Weekly Market Pulse - Week ending July 26, 2024

Market developments

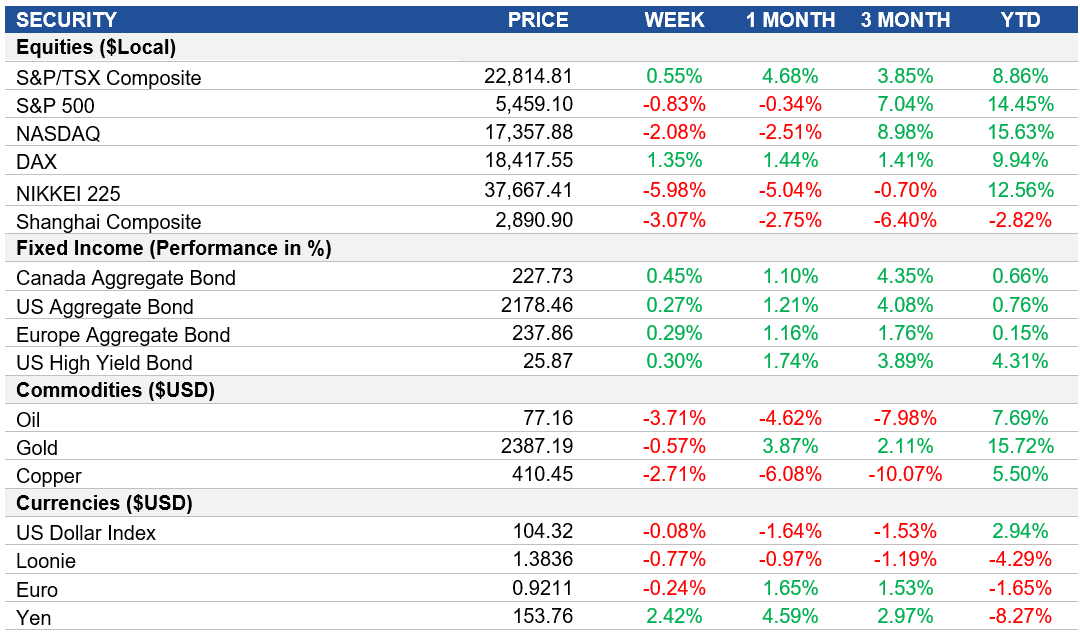

Equities: Wall Street traders are optimistic that the Federal Reserve will achieve a soft landing, which has led to a rally in riskier market segments. This led to a shift from tech stocks to other sectors, driven by expectations of lower interest rates. Economically sensitive shares, such as financial and industrial companies, led gains, with smaller firms outperforming tech megacaps. Earnings season is well underway and although ~80% of S&P 500 companies are beating their second quarter earnings estimates, the outlook for the back half of the year has been more cautious and drove some large cap stocks lower this week.

Fixed Income: The 25bps cut for the Bank of Canada (BOC) this week, along with the increased expectation of a third cut this fall helped drive short term government yields lower. On the U.S. side, traders are betting on a rate cut in September, which they believe will benefit the economy without signaling a severe slowdown.

Commodities: Copper prices fell to its lowest level since early April due to a selloff in global stock markets and rising concerns about demand in China and other regions. The metal has dropped about 20% since its peak in mid-May, as initial bullish bets on supply constraints and increased usage have been overshadowed by worries about rising inventories and weak conditions in China's spot market.

Performance (price return)

Source: Bloomberg, as of July 26, 2024

Macro developments

Canada – Bank of Canada Cuts Interest Rate

The Bank of Canada reduced its key interest rate by 25bps to 4.5% in July 2024, following a similar cut in June. The decision was influenced by excess supply in the economy, moderating labour market conditions, and the need to reduce high mortgage and shelter costs. Inflation is expected to decline in the second half of the year due to base effects from gasoline prices.

U.S. – U.S. Composite PMI Rises, U.S. Economy Growth Accelerates, PCE Remains Steady

The S&P Global U.S. Composite PMI increased to 55.0 in July 2024, the highest since April 2022, driven by strong service sector growth despite a decline in manufacturing output. New work inflows rose modestly, employment growth slowed, and business confidence fell due to political uncertainty. Competitive pressures kept price increases low despite rising input costs.

