Weekly Market Pulse - Week ending November 1, 2024

Market developments

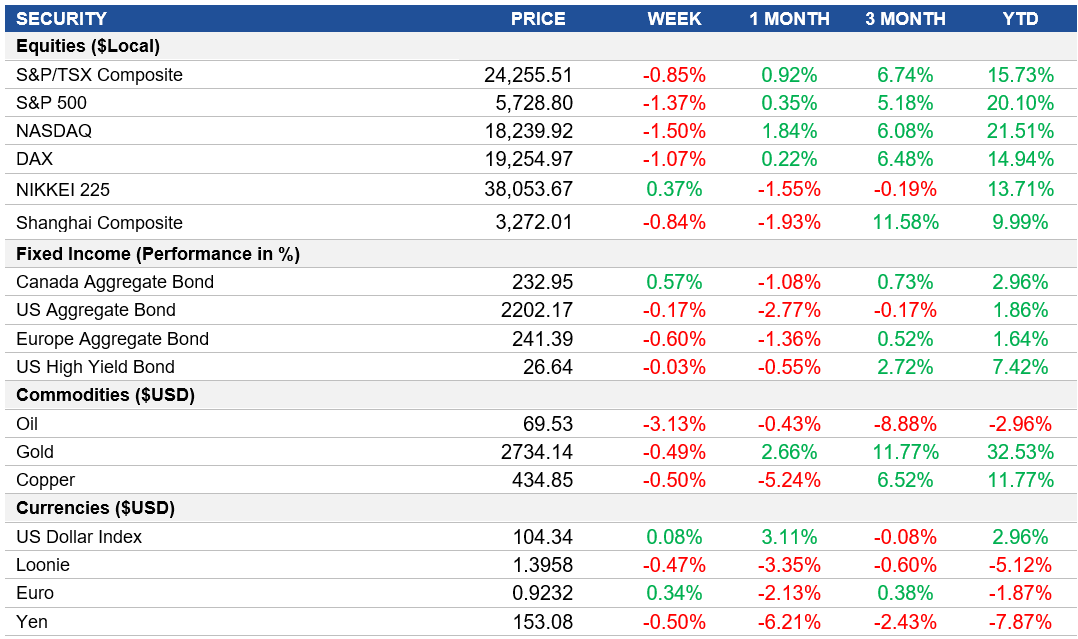

Equities: This week, the earnings reports from the Magnificent Seven tech stocks highlighted mixed results. Apple saw a decline in its stock despite record iPhone sales. Amazon exceeded expectations that led to a notable surge in its stock, while Meta and Microsoft faced stock declines following earnings announcements, contributing to a cautious market sentiment overall. North America and Europe declined this week, with the S&P 500 and TSX Index down by -1.4% and -0.85% respectively.

Fixed Income: U.K. bonds continued to decline this week following the Labour government's budget announcement and plans for increased bond sales, which led to significant selling pressure. Meanwhile, U.S. Treasuries remained stable after minor gains, but October marked the worst month for Treasuries in two years due to a re-evaluation of U.S. interest rates amid signs of economic resilience.

Commodities: Oil prices experienced weekly losses after a volatile period influenced by geopolitical tensions and weak market fundamentals. Brent crude is trading around $73 per barrel, while West Texas Intermediate (WTI) is approximately $70 per barrel. Both benchmarks experienced significant fluctuations due to news of Israel's military actions, signs of resilience in U.S. fuel demand, and potential delays in OPEC's output increases.

Performance (price return)

Source: Bloomberg, as of November 1, 2024

Macro developments

Canada – Slow GDP Growth Signals Potential Rate Cut, Canadian Manufacturing PMI Signals Growth

Canada's GDP remained unchanged in August, with a downgraded estimate for July suggesting that third-quarter growth may fall short of the Bank of Canada’s 1.5% target. The data strengthens the case for a possible rate cut in December, although a projected 0.3% increase in September could help boost fourth-quarter growth.

This week, the S&P Global Canada Manufacturing PMI rose to 51.1 in October, marking the second consecutive month of expansion in Canadian factory activity after 17 months of contraction. This growth was driven by increased domestic orders and rising employment levels. Despite falling new export business for the 14th month, manufacturers showed optimism about future growth as input cost inflation softened, allowing for slower output charge inflation.

