Weekly Market Pulse - Week ending October 20, 2023

Market developments

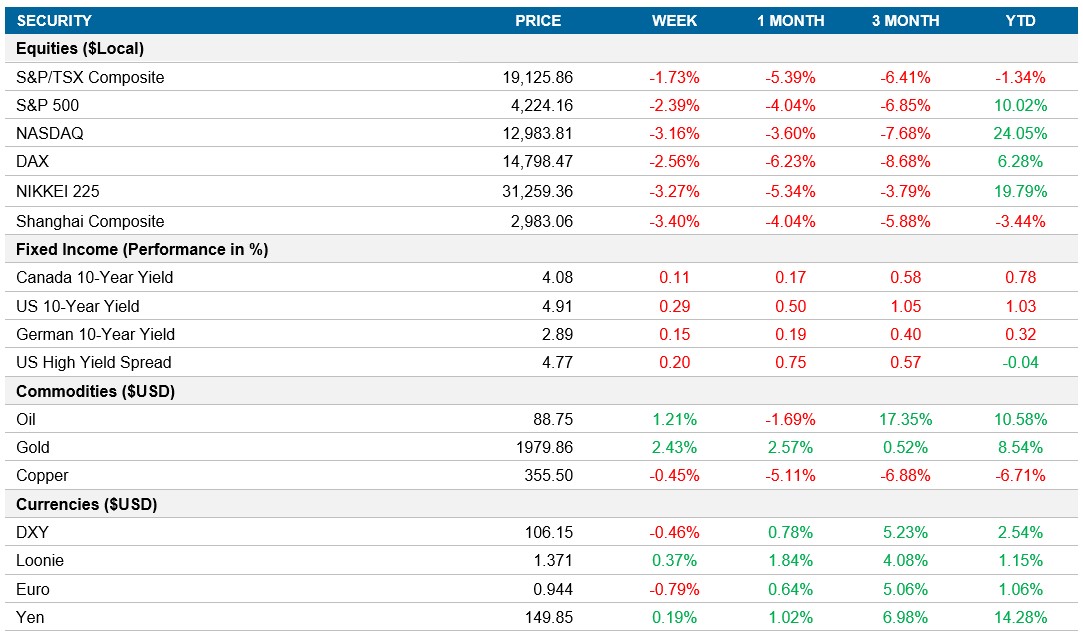

Equities: The U.S. stock market has been volatile due to geopolitical concerns, rising Treasury yields, and worries about higher interest rates. Of the 86 companies in S&P 500 that have announced results through Friday morning, 74% beat analysts’ estimates, with strong prints from the major U.S. banks and Netflix. Despite positive corporate earnings results, there's a sign of mounting distress as the VIX moved higher. Geopolitical risks and inflationary concerns, especially related to energy, are contributing to uncertainty. Equities closed lower across the globe as the S&P 500 and TSX were down -2.4% and -1.7% respectively.

Fixed income: U.S. corporate debt markets are showing signs of weakness, with risk premiums rising for investment-grade corporate bonds and junk bonds. Even asset-backed securities are affected, with companies having difficulty selling debt. The selloff in Treasuries has affected corporate credit markets, with Treasury yields reaching their highest levels in years as the U.S. 10yr closed above 4.9%.

Commodities: Oil prices were up 1.2% this week and closed just below $89, even as prices dropped on Friday as Israel agreed to delay a ground offensive in Gaza. The ongoing tensions and tight oil supplies due to OPEC+ cuts and Saudi Arabia's production reduction are expected to keep prices elevated.

Performance (price return)

As of October 20, 2023

Macro developments

Canada – Inflation Falls to 3.8%, Retail Sales Remain Stable

In September, Canada's annual inflation rate fell to 3.8%, down from 4% in the previous month, which was below market expectations of 4%. This decline reinforced the expectation that the Bank of Canada would avoid further interest rate hikes. Notably, inflation eased in the food and beverage sector and for durable goods.

Retail sales in Canada remained steady, but the preceding month saw a 0.1% decline, primarily due to disruptions caused by port strikes in British Columbia, with approximately 12% of surveyors reporting lower business activity because of issues with supply chain logistics from the strikes.

