Weekly Market Pulse - Week ending May 19, 2023

Market developments

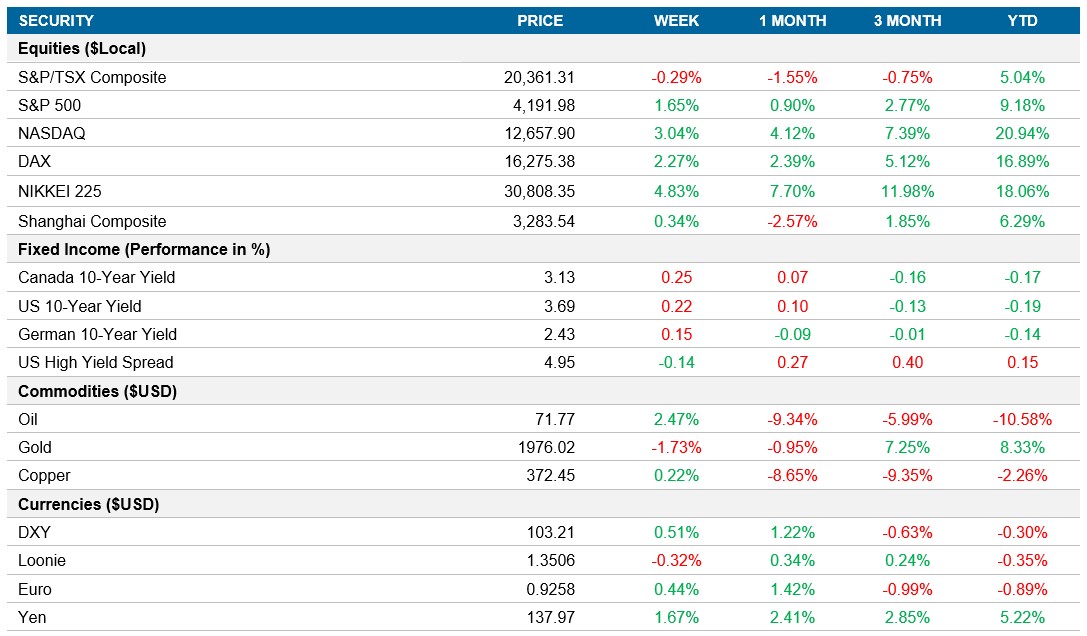

Equities: The S&P 500 failed to maintain its two-day rally, falling below the crucial level of 4,200, but was up 1.6% for the week. The possibility of a Federal Reserve rate hike in June was diminished as Jerome Powell signaled a pause. The uncertainty surrounding debt-ceiling negotiations and the potential delay in reaching a resolution weakened the chances of a rate increase. Additionally, the news of Treasury Secretary Janet Yellen suggesting the need for more bank mergers led to a slump in the SPDR S&P Regional Banking exchange-traded fund, which fell 1.9%.

Fixed income Money managers are increasingly favoring longer-term corporate bonds as they anticipate a potential pause in rate hikes. This month, approximately 26% of U.S. investment-grade corporate bond sales have consisted of securities maturing in 30 years or more, a significant increase compared to April's 4% and last year's 15%. Investors are seeking higher coupon payments and locking in attractive yields amid the belief that the Fed has concluded its tightening campaign. This shift reflects a change in strategy as shorter-term debt was preferred during rising rate periods. With the macro-outlook uncertain, money managers are drawn to longer-dated securities, expecting potential rate cuts and improved performance in the event of a recession. Despite wider high-grade corporate bond spreads, longer-term securities have demonstrated relatively better performance compared to intermediate notes.

Commodities: Oil prices recorded their first weekly gain since early April, driven by market sentiment favoring risk assets due to growing optimism surrounding a potential debt-ceiling deal in the U.S. The focus shifted away from fundamental factors, with traders closely monitoring developments in Washington. Signs of supply tightening, including Asian refiners resuming purchases of U.S. oil cargoes, contributed to the price buoyancy. However, crude prices remain down approximately 11% for the year due to China's sluggish economic recovery and the Federal Reserve's monetary tightening.

Performance (price return)

As of May 19, 2023

Macro developments

Canada – Canadian Inflation Surges to 4.4% in April, Canadian Retail Sales Expected to Rise 0.2% in April

The annual inflation rate in Canada rose to 4.4% in April 2023, exceeding market expectations of 4.1% and reigniting fears of a more hawkish stance from the Bank of Canada. The increase in consumer prices was driven by the central bank's tightening measures, leading to higher mortgage rates and rent prices (6.1% vs 5.3%). Transportation costs also accelerated (1.3% vs 0.3%) due to OPEC's crude oil output cut, while food inflation fell (8.3% vs 8.9%) due to eased pressures from fresh vegetables, coffee, and tea. On a monthly basis, the Canadian CPI saw a significant 0.7% increase, the highest in six months.

Preliminary estimates indicate that retail sales in Canada are projected to increase by 0.2% month-over-month in April 2023. March saw a 1.4% decline in retail sales, driven by decreases at motor vehicle and parts dealers (-4.4%) and gasoline stations and fuel vendors (-3.9%). However, core retail sales, excluding these categories, experienced a fourth consecutive increase of 0.3%. Notable contributors to this growth were building material and garden equipment and supplies dealers (+1.6%), as well as sporting goods, hobby, musical instrument, book, and miscellaneous retailers (+1.6%), while clothing and accessories retailers saw a decrease of 1.2%.

