Weekly Market Pulse - Week ending November 3, 2023

Market developments

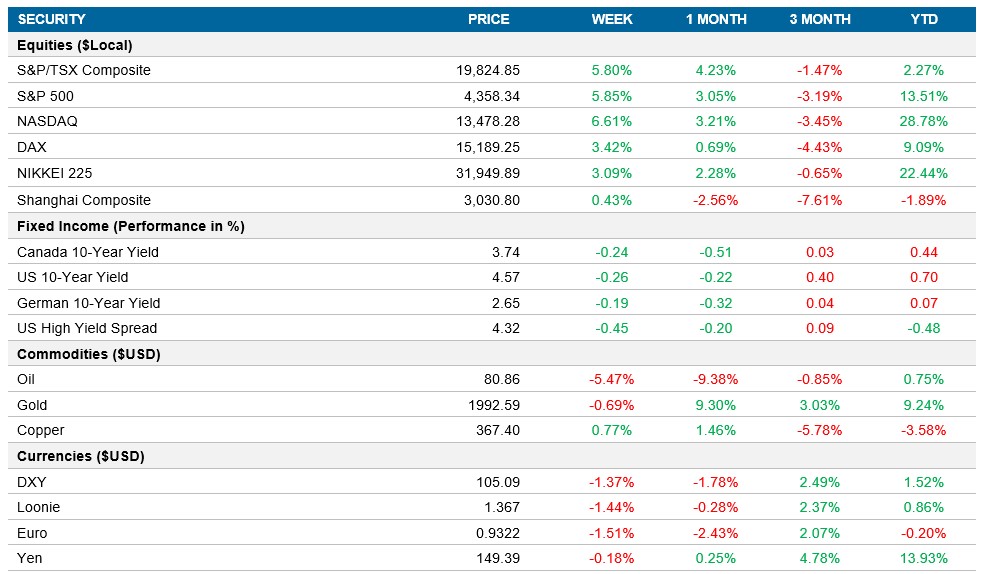

Equities: Stocks rallied, indicating that the Federal Reserve's stance of no further rate hikes and potential rate cuts as early as June resonated with investors. The S&P 500 gained around 5.9%, with the VIX (volatility index) experiencing its largest five-day decrease in 21 months. Despite the recent stock market rebound, concerns persist regarding the profit outlook for Corporate America. Companies providing guidance for the next quarter and beyond have frequently given estimates that fall short of analysts' expectations. A gauge of forward guidance, comparing corporate forecasts with Wall Street consensus, is at its lowest level since 2019, based on data from Bloomberg Intelligence.

Fixed income: Traders have reduced the likelihood of another rate hike by January to just 20% and have fully priced in the possibility of a rate cut by June instead of July. This change in sentiment followed weaker data, including the slowest growth in the U.S. service sector in five months, moderated job growth, and an increase in the unemployment rate to 3.9%. Wage growth also slowed. This led to a drop in yields this week and the U.S. 10yr fell 26bps to 4.57% and the Canadian 10yr closed 24bps lower.

Commodities: Oil prices are experiencing their second weekly loss as the risk premium linked to geopolitical tensions in the Middle East has dissipated. Signs of soft demand are becoming more prominent. Soft U.S. jobs data and a weaker dollar have contributed to this trend, making crude more affordable for importers. Additionally, rising U.S. oil stockpiles and factory activity contraction in China, a major crude importer, have added to concerns.

Performance (price return)

As of November 3, 2023

Macro developments

Canada – Canadian Manufacturing PMI Declines Slightly, Rising Unemployment in Canada

The S&P Global Canada Manufacturing PMI for October decreased to 48.6, indicating a sixth consecutive slowdown in Canadian manufacturing, though at a slower pace. This was due to lower global demand, leading to decreased output and job cuts, despite rising input prices. Manufacturers remained hopeful for a gradual demand recovery in the future.

