Weekly Market Pulse - Week ending March 24, 2023

Market developments

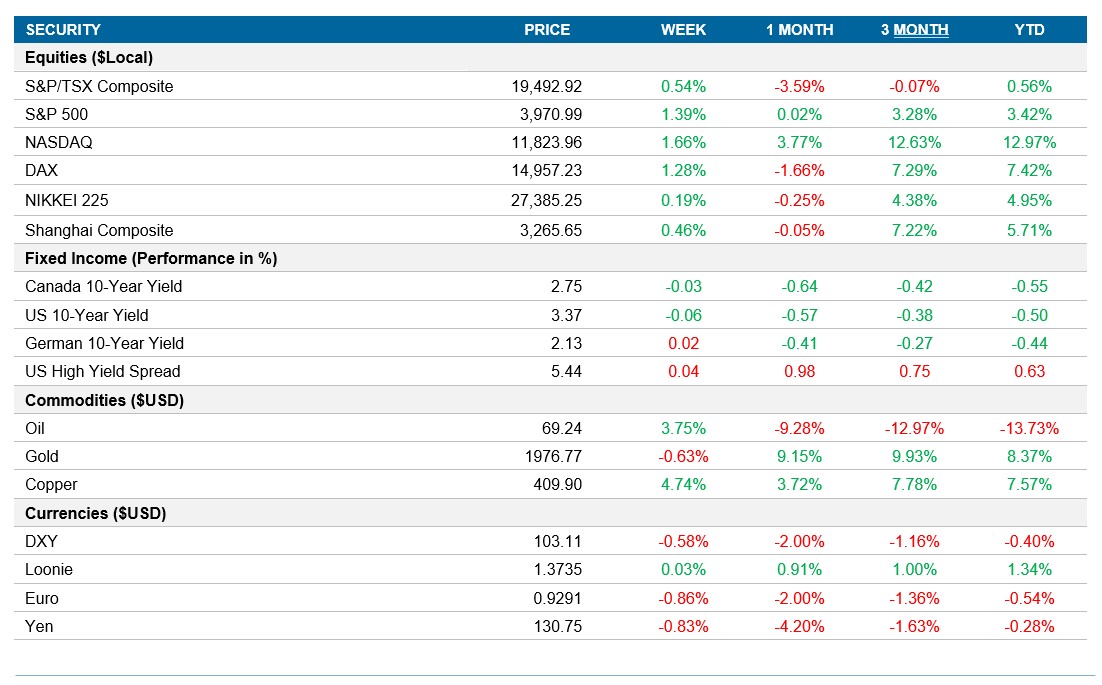

Equities: Banking stocks remained in focus this week as Deutsche Bank said they are redeeming a tier 2 subordinated bond early. The intention of the announcement was to bolster investor confidence, but the already negative sentiment in the global banking sector drove Deutsche Bank’s share price and the European banking sector lower on Friday. The S&P 500 and Nasdaq ended the week up 1.4% and 1.6% respectively as investors bet that the Federal Reserve is done raising rates following the 25bps hike we saw this past week and will beginning cutting rates as early as this summer.

Fixed income: The Federal Reserve raised interest rates by 25bps on Wednesday and during the press conference had a less hawkish tone regarding future interest rate hikes. Powell stated that he does not expect interest rates cuts this year, however the market is expressing a different view and sees nearly 100bps of cuts by year-end. The impact was felt across the curve as yields closed lower for the week and the U.S 10yr closed below a key support level of 3.4%.

Commodities: Oil settled lower on Friday but finished the week up over 3% as renewed concerns over the U.S. and European banking sector were revived on Friday morning. Investors are worried that higher rates will lead to an economic slowdown and the potential for tighter credit standards will hurt overall demand. Oil remains under $70 as it closed the week at $69.24.

Performance (price return)

As of March 24, 2023

Macro developments

Canada – CPI falls to 5.2% and retail sales jump in January

Annual inflation in Canada fell to 5.2% in February, below market expectations of 5.4% and the lowest reading since January 2022. Although prices remain high, there was a deceleration for transportation, shelter, and food costs which offset the acceleration in mortgage costs.

Retail sales in for the month of January was up 1.4% from a month earlier, above market expectations of 0.7%. The warmer weather drove 9 out of the 11 sectors higher. The preliminary estimate for February is for retail sales to fall -0.6% after the strong start to the year.