U.S. – U.S. Retail Sales Rise Above Expectations

In September, retail sales in the United States increased 0.7%, surpassing forecasts of a 0.3% advance, following an upward revision of 0.8% in August, this data highlighted the resilience of consumer spending, despite high prices and borrowing costs. Sales increased in several sectors, with a robust 0.6% rise (excluding specific categories), emphasizing the positive trend.

International – U.K. Inflation Comes in Higher than Expected, China’s Economy Expands by 4.9% in Q3, Japan Inflation Dropped to 3%

The United Kingdom maintained a stable inflation rate of 6.7% in September, defying expectations of a slight decrease to 6.6%. This stability was attributed to softer price increases in food and non-alcoholic beverages and furniture and household goods. However, it was offset by a smaller decline in energy costs due to rising motor fuel expenses. Additionally, core inflation, which excludes volatile items like energy and food, decreased to 6.1%.

China's economy exceeded expectations by expanding 4.9% year-on-year in Q3 2023. This performance provided hope that China could meet its official annual growth target of around 5% despite challenges like a prolonged property crisis and weak trade. Key economic indicators, such as retail sales and industrial output, showed positive trends, with retail sales surging in September, and the surveyed jobless rate reaching a 22-month low. Exports also fell at a slower pace, partly due to a peak shipping season for Christmas products. Considering the first nine months of the year, the Chinese economy advanced by 5.2%.

Japan's annual inflation rate dropped to 3.0% in September, with changes in prices for various categories, including food, fuel, and housing. Core inflation remained above the Bank of Japan's target, and monthly consumer prices increased by 0.3% in September.

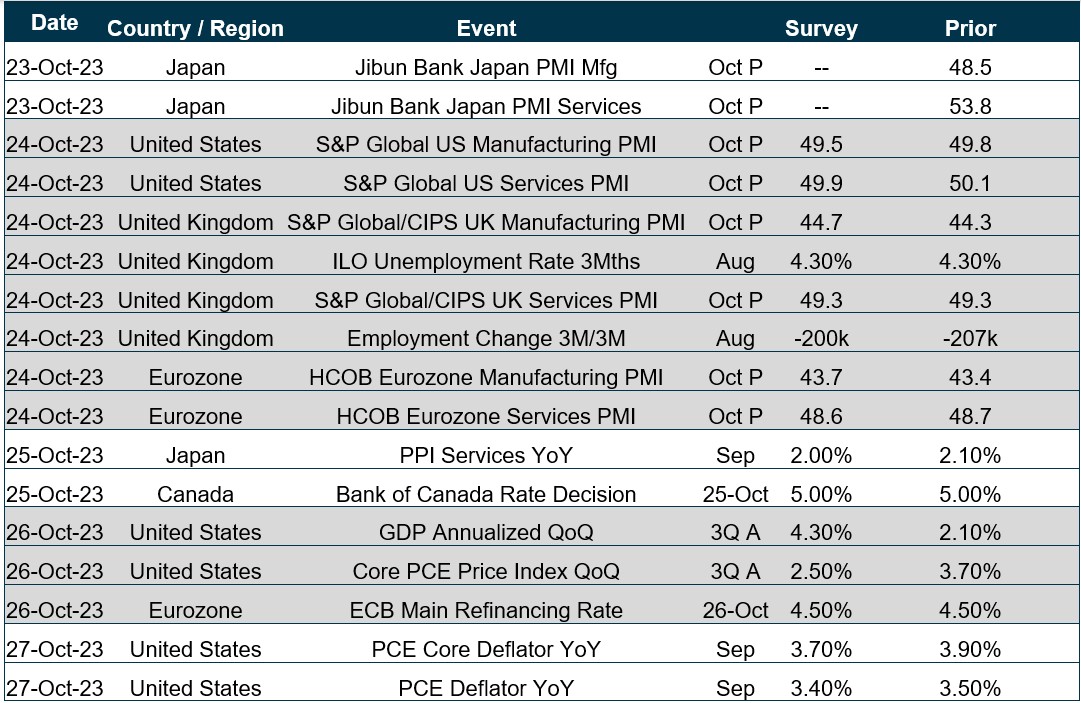

Quick look ahead

As of October 20, 2023