Weekly Market Pulse - Week ending September 8, 2023

Market developments

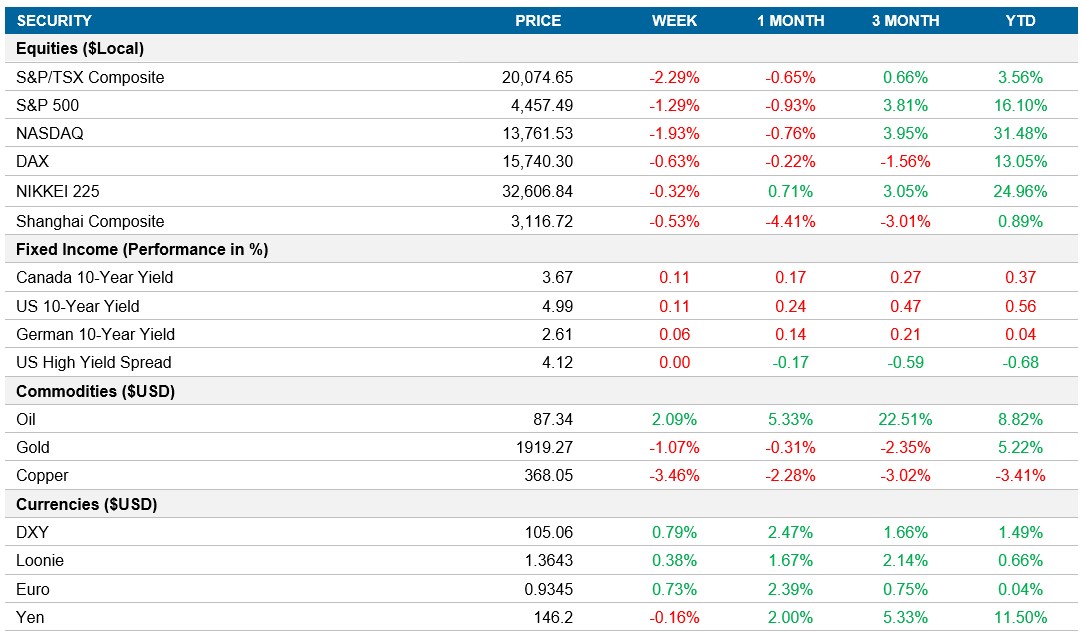

Equities: This week concerns surrounding economic slowdowns in China and the euro area, alongside rising oil prices caused equities to slide. Notably, technology stocks, such as Apple and Nvidia, played significant roles in market movements, especially with China's plan to expand an iPhone ban. Concurrently, speculations intensified that the Federal Reserve might maintain higher interest rates due to strong service-sector activity data and the impact of high oil prices on inflation.

Fixed income: Over the week, Treasury yields experienced dynamic shifts influenced by multiple factors. The initial surge in yields was driven by the reinvigoration of the corporate new-issue market post-Labor Day and a rise in crude oil prices. Despite this, subsequent sessions saw a slight retraction, influenced by corporate borrowing activities and oil price fluctuations. Mid-week observations highlighted a mixed performance in Treasuries, with notable strength at the front-end, while later in the week, variations in yields across different tenors emerged.

Commodities: Crude oil prices experienced significant fluctuations, primarily influenced by decisions made by OPEC+ leaders, Saudi Arabia and Russia. The duo decided to extend their supply curbs through the end of the year, which prompted oil prices to surge, with Brent crude surpassing $90 a barrel for the first time since November of last year. The persistent supply cuts aim to deplete inventories further and have been reinforced just as global crude consumption is estimated to be at an all-time high.

Performance (price return)

As of September 8, 2023

Macro developments

Canada – Bank of Canada Leaves Interest Rates Unchanged

The Bank of Canada has decided to keep interest rates unchanged at 5.0% but expressed its willingness to hike rates further if necessary. The bank acknowledged the recent contraction in the Canadian economy, which was mainly driven by a decline in consumption growth and housing activity. The bank expressed concern about high inflation persisting and the risk of it becoming entrenched, but it expects inflation to ease again after a near-term increase.

U.S. – ISM Services Index Hits Six-Month High in August

The August ISM services index rose to a six-month high of 54.5, indicating that activity growth is holding up in the third quarter, driven by increases in all of the main sub-components, with the employment index rising particularly sharply. However, the survey doesn’t support the idea that the economy is accelerating, and the weighted average of the two ISM surveys is still consistent with below-trend GDP growth.

International – China's Trade and Europe's Retail Sales

Euro-zone retail sales fell by 0.2% in July, with Germany experiencing the largest drop of 0.8%, while France, Spain and Portugal saw a rise. Tighter monetary policy is expected to continue to impact consumers and push retail sales down further for the remainder of the year. Although new car registrations have increased, household spending on non-retail items has not yet been able to offset the decline in retail sales.

China's export values contracted in August due to lower prices, but export volumes remained steady and above pre-pandemic levels. However, this resilience is unlikely to last as global goods demand continues to face a challenging outlook. Import volumes picked up and are expected to persist in the coming months due to the recovery in construction activity and international travel boosting commodity demand.

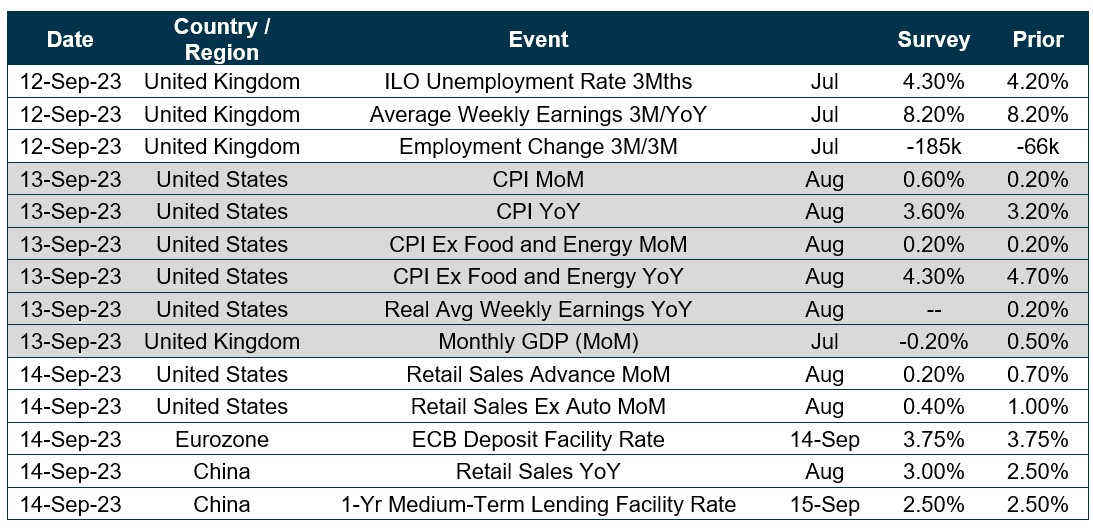

Quick look ahead

As of September 8, 2023