U.S. – Manufacturing and Services PMI both come in ahead of expectations

The preliminary S&P Global U.S. Manufacturing PMI was 49.1 in March, an increase from the 47.3 in February and well ahead of forecasts of 47. The smaller than expected contraction was due to a rise in production and a slight fall in new orders. Inflationary pressures softened due to less supplier price hikes and deceleration in some raw material costs.

U.S. Services PMI also rose in March, as it was up to 53.8 compared to the previous reading of 50.6 and well ahead of market expectations of 50.5. Company pricing power was boosted by stronger demand, while pressure on capacity drove job creation.

International – Eurozone Composite PMI rose to 54.1in March, U.K. inflation accelerated MoM in February and CPI in Japan fell to 3.3%

Composite Eurozone PMI rose to 54.1 in March, up from 52 in February and ahead of market forecast of 51.9. These preliminary estimates would mark the fastest expansion in nearly a year. The growth was driven by the services sector, which expanded the most in 10 months, offsetting the contraction for manufacturers.

Annual inflation rate in the U.K. climber higher to 10.4% in February from 10.1% and easily higher than market forecasts of 9.9%. The upward pressure was driven by the cost of food and non-alcoholic beverages, higher electricity prices and restaurant and hotels.

Annual inflation rate in Japan fell to 3.3% in February 2023, off from the 41-year high of 4.3% in January. The deceleration was driven by the cost of transportation and electricity. Core CPI was also up the lowest in five months, up 3.1% YoY, matching forecasts and still above the 2% target.

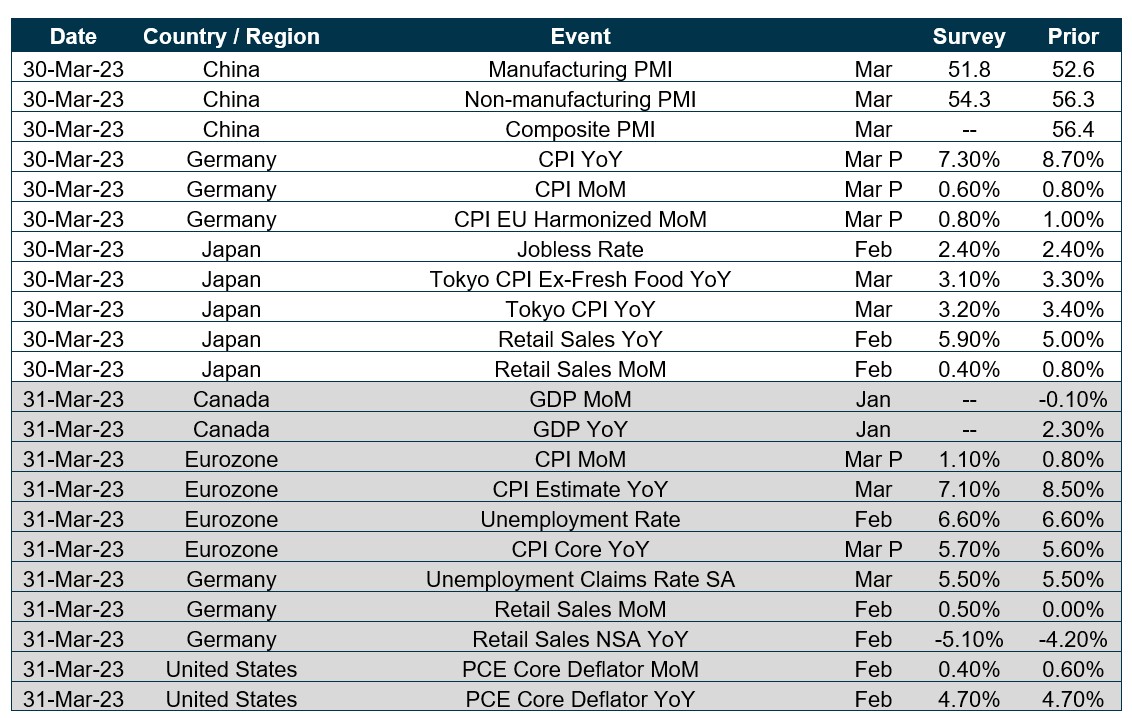

Quick look ahead

As of March 24, 2023