Weekly Market Pulse - Week ending November 17, 2023

Market developments

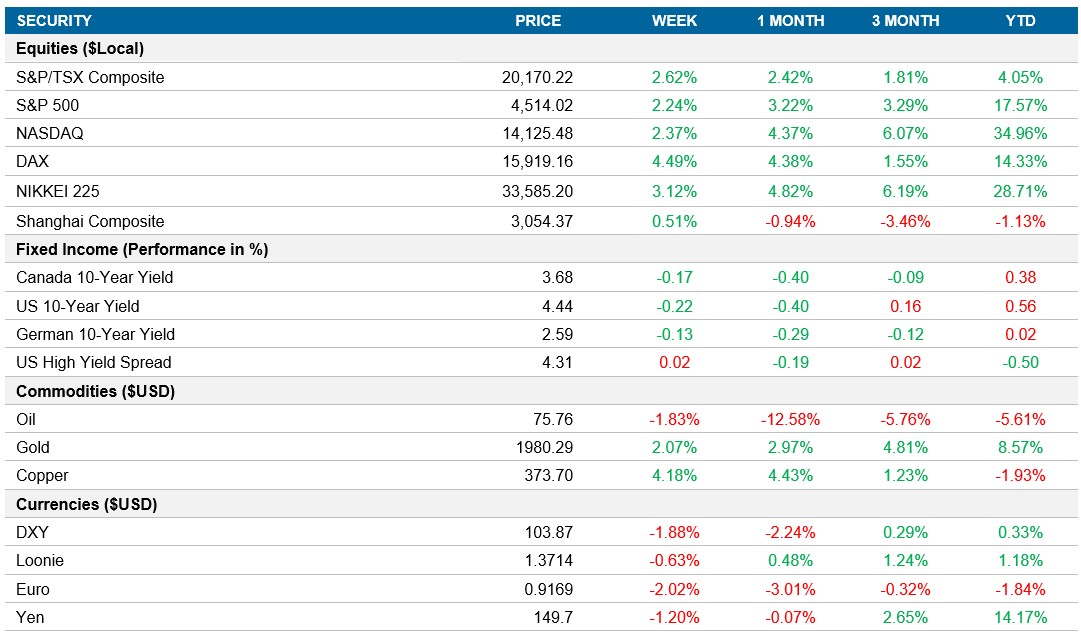

Equities: After a $2.7 trillion rally in November, spurred by speculation that the Federal Reserve might halt its hiking cycle, the S&P 500 is now trading above 4,500 and posted its third consecutive week of gains. The S&P 500, despite recent consolidation, faces potential short-term pullback, valuations of high-quality stocks have surged, historically associated with periods of turmoil. Earnings season concludes with a 4% YoY increase, potentially ending a three-quarter streak of declines, with attention on upcoming reports from retailers and tech companies like Best Buy, Nordstrom, Lowe’s, and Nvidia.

Fixed income: Inflation in the U.S. continues to cool leading to lower yields in the U.S. with the 10yr and 2yr yields down ~20bps and ~15bps respectively. Investors are cautious about potential rate cuts, with mixed signals from Fed officials, however at this moment it appears investors believe we are at global peak rates as the U.S., Canada and Eurozone show no probability of another rate hike.

Commodities: Oil futures rebounded on Friday, erasing previous session losses that pushed U.S. benchmark prices into bear-market territory. The Financial Times reported that OPEC+ might consider additional production cuts in their November 26 meeting, boosting prices. Saudi Arabia is reportedly planning to extend its oil-production cuts into the next year. The recent dip below $80 in prices triggered speculation about OPEC intervention.

Performance (price return)

As of November 17, 2023

Macro developments

Canada – No Notable Releases

No notable releases this week.

U.S. – Inflation Slows to 3.2%, Retail Sales Declined 0.1%, PPI Falls 0.5% in October

The U.S. annual inflation rate slowed to 3.2% in October, below market forecasts. Energy costs, particularly gasoline, utility gas, and fuel oil, decreased significantly. Prices for food, shelter, and new vehicles softened, while apparel, medical care commodities, and transportation services saw faster increases. The Consumer Price Index (CPI) was unchanged from September, and the core CPI unexpectedly rose 4%.

