Weekly Market Pulse - Week ending December 8, 2023

Market developments

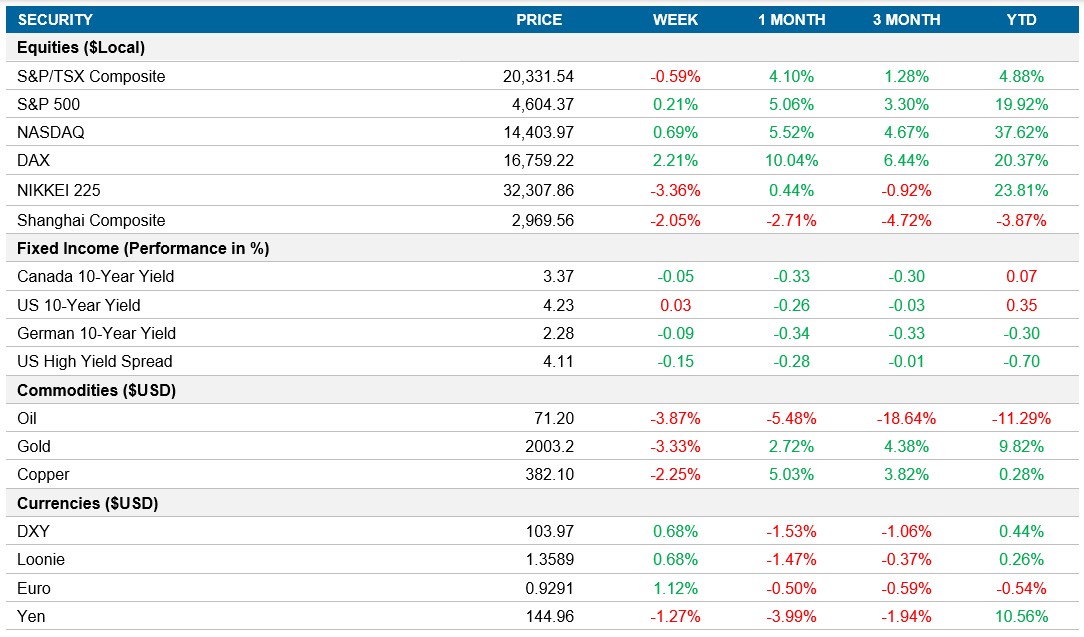

Equities: The global equity markets showed a positive trend this week, with major indices such as the S&P 500 and Nasdaq 100 recording gains. The S&P 500 rose by 0.2%, while the Nasdaq 100 increased by 0.7%. This upward movement reflects growing investor confidence, bolstered by the expectation of inflation easing and a stable economic environment. Despite these optimistic trends, the market continues to navigate through a mix of economic data and varied forecasts for corporate earnings in the upcoming year.

Fixed income: In the fixed income sector, the focus remained on the anticipation of future central bank policies, especially regarding interest rate movements in the coming year. Investors are closely watching the economic indicators and central bank statements to gauge the likelihood and timing of rate cuts. This heightened attention on macroeconomic trends and policy shifts underscores the current market sensitivity to monetary policy changes and their potential impact on fixed income investments.

Commodities: The oil sector was volatile, with WTI crude futures fluctuating throughout the week. Prices ultimately settled around $71 a barrel, influenced by global market dynamics and OPEC+ discussions. Despite some recovery in oil prices, concerns about a global surplus continue to exert downward pressure. The market is also keeping an eye on the U.S.'s actions to refill its Strategic Petroleum Reserve, which has implications for future oil supply and pricing.

Performance (price return)

As of December 8, 2023

Macro developments

Canada – Economic Slowdown and BoC's Inflation Concerns

The Bank of Canada (BoC) has maintained its overnight target rate at 5.0% for the third consecutive meeting, aligning with the unanimous consensus. Despite signs of a weakening economy and decreasing inflation pressures, the BoC continues to emphasize the potential for further rate increases, contingent upon sustained easing in core inflation and a balanced demand-supply economy.

