gold's status as a safe-haven asset. Strong U.S. jobs data and the Federal Reserve's remarks have adjusted the outlook for future rate cuts, but geopolitical tensions and robust demand from China have bolstered gold's market strength.

Performance (price return)

Source: Bloomberg, as of April 5, 2024

Macro developments

Canada – Manufacturing PMI Shows Slight Improvement, Unemployment Rate Surges

Canadian Manufacturing PMI: The Canadian Manufacturing PMI increased slightly to 49.8 in March 2024, marking the eleventh consecutive contraction but at a slower pace. New orders declined, affecting factory output, while supply chain issues led to higher input prices. Despite below-trend business optimism, companies increased hiring to meet potential demand.

Canadian Unemployment Rate: Canada's unemployment rate rose to 6.1% in March 2024, the highest since October 2021, indicating the impact of higher interest rates on the labor market. The unemployed population increased, especially among youth, while net employment declined, and hourly wage growth accelerated.

U.S. – Manufacturing Sector Expands, Accompanied by Strong Job Growth, Unemployment Rate Drops

The U.S. ISM Manufacturing PMI expanded to 50.3 in March 2024 after 16 months of contraction. There were positive trends in demand, with indicators such as the new orders Index (51.4 vs 49.2 in the previous month) and new export orders Index (51.6, the same as in February) showing expansion, while backlogs (at 46.3) remained in moderate contraction.

U.S. Job growth surged by 303K, above expectations, mainly in health care, government, construction, and leisure/hospitality sectors, surpassing not only expectations but historical standards.

The U.S. unemployment rate decreased to 3.8% in March 2024, with a significant increase in employment and labor force participation, indicating a resilient labor market despite recent policy tightening by the Federal Reserve.

International – Eurozone Consumer Price Inflation Declines, China’s Private Sector Activity Grows, Japan’s Private Sector Growth Continues Led by Service Industry Expansion

Consumer price inflation in the Eurozone declined to 2.4% year-on-year in March 2024, matching a 28-month low, with energy prices decreasing and moderated rises in food, alcohol & tobacco, and non-energy industrial goods.

China's Caixin General Composite PMI rose to 52.7 in March 2024, signaling the fifth consecutive month of growth in private sector activity, driven by increased manufacturing output and services activity, along with improved export orders and easing input costs.

Japan's Composite PMI stood at 51.7 in March 2024, indicating the third straight month of growth in private sector activity, led by a solid expansion in the service sector. Job creation was robust, and input prices increased, leading to higher selling prices to protect profit margins.

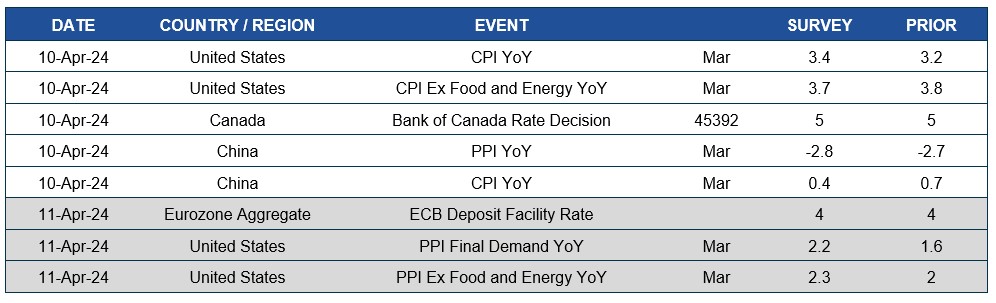

Quick look ahead

As of April 5, 2024