Weekly Market Pulse - Week ending July 21, 2023

Market developments

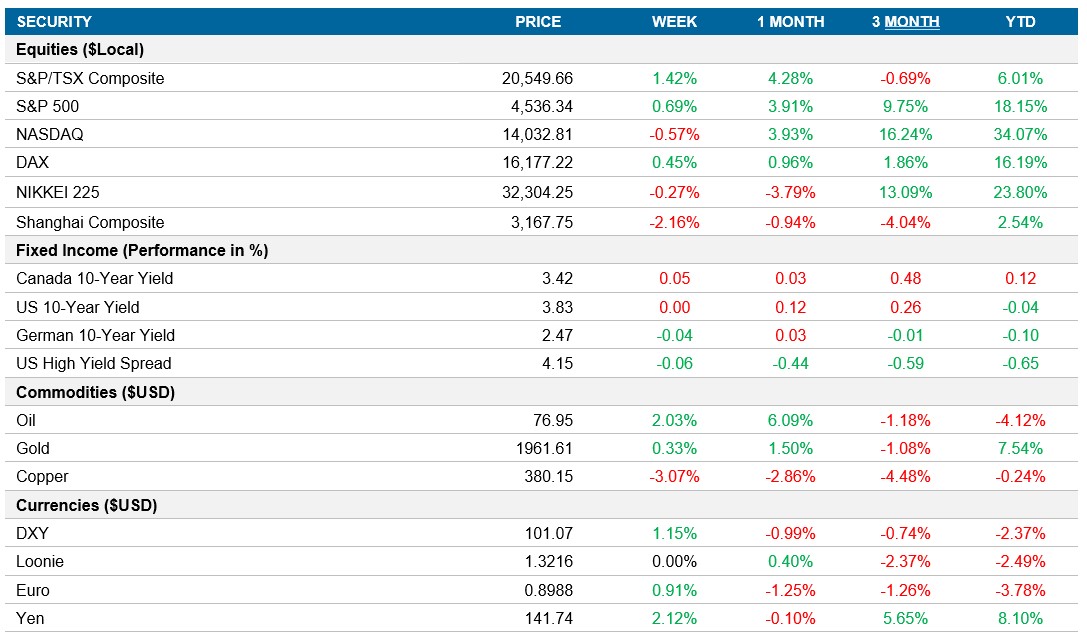

Equities: The Nasdaq was slightly positive on Friday, attempting to recover losses from the previous session following disappointing earnings from Tesla and Netflix, leading the index 0.57% lower this week. The focus remains on the sustainability of the Mega cap stock rally and the hype over artificial intelligence. As the S&P 500 has already exceeded most year-end estimates, profit-taking could occur next week ahead of a busy week with significant market-moving events, including rate decisions and key economic data. Investors will closely watch earnings reports from Alphabet, Exxon Mobil, Meta Platforms, and Microsoft next week.

Fixed income: On the week, yields are mixed, with the curve flatter due to a fully priced-in Fed rate hike on July 26 and strong demand for auctions of 20-year bonds. The 10-year yield is at 3.83%, flat for the week and holding above the 50-day average level breached earlier this week for the first time since May.

Commodities: Oil futures rose for the fourth consecutive week as expectations of tightening supplies in the second half of 2023 boosted prices. While concerns about interest rate hikes and China's slow rebound capped gains, Beijing's stimulus plans provided some hope to traders. Supply cuts by Saudi Arabia and Russia also supported the market amid expectations of moving into deficit in the second half.

Performance (price return)

As of July 21, 2023

Macro developments

Canada – Canadian Inflation Rate Falls to 2.8% in June, Retail Sales Likely to Stagnate in June

Canada's annual inflation rate declined to 2.8% in June, the lowest since March 2021, primarily due to lower gasoline prices, while transportation costs fell by 3.4%. Food inflation remained steady at 8.3%, and rising interest rates led to an increase in mortgage interest costs, raising shelter inflation to 4.8%. The core trimmed-mean rate, closely monitored by the Bank of Canada, fell slightly less than expected to 3.7%, and the headline CPI rose by 0.1% MoM.

