Weekly Market Pulse - Week ending April 6, 2023

Market developments

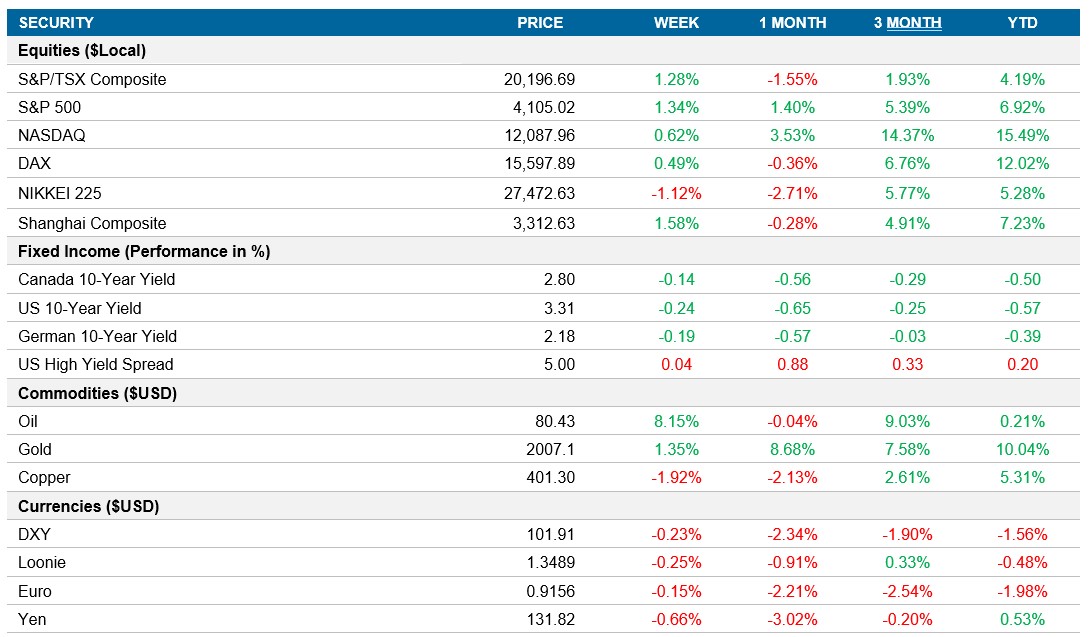

Equities: U.S equities closed the short holiday week higher, continuing the strength seen in Q1 as traders swiveled between defensive and cyclical stock as the focus shifts back and forth between recession fears and monetary policy concerns. Fed Bank of St. Louis President James Bullard boosted the market on Thursday afternoon as he noted the drop in bonds will help ease the macroeconomic fallout of the recent banking crisis. Risk-off sentiment continues to build, which may increase with key economic data releases and the start of earnings season next week.

Fixed income: Investors have aggressively priced in rate cuts this year as the market expects three cuts and a slightly above 4% Fed rate by December. Trading volumes were relatively low in the equity markets and investors continue to shift to the safety of bonds as the U.S. 10yr treasury yield dropped 25bps to 3.3% and the 2yr is firmly below 4%. The bond market will be waiting for the jobs report on April 7th and CPI data next week as a very strong jobs number and higher than expected inflation print may suggest the Fed has more tightening ahead.

Commodities: Oil had a strong gain this past week, closing above $80, up nearly 8.5% for the week. The spike was driven by Saudi Arabia and its OPEC+ allies unexpectedly announcing a round of production cuts. The gain didn’t move much past that $80 level as traders digest the production cuts along with the headlines that the U.S. economy is weakening.

Performance (price return)

As of April 6, 2023

Macro developments

Canada – Unemployment rate holds at 5%

Canada’s unemployment rate stayed at 5% for the fourth consecutive month, a touch below market expectations of 5.1% and remains close to the record low of 4.9%. Total hours worked rose 0.4%, while average hourly wages were up 5.3% YoY, the recent data is still signaling a tight labour market in Canada.

U.S. – ISM Services PMI fell to 51.2 and ISM Manufacturing PMI decreased to 46.3

The U.S. ISM Services PMI fell to 51.2 in March, dropping from 55.1 a month earlier and meaningfully below market forecasts of 54.5. In March there was a slowdown in business activity, new orders, and employment. The reading pointed to the slowest growth in three months as demand cooled and price pressures eased.

Manufacturing PMI decreased to 46.3 in March, the lowest rating since mid 2020 and down from 47.7 a month earlier. The marked the fifth straight month of contraction as companies’ decrease outputs to meet slowing demand in the first half of the year.

International – China Composite PMI increased to 54.5

The China General Composite PMI increased to 54.5 in March, up from 54.2 a month earlier and the led by the third straight month of growth in the private sector. An accelerated rise in services activity helped offset a deceleration in manufacturing output. Looking ahead, economic growth in China will be driven by a boost in demand and an uptick in household consumption.

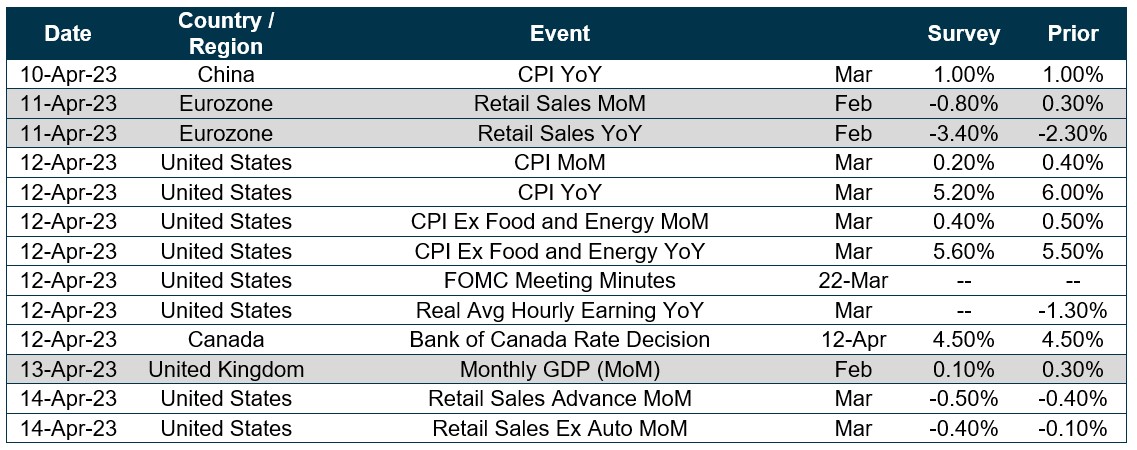

Quick look ahead

As of April 6, 2023