Weekly Market Pulse - Week ending November 8, 2024

Market developments

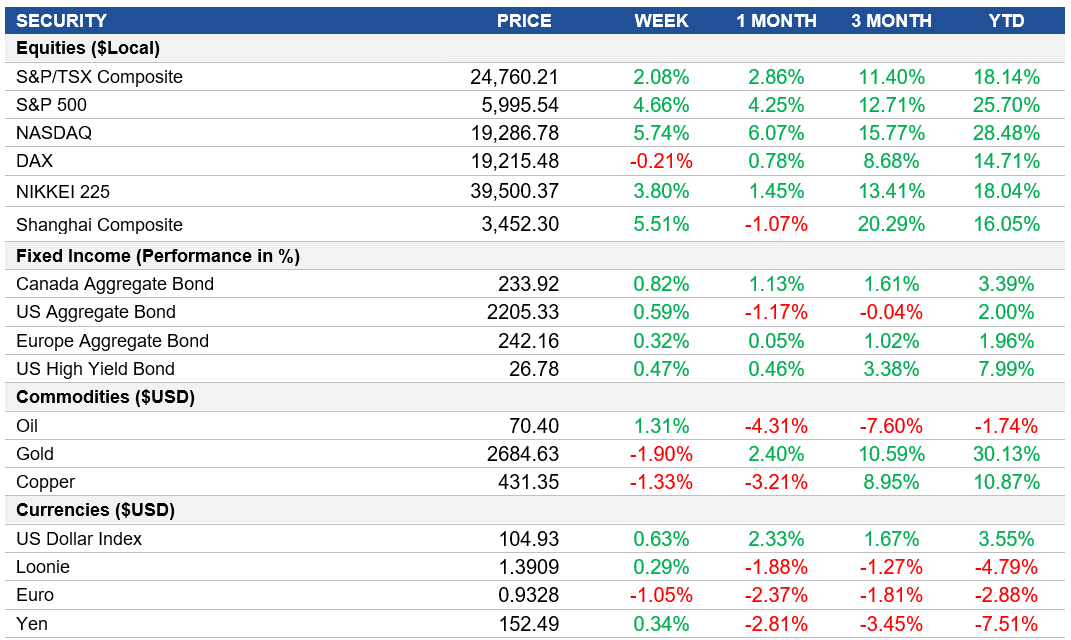

Equities: Investors were enthusiastic about stocks this week, driven by expectations that Donald Trump's economic policies will enhance corporate profits through tax cuts and deregulation. On the day of Trump's victory, approximately $20 billion flowed into U.S. equity funds. Market analysts are cautious about the sustainability of recent gains, noting that while there is initial enthusiasm for Trump's policies, significant legislative changes may take time to materialize. The S&P 500 and Nasdaq Index closed 4.7% and 5.7% higher, respectively.

Fixed Income: U.S. Treasury bond yields initially soared late Wednesday night as Trump's agenda is expected to fuel inflation. The U.S. 10-year yield crossed 4.45% before gradually settling around 4.30% by the end of the week. The U.S. dollar also strengthened to its highest level in a year against the Canadian dollar due to anticipated faster inflation and higher interest rates.

Commodities: Gold prices fell at the end of a volatile trading week as investors evaluated the implications of Donald Trump's election victory and the future path of U.S. interest rates. It suffered its largest weekly drop since May. The precious metal had briefly gained on Thursday following a Federal Reserve rate cut, but this was not enough to offset a significant rout earlier in the week triggered by Trump's win.

Performance (price return)

Source: Bloomberg, as of November 8, 2024

Macro developments

Canada – Canadian Unemployment Holds Steady at 6.5%

The unemployment rate in Canada remained at 6.5% in October 2024, lower than expected. Concerns about a weakening labour market eased as employment increased by 14,500, although the number of unemployed rose slightly by 900.

This week, the S&P Global Canada Manufacturing PMI rose to 51.1 in October, marking the second consecutive month of expansion in Canadian factory activity after 17 months of contraction. This growth was driven by increased domestic orders and rising employment levels. Despite falling new export business for the 14th month, manufacturers showed optimism about future growth as input cost inflation softened, allowing for slower output charge inflation.

U.S. – U.S. Services Sector Surges in October, Fed Cuts Interest Rates but Signals Caution

The U.S. ISM Services PMI rose to 56, the highest since August 2022, driven by a rebound in employment and improved supplier delivery times. While some areas like new orders and inventories slowed, concerns over political uncertainty and recent hurricanes were noted by survey respondents.

In November 2024, the Federal Reserve lowered the federal funds rate by 25 basis points to 4.5%-4.75%. Chair Powell emphasized that future rate cuts will be data-dependent, noting that the recent presidential election won’t affect near-term policy decisions.

International – Bank of England Lowers Rates Amid Falling Inflation, Eurozone Producer Prices Decline Further, Eurozone Retail Sales Show Modest Increase, China’s Economic Activity Rebounds with Policy Support

The Bank of England cut rates by 25 basis points to 4.75%, citing declining inflation. Most MPC members supported the cut as inflation fell to a multi-year low, though the Bank expects new government spending to drive inflation slightly higher in the near term.

Producer prices in the Eurozone dropped 3.4% year-on-year in August, largely due to lower energy and intermediate goods prices. The monthly decline was the sharpest since April, underscoring weakening price pressures.

Retail sales in the Eurozone rose 0.5% month-over-month in September 2024, marking a moderate gain compared to historical averages. The region has seen significant retail fluctuations since 2020 due to economic volatility.

China's Caixin Composite PMI increased to 51.9 in October, the highest since June, with renewed growth in factory and service sectors following policy measures. However, workforce reductions in manufacturing remain a concern as consumer demand will be crucial for sustained recovery.

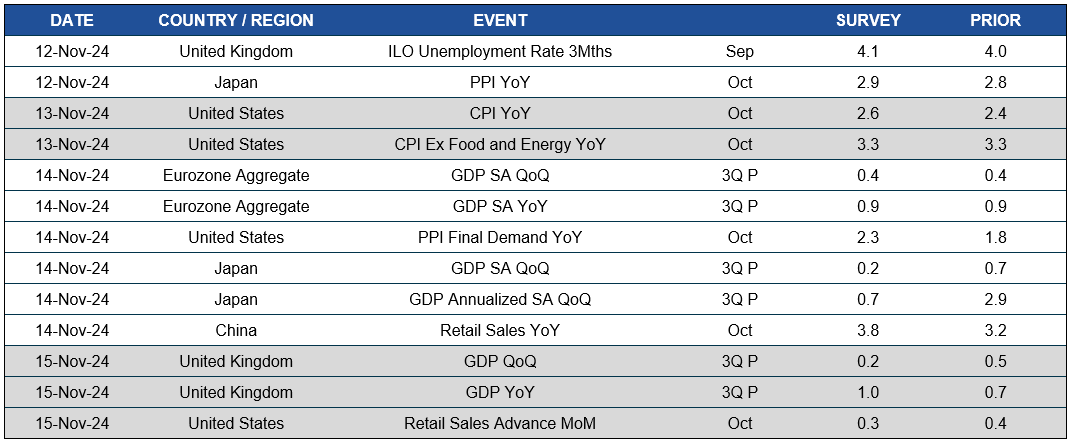

Quick look ahead

As of November 8, 2024