Preliminary estimates suggest that retail sales in Canada have stalled in June, showing no growth compared to the previous month. In May, retail sales had increased by 0.2%, revised downward from the initial estimate of a 0.5% increase, which was also a decrease from the revised 1% growth recorded in April.

U.S. – U.S. Retail Sales Rise 0.2% in June, Core Sales Surge 0.6%

U.S. retail sales increased by 0.2% in June 2023, following a 0.5% rise in May, but below the forecasted 0.5% growth. Core retail sales, excluding specific categories, surged by 0.6%, signaling resilient consumer spending, while inflation reached a two-year low in June.

International – UK Consumer Price Inflation Drops to 7.9% in June, China's Q2 2023 GDP Grows 6.3%, Below Market Estimates, Japan's Inflation Rate Reaches 3.3% in June

The UK economy contracted by 0.1% in May 2023, influenced by strikes and an additional bank holiday. Production, construction, and services were affected, resulting in no growth over the three months leading up to May. The GDP is currently estimated to be 0.2% above pre-covid levels.

China's economy expanded by 6.3% in Q2, faster than Q1 but lower than market expectations of 7.3%, influenced by last year's strict lockdowns. First half growth reached 5.5%, with a GDP target of around 5% for the year, as the government remains cautious about stimulus measures due to rising local government debt. June showed mixed economic indicators, including declining exports affected by high inflation and geopolitical factors.

Japan's annual inflation rate increased to 3.3% in June, up from 3.2% in May, but below market expectations of 3.5%. Various sectors experienced rising costs, while fuel and utility charges declined for the fifth consecutive month. Core inflation also reached 3.3%, remaining above the Bank of Japan's 2% target for the 15th month. On a monthly basis, consumer prices rose by 0.2%.

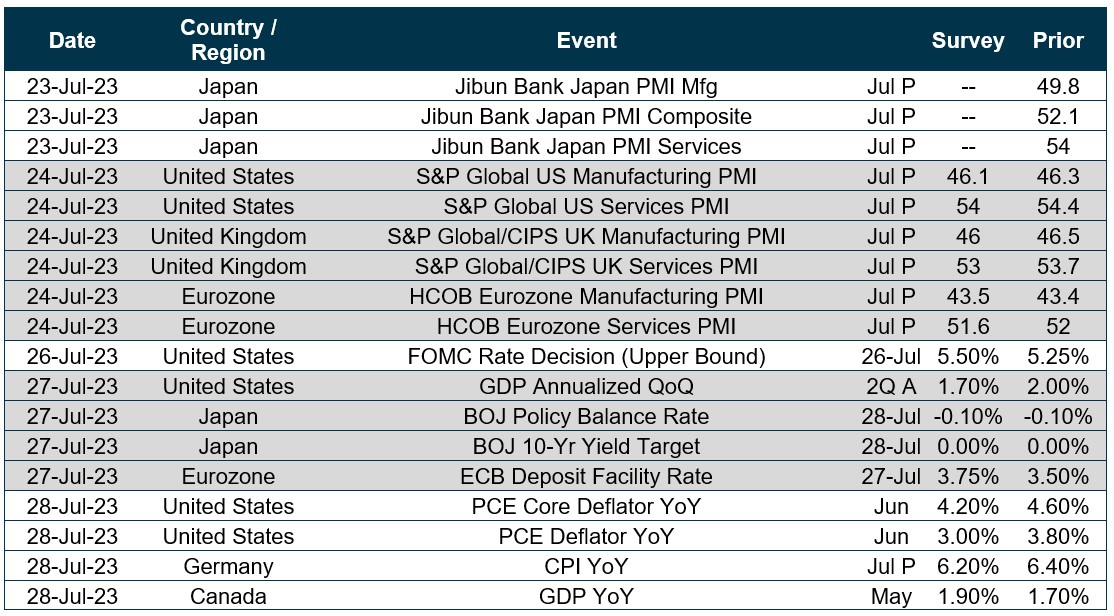

Quick look ahead

As of July 21, 2023