Weekly Market Pulse - Week ending October 11, 2024

Market developments

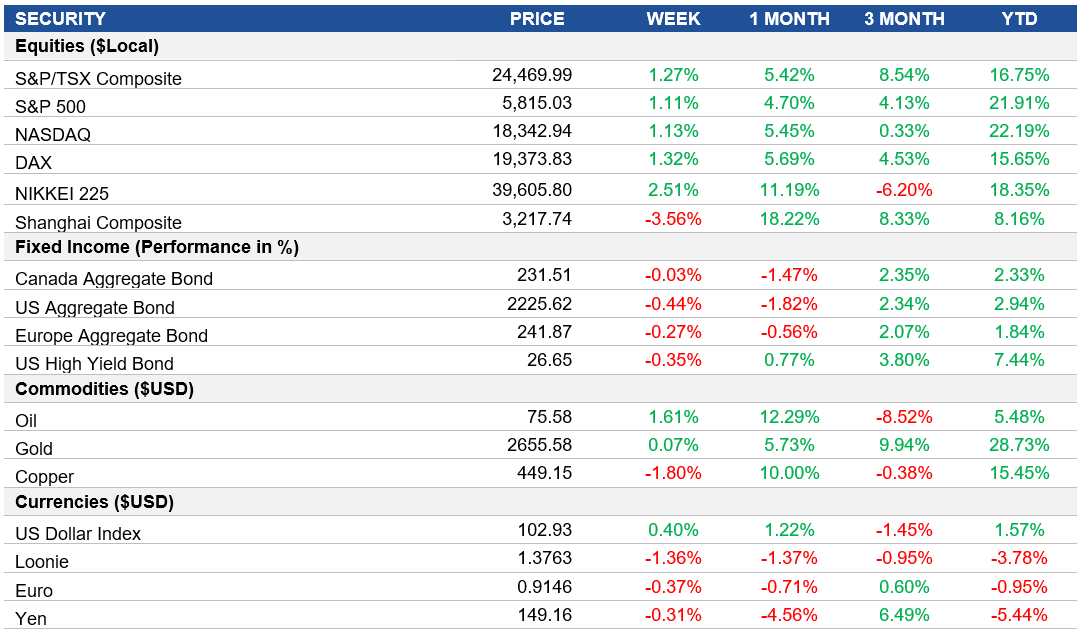

Equities: Chinese stocks experienced a significant decline as investors adjusted their positions ahead of a crucial policy briefing by the Ministry of Finance, scheduled for Saturday. The benchmark Shanghai Composite Index fell by 2.6% on Friday, marking a total weekly loss of ~3.5%. Concerns are mounting that if the measures announced do not meet market expectations, the recent rally in shares could reverse. The developed regions saw continued strength as the S&P 500 Index closed above $5800.

Fixed Income: Shorter-term yields were flat while longer-dated yields rose this week as investors parsed through the Consumer Price Index (CPI) release, which exceeded expectations, but was overshadowed by a significant increase in initial jobless claims. Traders are now pricing in about 23 basis points of rate cuts for the Fed's November meeting, reflecting a shift in sentiment due to the jobless claims data.

Commodities: Oil prices are currently stabilizing around $75 per barrel as market participants anticipate Israel's possible retaliation against Iran, which may include targeting Iranian oil infrastructure. This situation raises concerns about potential supply disruptions in the Middle East. Oil prices surged following the initial missile attacks from Iran but have since fluctuated as traders assess the likelihood and potential impact of an Israeli response. Analysts warn that sustained conflict could lead to significant price hikes.

Performance (price return)

Source: Bloomberg, as of October 11, 2024

Macro developments

Canada – Unemployment Rate Declines

Canada's unemployment rate fell to 6.5% in September, down from a 34-month high of 6.6% in August, defying expectations of an increase. The economy added 46,700 jobs, primarily benefiting youth employment, while the participation rate dipped to 64.9%. The addition of 46,700 jobs marks the first monthly decline in the unemployment rate since January, alleviating concerns about a weakening labour market. Despite this positive trend, hourly wage growth eased to 4.6%, indicating mixed signals within the economy.

U.S. – Headline Inflation Rate Slows, but Core Inflation Surprises

The annual inflation rate decreased to 2.4% in September, marking the lowest level since February 2021, although it was slightly above forecasts. Shelter prices rose less, and energy costs fell significantly, particularly for gasoline and fuel oil. However, food and transportation costs increased, and the core inflation rate unexpectedly edged up to 3.3%. Monthly CPI rose by 0.2%, matching August's increase.

International – Eurozone Retail Sales Show Modest Growth Amid Weak Consumption

Eurozone retail sales saw a slight increase of 0.2% in August but remained below May levels, indicating subdued overall consumption growth. While sales rose in France and Spain, they were unchanged in Italy, and Germany's retail data has not been reported since April. The outlook for household spending appears weak, with new car registrations declining and major purchase intentions remaining low, suggesting a potential quarterly decline in retail sales for Q3.

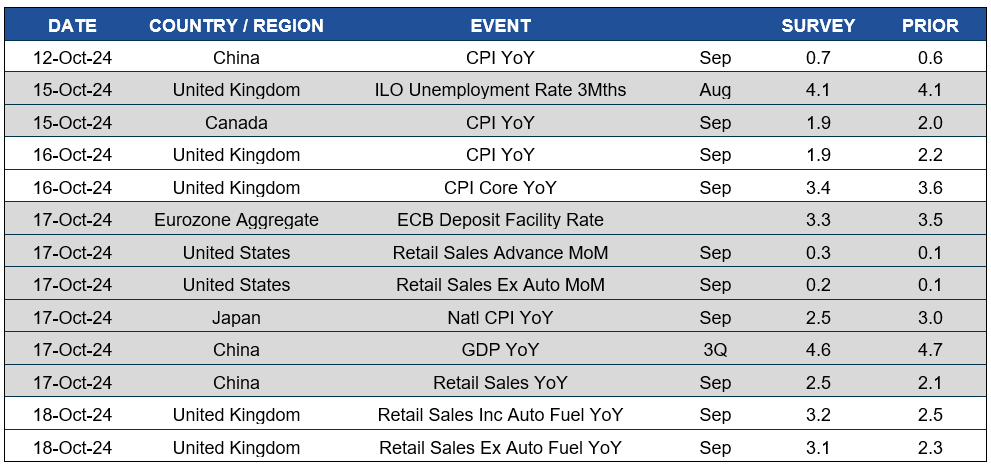

Quick look ahead

As of October 11, 2024