Retail sales in the U.S. declined by 0.1% in October, ending a six-month streak of increases. Miscellaneous store retailers, furniture stores, and motor vehicle dealers recorded the largest decreases. Health and personal care stores, food & beverage stores, and online trade partially offset these declines. On a yearly basis, retail trade growth slowed to 2.5% in October from an upwardly revised 4.1% in September.

Producer prices in the U.S. fell 0.5% in October, defying market expectations of a 0.1% increase. Good prices, especially gasoline, went down 1.4%. Services prices were unchanged after six consecutive advances. The decline in prices for some goods was offset by increases in prices for tobacco products. The overall decrease in producer prices was the most significant since April 2020.

International – U.K. Inflation cools, Eurozone Inflation at 2.9%, Eurozone GDP Growth was Negative in Q3, Japanese Economy Shrinks in Q3 and China Retail Sales Surged

The inflation rate in the U.K. dropped to 4.6% in October, below market expectations. Reduction in energy prices contributed to the decrease. Housing and utilities costs fell, as did food inflation. Consumer prices slowed for various categories, including transport, restaurants, and hotels. The core inflation rate, excluding volatile items, eased to 5.7%. The GDP in the Euro Area shrank by 0.1% in Q3 2023, marking the first contraction since 2020.

The inflation rate in the Eurozone was confirmed at 2.9% year-on-year in October, the lowest since July 2021. Energy prices decline and a slowdown in food inflation were key contributors. Core inflation also decreased to 4.2%.

The GDP in the Euro Area shrank 0.1% in Q3 2023, in line with the first estimate. The ECB expects the Euro Area economy to grow only 0.7% in 2023.

The Japanese economy shrank 0.5% qoq in Q3 2023, worse than market forecasts. Elevated cost pressure and global headwinds contributed to the contraction. Private consumption, capital expenditure, and public investment were all weaker than expected. Net trade was a drag on GDP as exports rose less than imports.

China's retail sales surged by 7.6% year-on-year in October, exceeding market expectations. Sales growth was observed across various sectors, including communications equipment, autos, gold and jewelry, home appliances, and office supplies. Trade growth slowed for certain categories. Retail sales for the January to October period increased by 6.9% compared to the same period in 2022.

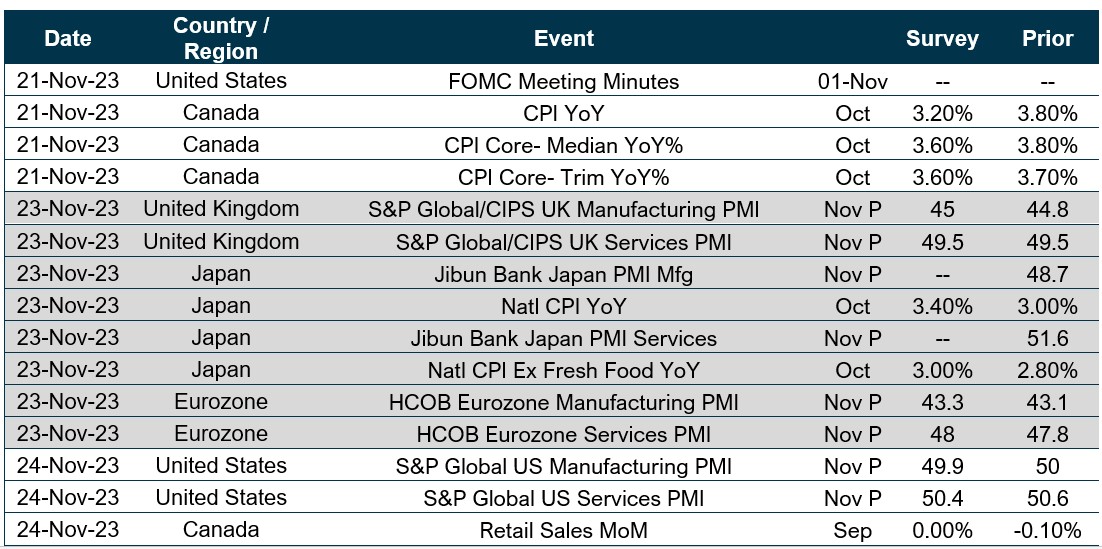

Quick look ahead

As of November 17, 2023