The Canadian Services PMI, as reported by S&P Global, reveals a continued downturn in the services sector in November. The PMI index, falling to 44.5, marks the lowest level since June 2020, indicating a significant decline in service sector activity. This downturn is attributed to slower market conditions and reduced demand, alongside high interest rates negatively impacting business activity. While inflation rates have eased to their lowest in over two years, the labor market remains tight, pushing up wages and contributing to persistent operating expense pressures

U.S. – JOLTS Report Reveals Cooling US Job Market

The U.S. Job Openings and Labor Turnover Survey (JOLTS) data illustrate a labor market experiencing a shift towards pre-pandemic trends. In October, job openings decreased from 9.4 million to 8.7 million, yet remained above the pre-pandemic average. This decline in openings, coupled with stable rates of job quits and layoffs, suggests a cooling labor market that aligns more closely with pre-pandemic levels.

The November payroll employment increase of 199,000, boosted by returning strikers, reflects a somewhat moderated growth in the U.S. labor market. Excluding the non-cyclical sectors, the economy added a modest number of jobs, indicating a slowdown in growth as the year's end approaches. However, a significant rebound in household employment and a drop in the unemployment rate to 3.7% show continued resilience in the labor market.

Europe –Retail Rebound and PMI Indicators Signal Mixed Economic Outlook

In October, the Euro Area saw a modest rebound in retail sales, with a 0.1% month-over-month increase, which was below expectations. This slight uptick reflects a gradual easing of consumer spending constraints, influenced by decreasing inflation and improved real wage growth. However, the broader outlook remains tempered, with concerns over sustained economic growth amid challenging labor market conditions.

Concurrently, the final Composite Purchasing Managers' Index (PMI) for November suggests the Eurozone is experiencing a growth slowdown, with both manufacturing and services sectors experiencing a downturn. Despite easing price pressures, the persistence of wage and operational cost pressures, especially in the services sector, complicates the economic landscape. These mixed signals point to an uncertain path ahead for the European economy, balancing cautious optimism in consumer spending against broader recessionary trends.

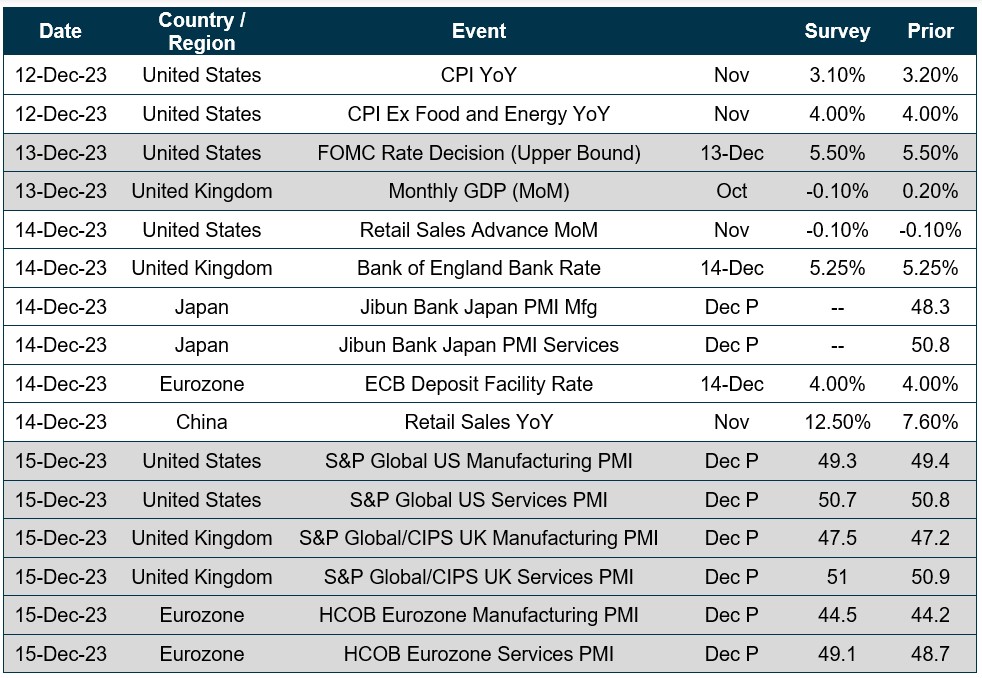

Quick look ahead

As of December 8, 2023