Weekly Market Pulse - Week ending May 3, 2024

Market developments

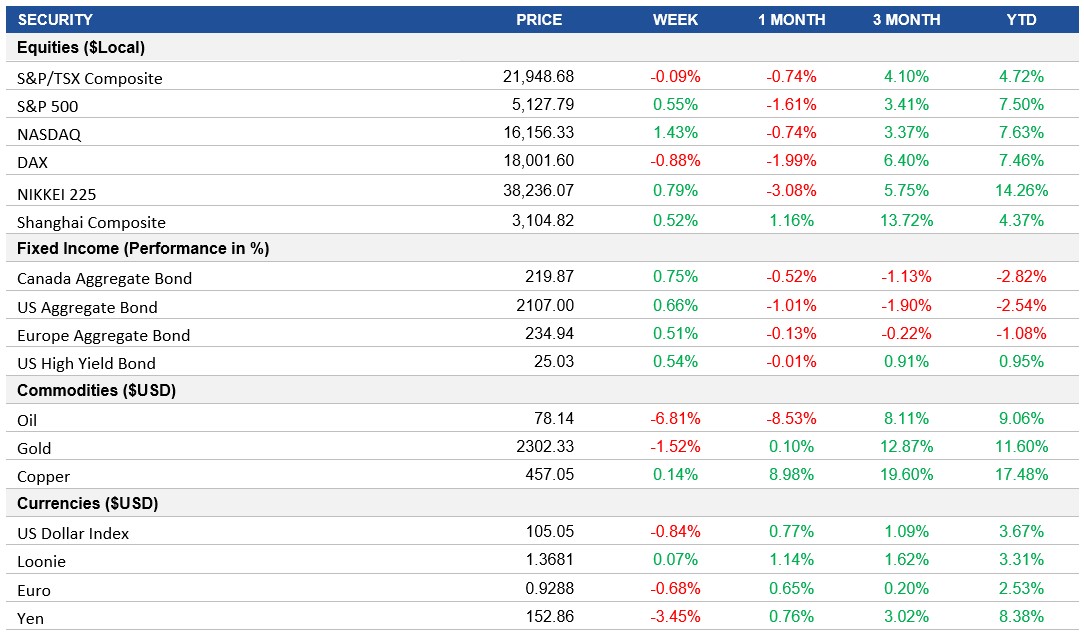

Equities: The economic data to close out the week was seen as a "Goldilocks" scenario by markets, indicating the economy is cooling enough for the Federal Reserve to likely start cutting interest rates as soon as September. The S&P 500 rose by approximately 0.55%, surpassing the 5,100 mark, with the Nasdaq outperforming, fueled by a 6% surge in Apple's stock as they capped off a busy two weeks of corporate earnings.

Fixed Income: The economic data was seen reviving rate cut expectations and easing recent "stagflation" fears in markets, as a gradual labour market cooldown could allow the Fed to ease policy later this year if inflation cooperates. Treasury yields fell sharply, with 2-year yields dropping as much as 17 basis points on Friday and bond prices ended the week in positive territory as traders now priced in around 50 basis points of Fed rate cuts this year.

Commodities: The removal of the "war risk premium" that was priced into oil due to escalating tensions between Iran and Israel. As hopes for a ceasefire between Israel and Hamas grow amid international pressure, oil prices have given back gains made since early March and lost -7% to end the week.

Performance (price return)

Source: Bloomberg, as of May 3, 2024

Macro developments

Canada – Canada's GDP Stalls in March 2024, Challenges Persist for Canadian Manufacturing

Despite some sectors like utilities and real estate experiencing growth, Canada's GDP remained unchanged in March 2024. While there were increases in utilities, real estate, and rental & leasing, these gains were offset by declines in manufacturing and retail trade. The transportation and warehousing sector saw a significant rise, thanks to the resumption of activity on rails and increased international travel to Asia. However, the contraction in the utilities sector and the decline in manufacturing tempered overall economic growth.

Canadian manufacturing faced ongoing challenges in April 2024, with the S&P Global Canada Manufacturing PMI indicating a contractionary trend for the twelfth consecutive month. Both output and new orders declined, primarily due to weak demand, especially from global markets. Despite a marginal increase in employment, inflationary pressures persisted, limiting pricing power. While there was some optimism about future output, concerns remained regarding the impact of high interest rates on market activity.

U.S. – Fed Maintains Interest Rates Amid Inflation Concerns, U.S. Job Growth Slows in April 2024, U.S. Services Sector Contracts in April 2024

During its May 2024 meeting, the Federal Reserve opted to keep interest rates unchanged for the sixth consecutive time, aiming to address ongoing inflationary pressures. Chair Powell expressed confidence in the current policy's ability to achieve the 2% inflation target, despite a lack of significant progress in recent months. The Fed also announced plans to reduce the speed of its quantitative tightening, starting from June 1st, in response to evolving economic conditions.

The U.S. economy added 175,000 jobs in April 2024, marking a significant slowdown compared to the previous month's upwardly revised figure. While job gains were notable in sectors like healthcare and transportation, the overall pace of growth fell short of market expectations. This slowdown underscores challenges in maintaining the brisk pace observed in the first quarter, raising concerns about future economic performance.

April 2024 saw a sharp contraction in the U.S. services sector, as indicated by the ISM Services PMI dropping to 49.4, the first contraction since December 2022. This unexpected decline, coupled with a similar contraction in manufacturing, suggests that higher borrowing costs from the Federal Reserve may be exerting significant pressure on business conditions. Slower growth in new orders and output, along with accelerated job shedding, highlight the challenges facing the services industry.

International – Eurozone Inflation Remains Stable, Mixed Signals for Eurozone Manufacturing, Eurozone Unemployment Stays Low and China's Manufacturing Sector Grows

In April 2024, inflation in the Eurozone remained stable at 2.4%, in line with market expectations. While prices rose faster for food, alcohol, and tobacco, inflation slowed for non-energy industrial goods and services. The Eurozone's economy expanded by 0.3% in the first quarter, exceeding market expectations, providing room for the European Central Bank to maintain its current stance on interest rates amidst evolving inflationary pressures.

Eurozone manufacturing experienced a slight deterioration in business conditions in April 2024, with declines in new orders offsetting easing output contraction. Although employment levels continued to fall, the rate of decline moderated. Suppliers' delivery times shortened, while both input costs and output charges decreased. Despite these challenges, business sentiment strengthened, indicating cautious optimism about prospects.

The Eurozone's unemployment rate remained at a record low of 6.5% in March 2024, in line with market expectations. Despite this stability, variations persist among major Eurozone economies, with Spain reporting the highest jobless rate and Germany the lowest. Overall, the Eurozone continues to see improvements in employment figures compared to a year earlier.

China's manufacturing sector experienced growth in April 2024, with the Caixin China General Manufacturing PMI increasing to 51.4. This marks the sixth consecutive month of growth, supported by improved demand conditions and rising output. However, employment continued to decline amidst ongoing challenges, including rising input costs and competitive pressures. Despite these obstacles, sentiment weakened slightly, reflecting concerns over rising costs and increased competition.

Quick look ahead

As of May 3, 2024