Weekly Market Pulse - Week ending August 2, 2024

Market developments

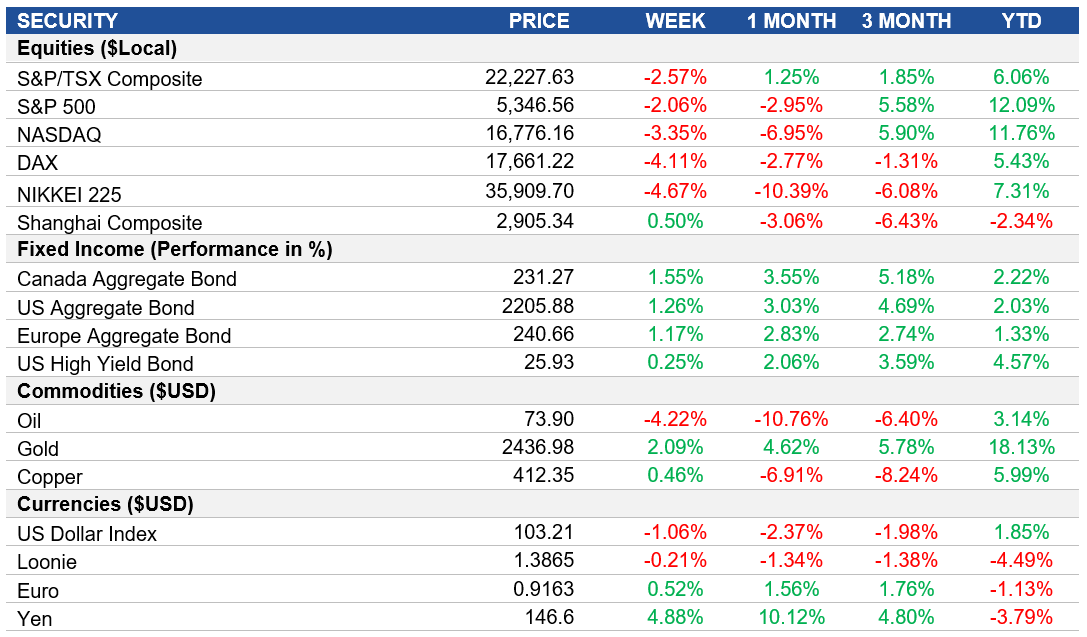

Equities: Wall Street experienced a significant selloff this week, with the Nasdaq 100 entering into correction territory (down 10% from its peak) and the S&P 500 on track for its worst reaction to jobs data in almost two years. The selloff was driven by concerns over big tech earnings and a weak jobs report, which stoked fears that the Federal Reserve's high interest rates might be risking a deeper economic slowdown. The VIX Index soared to its highest level since March 2023, signaling increased investor anxiety.

Fixed Income: Treasury yields tumbled as the weak jobs report fueled worries about economic slowdown. The ten-year Treasury yield declined 18bps to 3.80%. Traders are now projecting that the Federal Reserve will cut rates by a full percentage point in 2024, with some even anticipating a large 0.5% move at September’s meeting.

Commodities: Oil prices slumped to their lowest levels in almost seven months, with Brent crude falling to $77 a barrel. The decline was driven by concerns about demand in the world's two largest economies, the US and China, as manufacturing gauges in both countries showed contractions. This overshadowed heightened geopolitical risks in the Middle East.

Performance (price return)

Source: Bloomberg, as of August 2, 2024

Macro developments

Canada – GDP Expands, Manufacturing PMI Contracts

Canada's GDP expanded by 0.2% in May 2024, higher than preliminary estimates and market expectations of 0.1% growth. Goods-producing industries grew 0.4%, while services-producing industries grew by 0.1%. For June 2024, GDP is expected to grow 0.1%, driven by increases in construction, real estate, and finance sectors.

The S&P Global Canada Manufacturing PMI fell to 47.8 in July 2024, down from 49.3 in June. This indicates the sharpest contraction in operating conditions since December and extends the current period of decline to 15 months. Output and new orders decreased significantly due to challenging market conditions and heightened uncertainty.

U.S. – Fed Holds Rates, Manufacturing PMI Declines, Job Growth Slows

The Federal Reserve maintained the federal funds rate at 5.25%-5.50% for the eighth consecutive meeting in July 2024. The Fed noted progress toward the 2% inflation goal but remains cautious about rate cuts. Chair Powell indicated that a September cut could be on the table if inflation moves down in line with expectations.

The ISM Manufacturing PMI fell to 46.6 in July 2024 from 48.5 in the previous month, reflecting the sharpest contraction in U.S. factory activity since November 2023. New orders, production, and employment all declined, while prices faced by factories rose at a faster pace.

The U.S. economy added 114K jobs in July 2024, well below a downwardly revised 179K in June and forecasts of 175K. It is the lowest level in three months, signaling a cooling labor market. Employment continued to trend up in health care, construction, and transportation, while job losses occurred in information.

The unemployment rate in the United States rose to 4.3% in July 2024 from 4.1% in the previous month, the highest since October 2021. The labor force participation rate edged higher to 62.7% from 62.6%.

International – Central Bank Decisions and Eurozone Economic Indicators

The Bank of Japan raised its key short-term interest rate to 0.25% in July 2024, up from the prior range of 0 to 0.1%. The central bank also announced plans to reduce monthly bond-buying, signaling a move towards more normal monetary policy.

The Bank of England lowered its Bank Rate by 25bps to 5% in August, noting caution in further loosening monetary policy. The decision was described as "finely balanced," with four MPC members opting to hold borrowing costs unchanged.

The GDP in the Euro Area expanded 0.6% year-on-year in the second quarter of 2024, the most in five quarters. Quarter-on-quarter, the GDP grew by 0.3%.

The annual inflation rate in the Euro Area unexpectedly edged up to 2.6% in July 2024 from 2.5% in June, above forecasts of 2.4%. Energy costs increased, while inflation for services and food slowed slightly. The core inflation rate held steady at 2.9%.

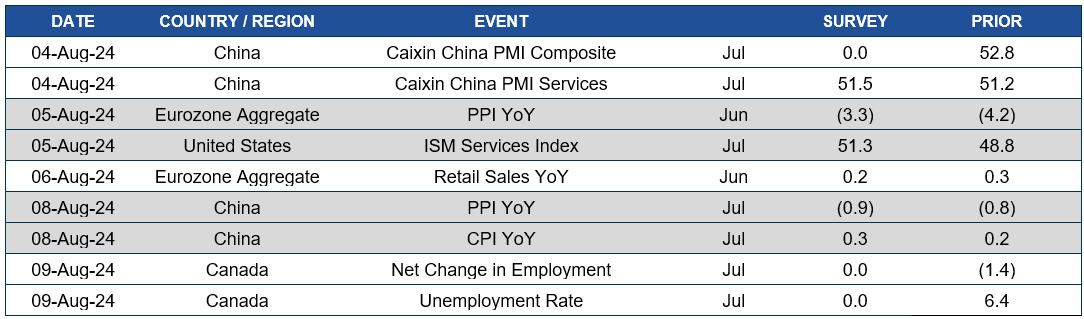

Quick look ahead

As of August 2, 2024