Weekly Market Pulse - Week ending October 4, 2024

Market developments

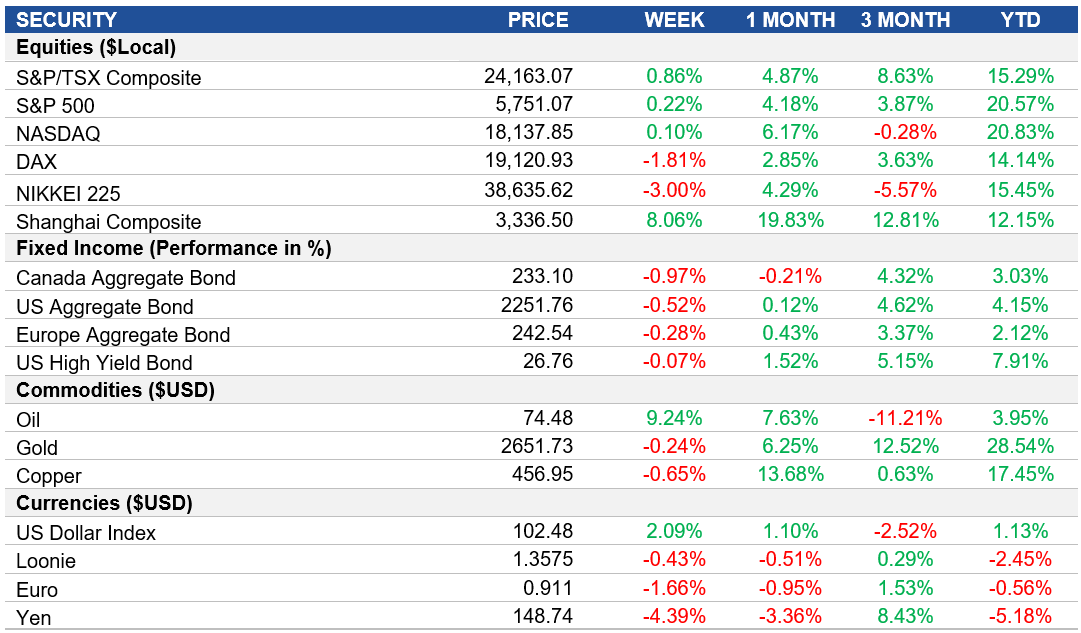

Equities: The S&P 500, Nasdaq and TSX Indices closed slightly higher, supported by positive labour market data that bolstered expectations for a soft landing in the economy. China continued its climb early in the week before closing for the weeklong holiday, set to open back up on October 8 after a nearly 30% rally to end the month.

Fixed Income: The two-year U.S. Treasury yield surged this week, reflecting traders' reassessment of the Federal Reserve's potential rate cuts considering the robust job figures. However, not all experts share this optimism, some cautioned that the Fed's battle against inflation is far from over, emphasizing that the labour market's strength late in the economic cycle could complicate monetary policy decisions.

Commodities: Oil prices surged this week. The increase is largely attributed to escalating tensions in the Middle East, particularly following President Biden's comments regarding U.S. discussions on possible Israeli strikes against Iranian oil facilities after Iran's missile attack on Israel earlier in the week. Despite these tensions, some analysts suggest that the market is not reacting as strongly as expected due to several factors. OPEC's spare production capacity and the recent reopening of oilfields in Libya are seen as stabilizing influences on global supply.

Performance (price return)

Source: Bloomberg, as of October 4, 2024

Macro developments

Canada – Manufacturing PMI Improvement

The S&P Global Canada Manufacturing PMI increased to 50.4 in September, marking the first improvement since April 2023, driven by new domestic orders and new product lines. Export orders continued to fall, while employment and output showed slight improvements. Input cost inflation rose sharply, but subdued demand prevented price hikes.

U.S. – Services Sector Growth Accelerates, Job Market Gains Momentum, Unemployment Rate Falls

The ISM Services PMI surged to 54.9 in September, the strongest growth since February 2023, with increased business activity, new orders, and inventories. However, employment declined, and price pressures persisted. Political uncertainty and supply chain challenges remain concerns.

The U.S. added 254,000 jobs in September, the highest in six months, with significant job gains in food services, healthcare, and construction. Manufacturing employment fell slightly, and revisions to previous months' data showed a stronger overall employment trend.

The unemployment rate dropped to 4.1% in September, the lowest in three months. Employment levels rose by 430,000, and the labour force participation rate remained steady at 62.7%.

International – U.K. Economic Growth Slows in Q2, Eurozone Inflation Falls Below Target, Eurozone Unemployment Steady at Record Low, Japan's Unemployment Rate Drops

The U.K. economy grew by 0.5% in Q2 2024, slightly below earlier estimates. Government spending and exports were revised lower, while investment, particularly in business, saw a significant boost.

The Eurozone's inflation rate dropped to 1.8% in September 2024, the lowest since April 2021, falling below the ECB's target of 2%. Energy prices declined sharply, while food and service prices rose slightly. Inflation is expected to rise later in 2024 before easing again.

Unemployment in the Eurozone held steady at 6.4% in August 2024, the lowest on record. Youth unemployment decreased, but Spain, Greece, and Sweden still recorded the highest jobless rates, while Poland and Germany saw the lowest.

Japan’s unemployment rate fell to 2.5% in August 2024, with a significant decline in the number of unemployed and an increase in employment to a record high. The labour force participation rate also rose, though the jobs-to-applications ratio decreased slightly.

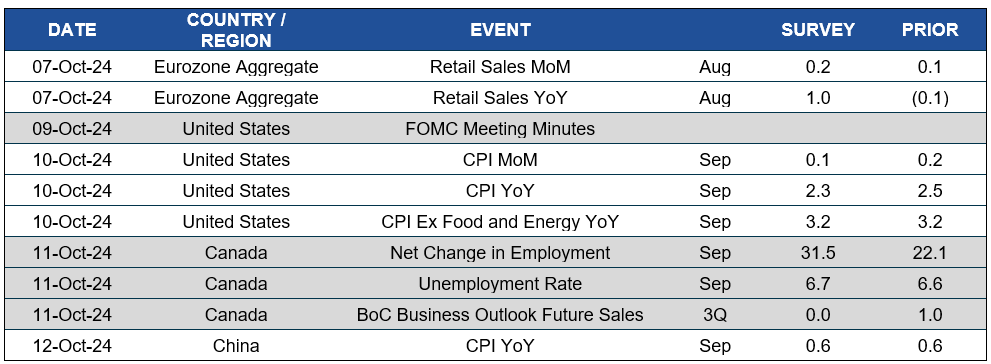

Quick look ahead

As of October 4, 2024