Weekly Market Pulse - Week ending July 19, 2024

Market developments

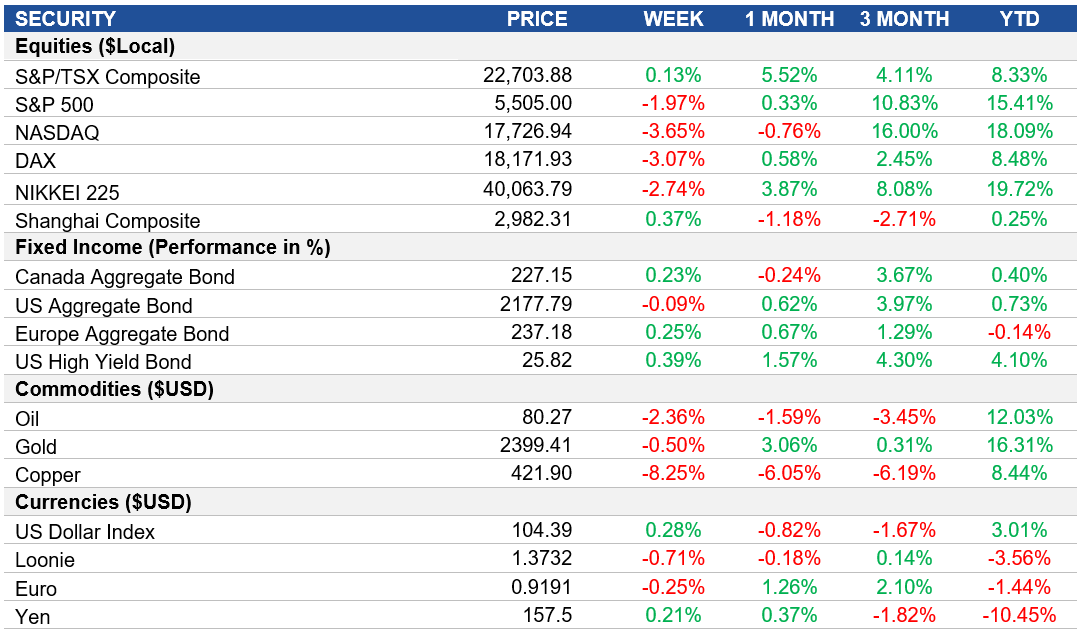

Equities: The U.S. stock market is poised to extend its decline for a third consecutive session on Friday, with major indices experiencing significant weekly losses. The S&P 500 and Nasdaq suffered their largest weekly declines since April. Technical glitches affecting CrowdStrike and Microsoft have contributed to market volatility, causing significant drops in their stock prices. The market downturn is also influenced by a rotation into smaller, riskier company shares and concerns about tighter U.S. restrictions on chip sales to China.

Fixed Income: The June CPI data was seen as supportive of further monetary easing, with many economists expecting another rate cut from the Bank of Canada (BOC) next week. Economists expect the BOC to focus more on the future trajectory of inflation rather than the latest data, and to emphasize that risks are becoming more balanced between economic downside and inflationary upside. The BOC is expected to announce an additional rate cut on Wednesday and traders are pricing in one more this fall.

Commodities: Gold prices have experienced a decline for the third consecutive day, retreating from the all-time high reached earlier this week. Gold reached a record price of $2,483.73 an ounce on Wednesday, driven by increased expectations of earlier and deeper monetary easing from the Federal Reserve. Some investors view the recent gains as excessive, leading to the current pullback.

Performance (price return)

Source: Bloomberg, as of July 19, 2024

Macro developments

Canada – Canadian Inflation Trends Downward in June, Sharp Decline in Canadian Retail Sales

The annual inflation rate in Canada decreased to 2.7% in June 2024 from 2.9% in May, surprising expectations that it would remain steady. This aligns with the Bank of Canada's forecast. Inflation fell for transportation and shelter but rose for food, and core inflation remained unchanged at 2.9%.

Canadian retail sales likely dropped 0.3% in June 2024, following a 0.8% fall in May, marking the steepest decline in 14 months. Sales fell in most subsectors, particularly building materials, food and beverage, and clothing. Core retail sales, excluding gas stations, dropped 1.4%, though yearly turnover increased by 1%.

U.S. – Stagnation in U.S. Retail Sales for June,

U.S. retail sales stalled in June 2024, following a 0.3% increase in May. Gasoline and auto sales dropped, while non-store retailers and several other sectors saw increases. Sales excluding gasoline rose 0.2%, and those excluding food services, auto dealers, building materials, and gasoline stations rose 0.9%, the highest since April 2023.

International – U.K. Inflation Steadies in June, Eurozone Inflation Slightly Eases, ECB Holds Interest Rates Steady, Japan’s Inflation Holds at 2.8%

U.K.'s annual inflation rate remained at 2% in June 2024, matching May's rate and holding at 2021 lows. Higher costs in restaurants, hotels, and transportation were offset by falling clothing and footwear prices. Housing and utilities prices continued to fall, while inflation for services and recreation remained steady.

The Eurozone's annual inflation rate was confirmed at 2.5% in June 2024, down from 2.6% in May. Energy and food prices eased, while inflation for services and non-energy industrial goods remained stable. Inflation slowed in Germany, France, and Spain but rose slightly in Italy.

The European Central Bank kept interest rates unchanged in July 2024, with the main rate at 4.25%. Despite some temporary inflation increases in May, most indicators stabilized in June. The ECB remains focused on returning inflation to 2% and will adjust rates based on economic data and inflation trends.

Japan's annual inflation rate held at 2.8% in June 2024, highest since February. Electricity prices stayed high and gas prices rose after energy subsidies ended. Prices for food, housing, transport, and other sectors rose, while education prices fell. Core inflation increased to 2.6%, suggesting a potential rate hike by the central bank.

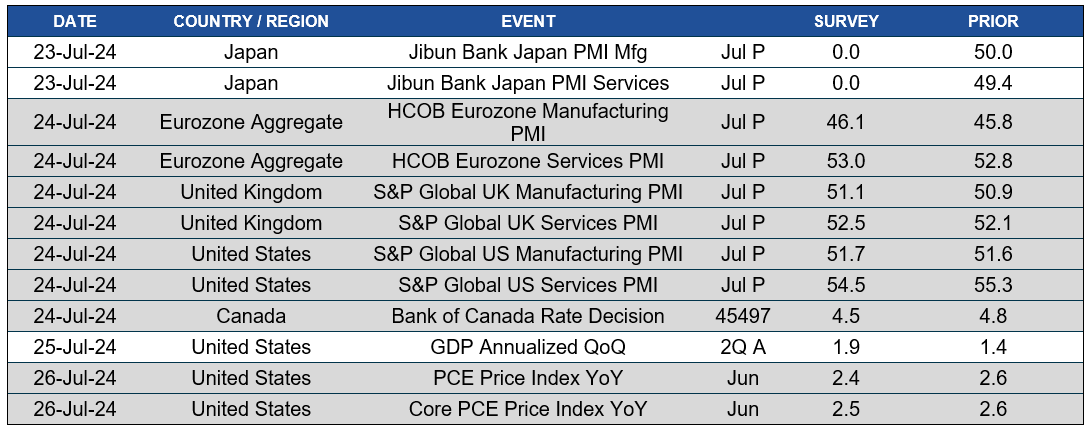

Quick look ahead

As of July 19, 2024