U.S. – U.S. Retail Sales Rebound in April

U.S. retail sales saw a 0.4% increase in April, recovering from two consecutive months of decline, but falling short of market expectations. Sales rose in various sectors, including motor vehicles and parts dealers, building materials and garden supplies dealers, food services and drinking places, health and personal care stores, merchandise stores, non-store retailers, and miscellaneous store retailers. However, sales at gasoline stations unexpectedly declined, while decreases were also observed in clothing, electronics, furniture, and sporting goods. Core retail sales, excluding certain categories, showed stronger growth at 0.7%, indicating sustained consumer demand.

International – Eurozone's Q1 2023 Economic Growth Stagnates at 0.1%, Japanese Economy Surges by 1.6% in Q1, Japan's Inflation Rate Rises to 3.5% in April

The Eurozone's first quarter of 2023 saw a modest growth rate of 0.1%, following a stagnant fourth quarter. The economy was impacted by higher consumer prices due to increased energy and food costs. The European Central Bank's aggressive tightening of monetary policy, the fastest in over two decades, compounded the economic strain. Confidence levels among businesses and consumers declined, with Germany recording no growth and the Netherlands experiencing a contraction. However, France, Italy, and Spain did see some expansion during the same period.

According to a flash reading, the Japan's economy exhibited remarkable growth in the first quarter of 2023, expanding by 1.6% on an annualized basis. This exceeded market expectations of 0.7% growth and followed a revised 0.1% contraction in the previous period. The strong growth was primarily driven by an acceleration in private consumption after the removal of all pandemic measures. Surprisingly, business investment also grew robustly, rebounding from a decline in the previous quarter. However, government spending remained stagnant after consecutive increases in the past four quarters, and net exports had a negative contribution to overall growth. This quarter's performance marked the strongest pace of growth in three quarters for Japan’s economy.

In April, Japan's annual inflation rate climbed to 3.5%, rebounding from the previous month's 6-month low of 3.2%. The significant rise was primarily attributed to a notable increase in food prices, reaching the highest level since August 1976. Additionally, costs accelerated across various sectors, including transport, clothing, furniture, medical care, and education. However, housing, and miscellaneous inflation slightly eased. Fuel, light, and water charges continued to decline, mainly due to electricity prices. Core inflation also reached a 3-month high of 3.4%, in line with market expectations and surpassing the Bank of Japan's 2% target for the 13th consecutive month.

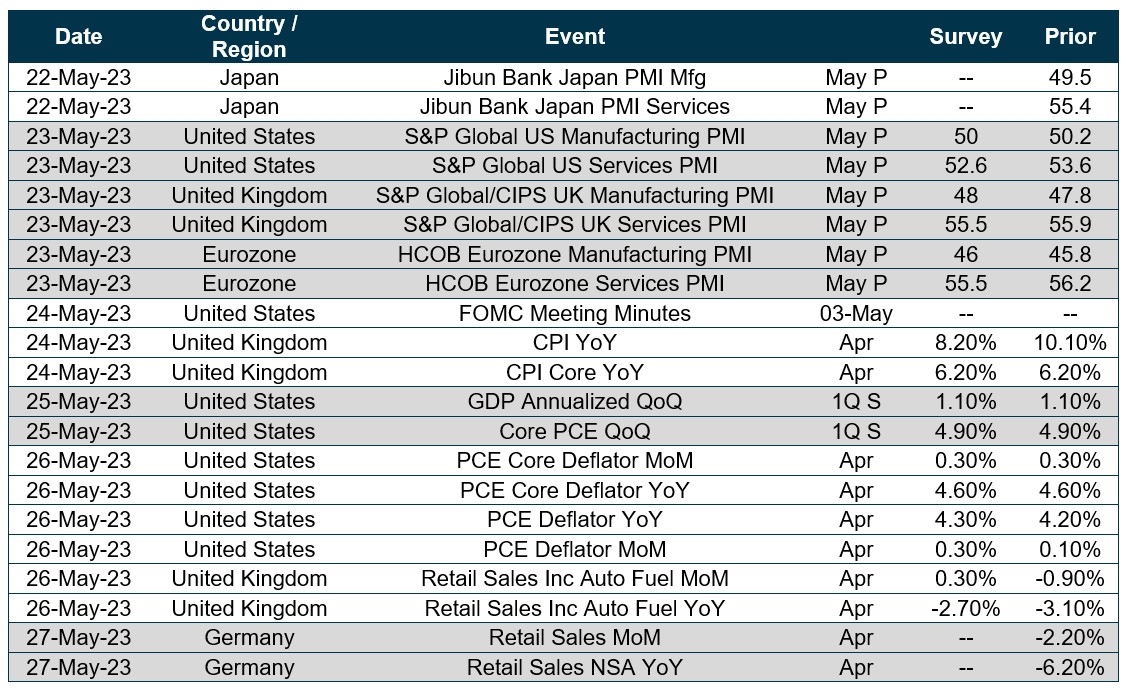

Quick look ahead

As of May 19, 2023