Weekly Market Pulse - Week ending August 11, 2023

Market developments

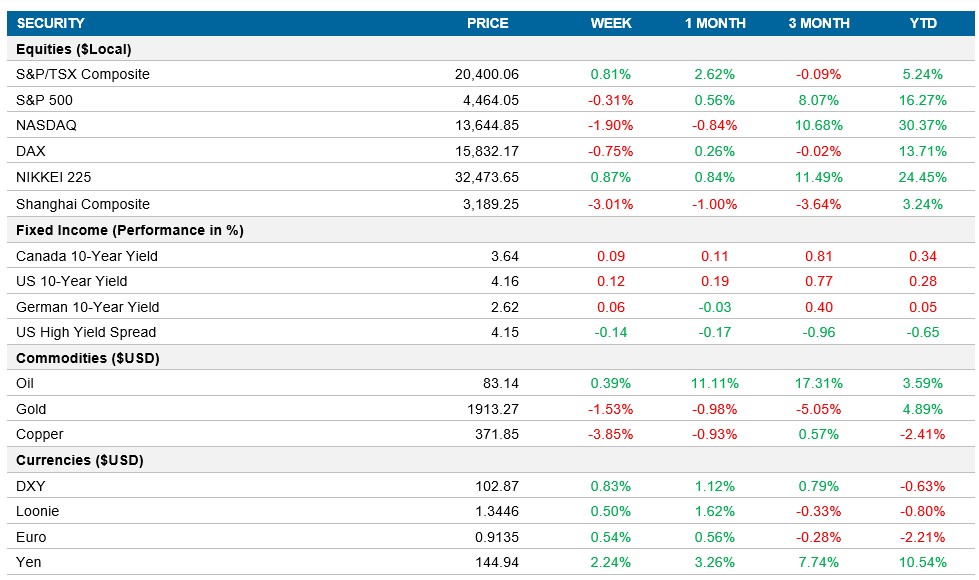

Equities: Tech mega caps faced renewed declines, causing stock markets to struggle as bond yields rose. The S&P 500 experienced a volatile week which ended with a small 0.30% loss, while the Nasdaq was down nearly 2%. Nvidia extended their decline, and market analysts suggest that upside momentum is waning as September nears, raising the possibility of a correction. The S&P is trading closer to a significant technical level, the 50-day moving average, potentially indicating further losses, although oversold conditions could lead to a bounce.

Fixed income: Fed officials have acknowledged more efforts are needed to combat rising prices despite recent positive inflation data. U.S. consumer prices showed a modest increase for the second consecutive month excluding recent surges in commodity prices like oil and natural gas, possibly impacting the Fed's stance. The U.S. 10yr yields closed the week above 4.15% while the 2yr closed ~4.9%, U.K. bond yields also rose as strong quarterly growth puts pressure on the Bank of England to consider further rate increases.

Commodities: Oil futures marked their seventh consecutive weekly gain as Saudi Arabia and Russia's supply cuts tightened crude oil availability. The International Energy Agency (IEA) forecasts further supply constraints into the fall due to OPEC+ actions and strong global demand. If supply targets hold, a significant drawdown in inventories could lead to higher prices.

Performance (price return)

As of August 11, 2023

Macro developments

Canada – No Notable Headlines

No notable headlines this week.

U.S. – U.S. Annual Inflation Rate at 3.2% in July, U.S. Producer Prices Rise 0.3% MoM in July

The U.S. annual inflation rate accelerated to 3.2% in July from 3% in June, ending 12 months of decline due to base effects. Energy costs fell less steeply, while apparel and transportation services costs increased. Core inflation excluding food and energy eased to 4.7% from 4.8% in June.

Producer prices in the U.S. increased by 0.3% MoM in July, the largest rise since January, surpassing expectations. Service prices surged by 0.5%, led by portfolio management and transportation services, rebounding from a June decline. Goods prices edged 0.1% higher, with food prices, particularly meats, driving the increase. Year-on-year, the PPI rose 0.8%, influenced by base effects, marking an acceleration from June's 0.2%.

