Weekly Market Pulse - Week ending August 9, 2024

Market developments

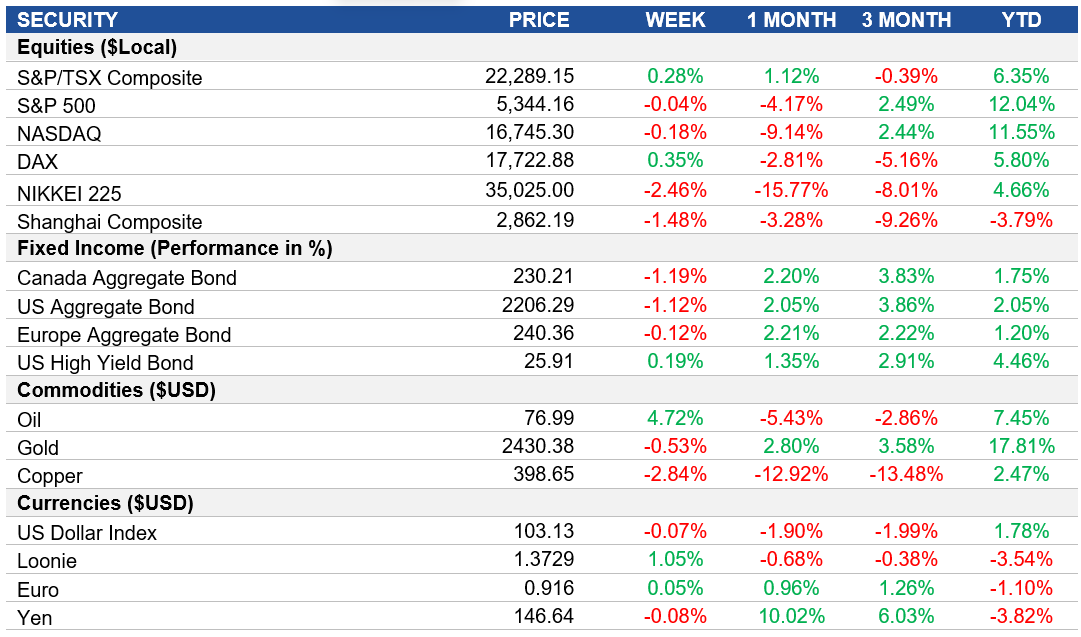

Equities: Markets have experienced a turbulent week, with the S&P 500 showing minimal movement after a significant volatility surge and suffering a fourth consecutive week of declines. Investor sentiment remains cautious amid concerns about potential late interest rate cuts by the Federal Reserve and fears of a recession, exacerbated by a recent rate hike from the Bank of Japan that impacted global markets. Despite the turmoil, some analysts suggest that extreme fear among investors could indicate a potential rebound in the S&P 500 over the next year.

Fixed Income: After initially continuing the decline from last week, U.S treasuries rallied back as an inline jobs number drove the U.S. 10-year yield to ~3.95% to end the week. Treasury yields in both Canada and Europe also climbed higher this week leading to bond prices giving back some of their gains from last week across North America and Europe.

Commodities: Oil prices are set for their first weekly gain in five weeks, trading at ~$77.00. This comes as U.S. crude inventories have fallen for six consecutive weeks, reaching their lowest levels since February, despite a decline in gasoline demand and a surprise increase in gasoline inventories.

Performance (price return)

Source: Bloomberg, as of August 9, 2024

Macro developments

Canada – Canadian Labour Market Softens

The unemployment rate in Canada held steady at 6.4% in July 2024, below expectations of 6.5% but indicating a softening labour market. Employment dropped by 2,800 jobs, contrasting with an expected increase of 22,500, while the number of unemployed decreased by 8,600. The labour force participation rate fell to 65%, its lowest since 1998 (excluding pandemic impacts), and unemployment varied across demographics.

U.S. – No Notable Releases

No notable releases this week.

International – Continued Deflation in Eurozone Producer Prices, Eurozone Retail Sales Decline, China's Private Sector Growth Slows, China's Inflation Rises

Producer prices in the Eurozone decreased by 3.2% year-on-year in June 2024, marking the 14th consecutive month of deflation. The decline was driven by significant drops in energy prices and intermediate goods, while prices excluding energy saw a smaller decline.

Retail sales in the Eurozone fell by 0.3% month-over-month in June 2024, more than expected, with declines in food, drinks, tobacco, and non-food products. However, auto fuel sales increased. Year-on-year, retail sales also declined by 0.3%.

The Caixin China General Composite PMI decreased to 51.2 in July 2024, indicating slower private sector growth. Services activity rebounded slightly, while manufacturing showed only marginal gains. Employment improved in the service sector, but input costs continued to rise, and selling prices declined. Overall, business sentiment improved.

China's annual inflation rate rose to 0.5% in July 2024, exceeding forecasts. This increase was driven by a reversal in food price declines and continued rises in non-food costs. However, transport costs fell further, and core consumer prices grew at the slowest rate in six months. Monthly, the CPI increased by 0.5%, above expectations.

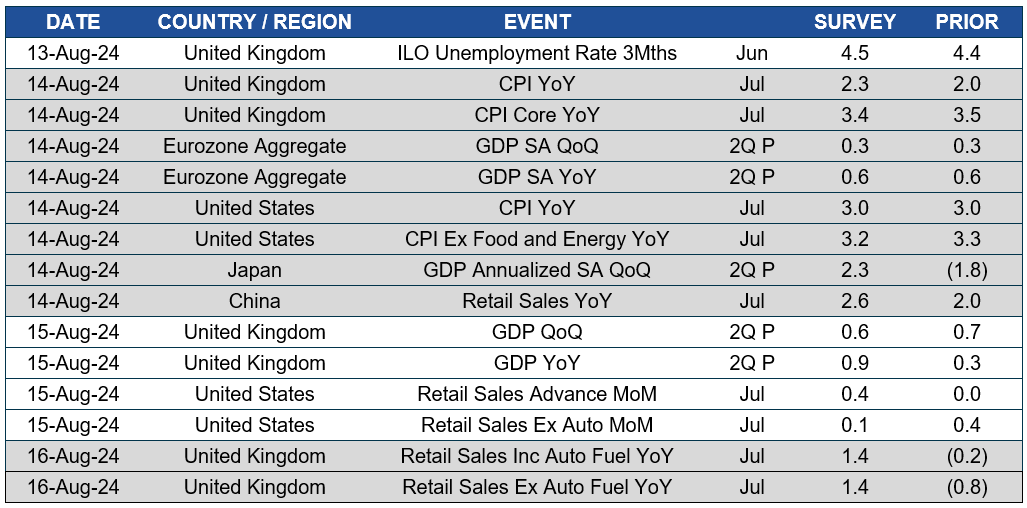

Quick look ahead

As of August 9, 2024