U.S. – Job Openings Drop Reflects Cooling U.S. Labour Market, Q3 GDP Growth Slows, Inflationary Pressures Rise in U.S. PCE Index, Job Growth Slows Sharply in October, U.S. Unemployment Rate Steady

Job openings in the U.S. fell to 7.443 million in September, the lowest since January 2021, signaling a cooling labour market. Significant declines were noted in healthcare, government, and the South, while the finance sector saw increased job openings. Hires and separations remained stable.

The U.S. economy grew 2.8% in Q3 2024, below the previous quarter and forecasts, as inventory investment weakened and trade impact lessened. Consumer spending rose sharply, while fixed investment slowed, with declines in structures and residential investment.

The PCE price index rose by 0.2% in September, led by service prices. The core index saw a 0.3% increase, its highest in five months. Annually, the PCE inflation rate dropped to 2.1%, a new low since early 2021, with core inflation steady at 2.7%.

The U.S. added only 12,000 jobs in October, impacted by strikes and hurricanes, marking the lowest job growth since 2020. While healthcare and government added jobs, temporary services and manufacturing saw declines. Revisions to past months also indicated fewer jobs than initially reported.

Unemployment rate held at 4.1% in October, with 7 million unemployed. Permanent job losses rose slightly, while temporary layoffs remained stable. The labour force participation rate dipped to 62.6%.

International – Eurozone’s Strongest Growth in Two Years Driven by Major Economies, Eurozone Inflation Reaches ECB Target, Japan’s Unemployment Falls, Bank of Japan Holds Rates Amid Global Uncertainty, China Manufacturing PMI Shows Contraction

The Eurozone GDP grew 0.4% in Q3 2024, with stronger growth across Germany, France, and Spain. While most countries saw improved growth, Italy’s GDP stalled, and Latvia remained in contraction. The annual growth rate reached 0.9%, its best since early 2023.

Eurozone inflation accelerated to 2% in October, meeting the ECB’s target. Rising food, alcohol, and industrial goods prices contributed, while energy prices fell at a slower pace. Core inflation held steady at 2.7%, still above forecasts.

Japan’s unemployment dropped to 2.4% in September, its lowest since January, with a minor increase in labour force participation. However, employment also fell, suggesting a slight cooling in labour demand.

Japan’s retail sales growth slowed to 0.5% year-on-year in September, the weakest in over a year, with declines in fuel and pharmaceuticals. Monthly retail sales dropped by 2.3%, marking the largest contraction since 2021.

The BoJ held its interest rate at 0.25%, noting global economic uncertainties. Governor Kazuo Ueda highlighted the need to monitor economic risks before further changes. Inflation forecasts remain at 2.5% for 2024, with steady growth projections.

China’s Manufacturing PMI declined to 49.3 in September, below expectations, indicating contraction. New orders and employment fell, with the lowest foreign sales in 13 months. Input and output prices decreased amid rising competition, and business sentiment reached its second-lowest level.

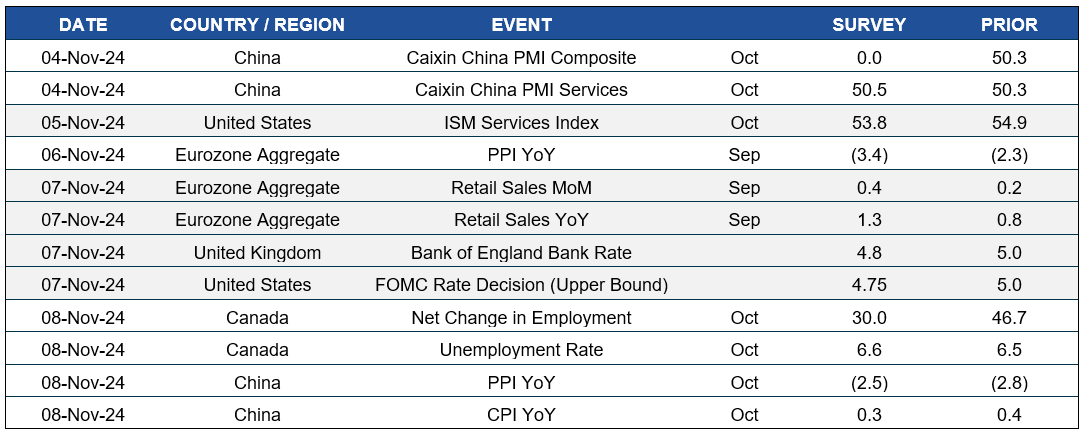

Quick look ahead

As of November 1, 2024