International – U.K. Economy Expands 0.2% in Q2, Led by Services and Manufacturing, Japan's Producer Price Growth Slows to 3.6% YoY in July, China's Consumer Prices Dip 0.3% YoY in July 2023, Led by Food Costs

The British economy grew 0.2% in Q2 2023, surpassing expectations, with services boosted by the entertainment and dining sectors. Manufacturing led the production sector's 0.7% rise, driven by vehicle manufacturing. Household consumption and government spending saw strong growth, while fixed capital formation stalled due to contrasting business and government investments. Exports declined 2.5%, while imports increased by 1%.

Producer prices in Japan increased by 3.6% YoY in July, marking the seventh consecutive month of deceleration in inflation. The moderation was driven by easing global cost pressures, with several sectors experiencing slower price growth, including transport equipment, beverages, foods, iron and steel, and others. However, petroleum, coal products, and non-ferrous metals saw accelerated price increases. Monthly producer prices edged up by 0.1% in July, reversing a previous decline.

China's consumer prices fell by 0.3% YoY in July, the first decrease since February 2021, driven by a 1.7% drop in food prices due to lower pork costs. Non-food prices remained flat, while clothing, housing, health, and education costs saw slight increases. Transport prices continued to decline. China's statistics agency expects the dip to be temporary, with inflation projected to gradually rise due to fading base effects from the previous year. Core consumer prices excluding food and energy rose by 0.8% YoY, the highest since January. Unexpectedly, consumer prices increased by 0.2% on a monthly basis, marking the first rise in six months.

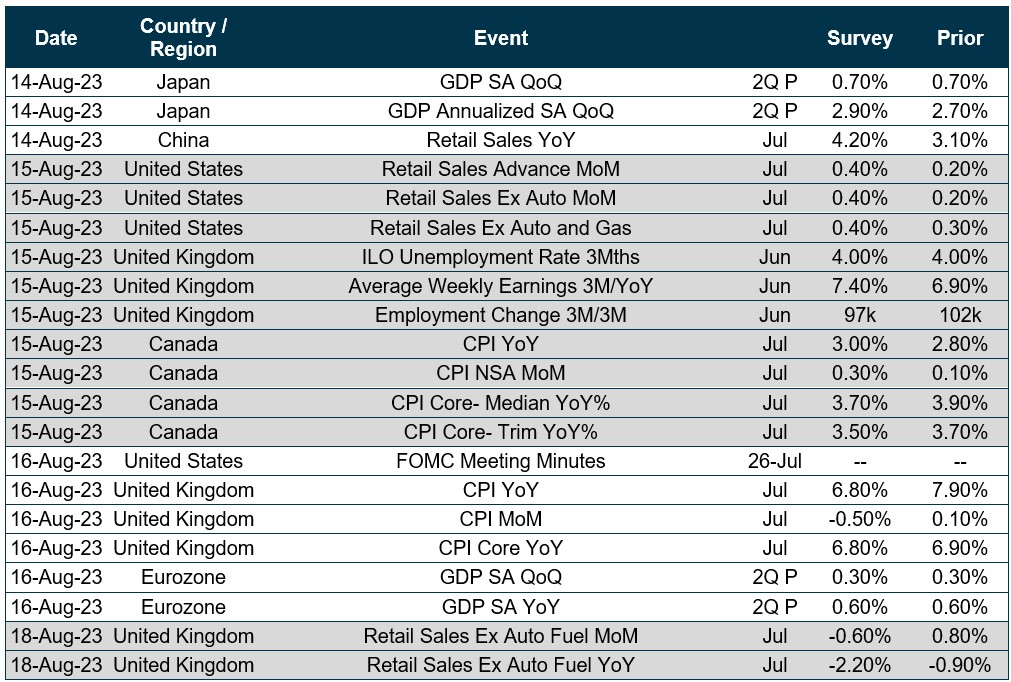

Quick look ahead

As of August 11, 2023