Weekly Market Pulse - Week ending September 13, 2024

Market developments

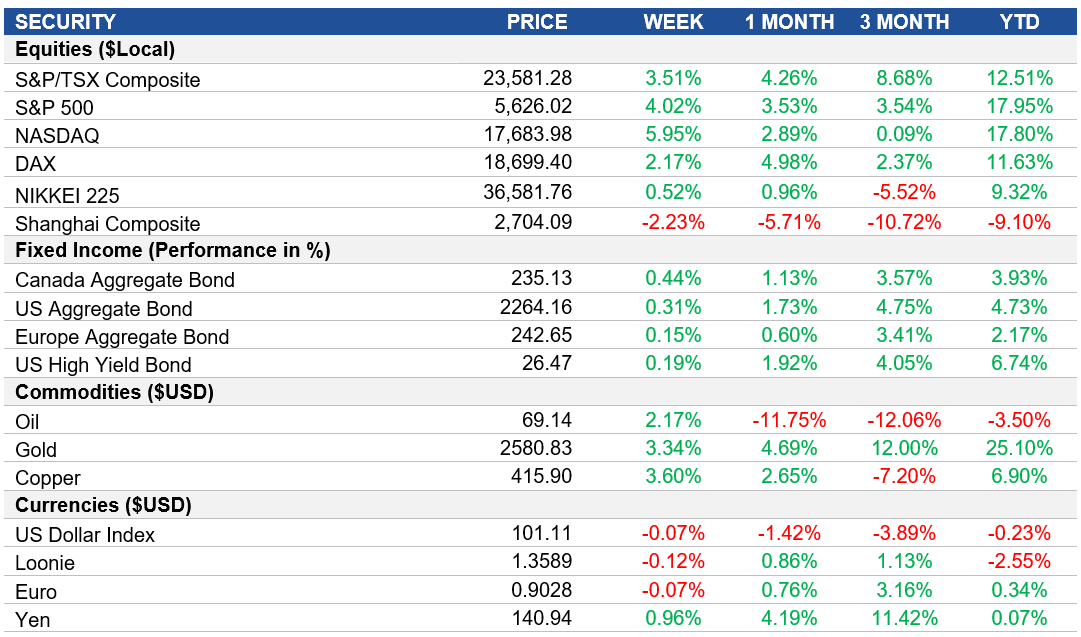

Equities: U.S. equities had one of their strongest weeks of the year as traders anticipated the Federal Reserve's upcoming meeting, where a reduction in interest rates is widely expected. The S&P 500 Index increased by over 4% and the Nasdaq by nearly 6%. Analysts from Bank of America predicted that stock market will likely trade sideways until clearer signals regarding employment trends emerge. The recent non-farm payrolls report showed a smaller-than-expected increase, indicating a cooling labour market.

Fixed Income: Recent mixed economic data has fueled discussions about the potential magnitude of the Fed's rate cut, with some investors leaning towards a smaller reduction while others considering a half-point cut. The latest consumer price index showed a slight increase in underlying inflation for August, while higher unemployment benefit applications raised concerns about economic growth slowing too rapidly. Overall, global bond markets built off last week’s strength and rose slightly this week.

Commodities: Gold prices surged to a record high this week, climbing over 3%. The surge is attributed to a declining dollar and expectations of a Federal Reserve interest rate cut next week. Alongside gold, silver and platinum prices also rose, while palladium showed mixed performance. The overall trend in precious metals reflected a shift towards safer investments as economic conditions fluctuate.

Performance (price return)

Source: Bloomberg, as of September 13, 2024

Macro developments

Canada – No Notable Releases

No notable releases this week.

U.S. – Inflation Slows Amid Declining Energy Prices, Factory Gate Prices Increase Slightly

The U.S. inflation rate fell to 2.5% in August 2024, its lowest since February 2021. Energy costs, particularly gasoline, declined sharply, while inflation for food, transportation, and vehicles also eased. However, inflation rose for shelter and apparel. The monthly CPI rose 0.2%, with shelter being the primary driver, and core inflation steadied at 3.2%.

U.S. producer prices increased by 0.2% in August 2024, surpassing expectations. The rise was driven by higher service prices, particularly in guestroom rentals. Goods prices remained unchanged, with some costs rising, like for non-electronic cigarettes, while others, like jet fuel, declined. Year-on-year, producer prices increased by 1.7%.

International – ECB Cuts Rates to Ease Policy Amid Stable Inflation Projections, U.K. Unemployment Falls Amid Rising Full-Time Employment, Japan's Producer Inflation Slows to Lowest Level Since May, China's Inflation Rises Slightly Amid Supply Issues

The European Central Bank (ECB) reduced the deposit rate to 3.5% to ease monetary policy, reflecting a favourable inflation outlook. The ECB aims to bring inflation back to 2%, with projections of 2.5% for 2024 and a decline in core inflation to 2.0% by 2026. Domestic inflation remains high due to rising wages, but moderating labour costs offer some relief.

The U.K. unemployment rate dropped to 4.1% from May to July 2024, with a decrease of 74,000 unemployed individuals. Employment surged, reaching 33.23 million, driven by full-time jobs. The economic inactivity rate also decreased, and the number of people with second jobs increased to 3.9% of employed individuals.

Japan's producer prices grew by 2.5% in August 2024, the slowest pace in months. Costs for beverages, chemicals, and machinery eased, while prices for petroleum and steel fell. However, inflation accelerated for transport equipment and other machinery. Producer prices fell by 0.2% monthly, the first decline in ten months.

China's annual inflation rate increased to 0.6% in August 2024, the highest since February, but below expectations. Food prices surged due to supply disruptions from extreme weather, while non-food prices rose more slowly. Transport costs fell due to lower oil prices, and core inflation increased by 0.3%. Monthly, the CPI rose 0.4%.

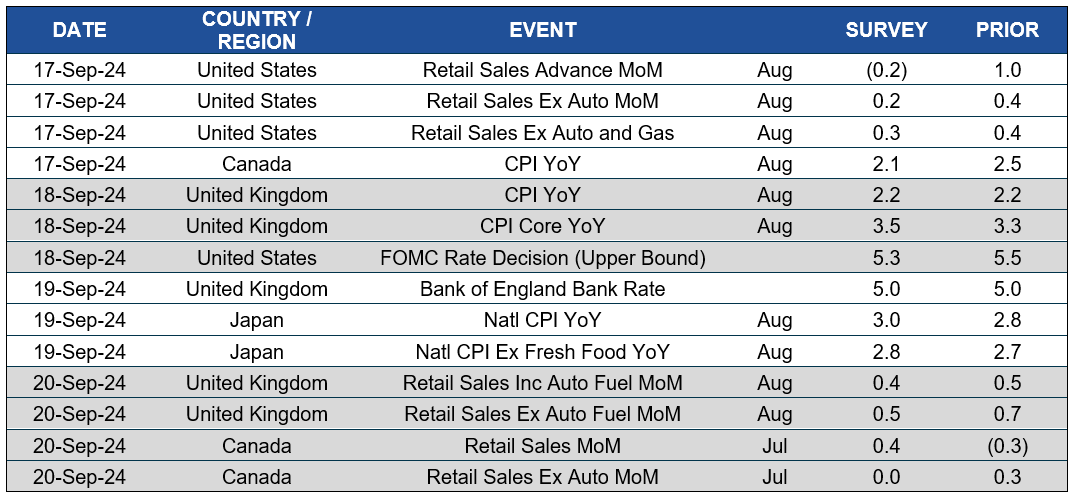

Quick look ahead

As of September 13, 2024