Canada's unemployment rate rose to 5.7% in October, driven by the impact of rate hikes on the Canadian economy. Jobless individuals increased, and a significant portion remained unemployed for over a month, indicating a challenging job market. Job additions were below expectations, and wage growth slowed.

U.S. – Federal Reserve Maintains Interest Rates, Higher Unemployment in the United States, ISM Services PMI Falls

The Federal Reserve kept the federal funds rate at 5.25%-5.5% in November, focusing on managing inflation and evaluating the impact of previous rate hikes. There was uncertainty regarding the accuracy of earlier rate hike forecasts. Rate cuts were not discussed, and the central bank's focus was on potential additional rate hikes.

The U.S. unemployment rate rose to 3.9% in October, the highest since January 2022. This increase was accompanied by a decline in employed individuals, indicating a challenging labor market. The employment and participation rates also decreased.

The ISM Services PMI for October dropped to 51.8, marking a five-month low. Various factors contributed to this, including slower business activity and employment, while new orders grew faster. Some firms expressed mixed sentiment, with concerns about economic factors such as inflation and interest rates.

International – Bank of England Maintains High Interest Rate, Eurozone Inflation Cools, Eurozone Unemployment Rate Rises, China's Manufacturing Sector Contracts

The Bank of England kept its benchmark interest rate at 5.25% due to signs of an economic slowdown in the UK and persistent high inflation. The Monetary Policy Committee voted to keep rates unchanged, with some members advocating for an increase. Monetary policy was expected to remain restrictive for some time.

In October, the inflation rate in the Eurozone declined to 2.9%, the lowest since July 2021. Core inflation also cooled to 4.2%. Energy costs decreased significantly, and inflation rates eased for food, alcohol, and tobacco, as well as non-energy industrial goods. Services inflation remained stable. On a monthly basis, consumer prices saw a slight increase.

The Eurozone seasonally adjusted unemployment rate increased to 6.5% in September, with the number of unemployed rising. The highest jobless rates were observed in Spain, Italy, and France. Youth unemployment also edged up.

The Caixin China General Manufacturing PMI for October fell to 49.5, indicating the first contraction in the manufacturing sector since July. This was due to reduced output, marginal new order growth, declining employment, and input cost inflation. Sentiment in the sector was at its lowest point in a year, driven by global economic concerns.

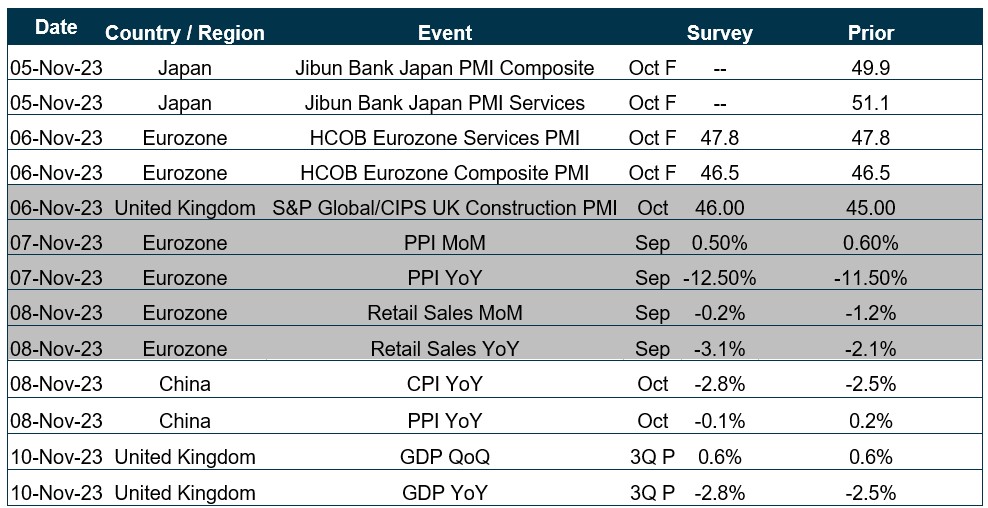

Quick look ahead

As of November 3, 2023