The U.S. economy grew at an annualized rate of 2.8% in Q2, up from 1.4% in Q1, surpassing forecasts. Consumer spending and non-residential investment accelerated, while private inventories and government spending also contributed to growth. However, residential investment contracted, and net trade negatively impacted growth as imports rose faster than exports.

The U.S. Personal Consumption Expenditure (PCE) price index rose 0.1% in June 2024, meeting expectations. The core PCE index, excluding food and energy, increased 0.2%, surpassing forecasts. While the annual PCE rate dropped to 2.5% as anticipated, the annual core PCE inflation remained steady at 2.6%, contrary to expectations of a decrease to 2.5%

International – U.K. Composite PMI Exceeds Expectations, Eurozone PMI Signals Stagnation, Japan Composite PMI Improves

The S&P Global U.K. Composite PMI rose to 52.7 in July 2024, marking the ninth consecutive month of expansion. Services activity growth and manufacturing output both increased, with new business and hiring rates also improving. Average prices rose at the slowest rate in over three years, although costs remained high due to supply chain issues, particularly in manufacturing.

The HCOB Flash Eurozone Composite PMI declined to 50.1 in July 2024, indicating near-stagnation in the Eurozone's private sector. Manufacturing weakness worsened, and the services sector slowed, leading to a drop in new orders and business confidence. Input cost inflation rose, but companies increased selling prices at a slower pace. Germany and France underperformed, with Germany's output decreasing and France experiencing a reduction in business activity.

The au Jibun Bank Flash Japan Composite PMI rose to 52.6 in July 2024, the highest in three months, driven by strong service sector growth despite a contraction in manufacturing. Demand conditions strengthened, employment increased, and backlogs of work rose slightly. Input prices and selling prices quickened, and sentiment remained positive, though optimism softened.

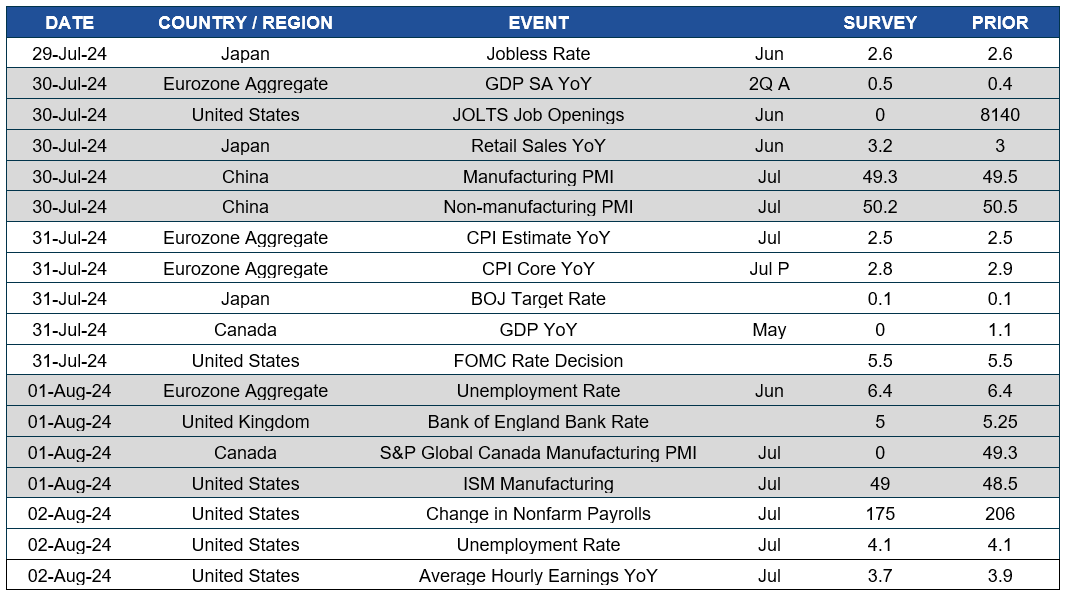

Quick look ahead

As of July 26, 2024