Monthly Market Insight - August 2023

Markets cool off in August

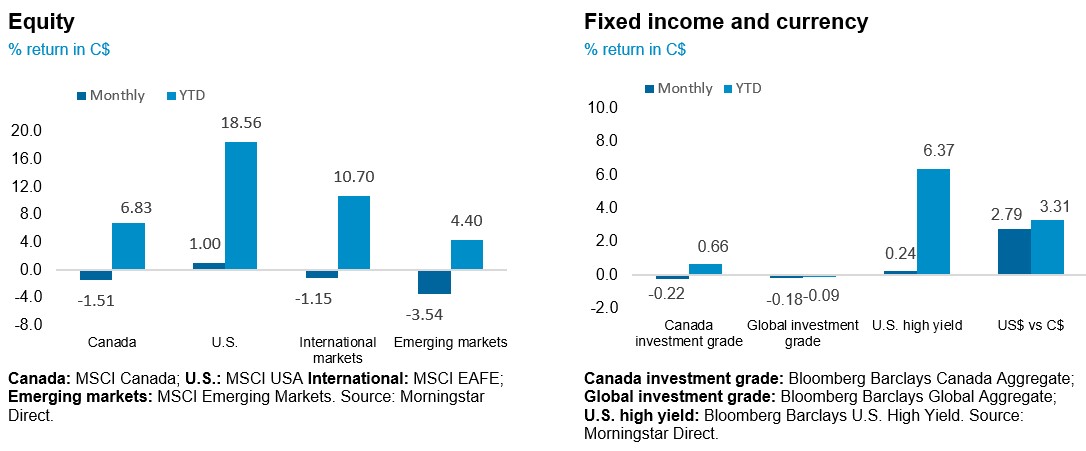

The end of July marked the peak for the S&P 500 so far this year, as the steady market uptrend that began in mid March started to retreat as soon as the August began. Following a 20% S&P 500 Index return in the first seven months of the year, the index fell -1.77% in August. Rising yields and uncertainty surrounding the path of China’s economic recovery were chief concerns among investor in recent weeks, which contributed to a volatile month in global markets. Global stocks sold off through the month with the MSCI All Country World Index declining 2.96% over the month. Developed markets outperformed emerging markets, which lost 3.54% in US dollar terms. Fixed income markets also fell in August as yields rose. Yields on the 10-year US Treasury increased by 15 basis points (bps), to 4.1%.

The NEI perspective

Long bond yields have steadily pushed higher over the past few months even as inflation in the U.S. has fallen from around 9% to just above 3% over the last year. The yield on the 10-year Treasury continued to move up in August, reflecting an ongoing reassessment of the long-run neutral rate of interest.

Investors took profits on the back of stronger than expected Q2 earnings and drove the market lower in August. Price reaction in the few days following positive earnings surprises generally didn’t reward the companies that beat consensus, as earnings outlook and rising long yields weighed on investor sentiment.

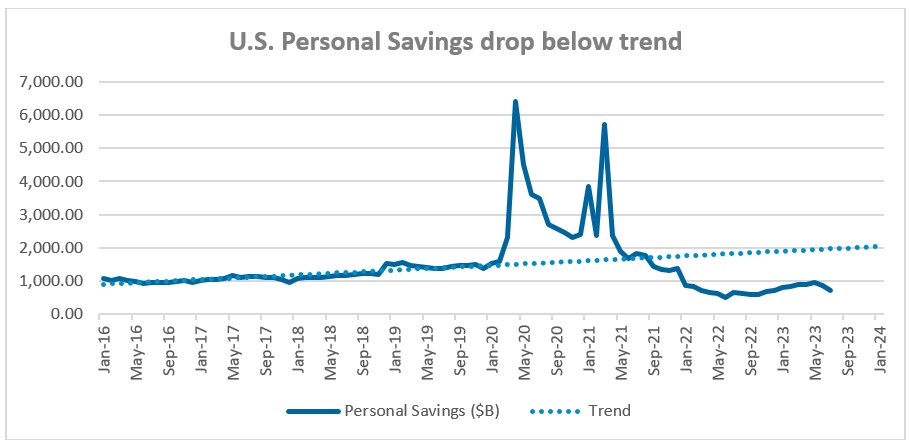

Global growth expected to slow as recent data revealed that consumer and business loans weakened and that banks anticipate the ongoing tightening of lending standards to continue in the second half. Plus personal savings rates in the U.S. continue to fall as credit card and auto loan delinquencies are beginning to rise.

From NEI’s Monthly Market Monitor for August. Read the full report for more insights.

As of August 31, 2023

Profit taking on strong second quarter earnings

Second quarter earnings for most companies widely beat consensus estimates which were set at a very low bar prior to the start of the quarter. Given the equity market performance this year, the low bar that was set, and the valuations, a bigger driver for market valuations was the forward-looking earnings growth guidance. As a result, price reaction in the few days following positive earnings surprises generally didn’t reward the companies that beat consensus, as earnings outlook and rising long yields weighed on investor sentiment.

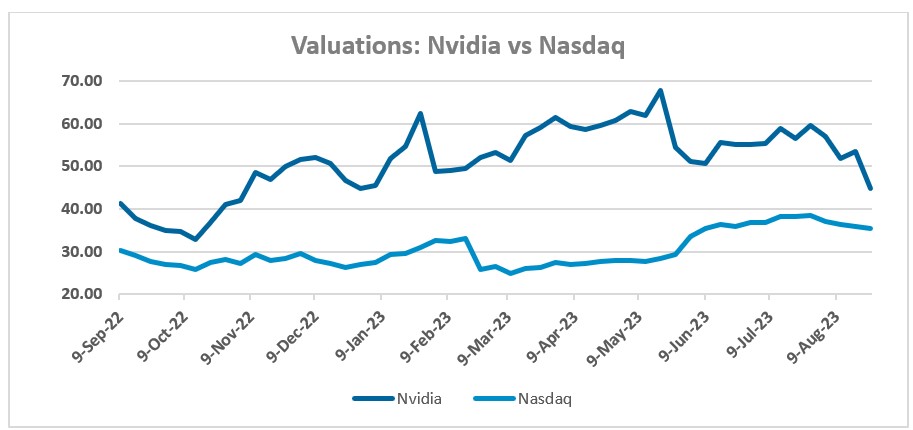

For example, Nvidia’s second quarter blockbuster earnings beat analyst estimates by a wide margin. Coupled with projected increases in chip supply and the announcement of share buybacks, Nvidia was up over 6% after hours. The recent performance of technology stocks with a focus on AI has put Nvidia under the microscope and although the stock initially rallied on this news, the days following the announcement—given the stock’s already sky-high valuation—some of profit taking by investors brought the stock back to previous levels.

Source: Bloomberg data as of August 31, 2023

Global growth expected to slow

Thanks to rising gas prices and base year effects, inflation may register higher levels in the near term, as large monthly declines from summer of 2022 no longer impact the 12-month inflation movement. However, inflation is expected to continue to go lower by year end, as rent and wage growth inflation are showing early signs of moderation.

Multiple indicators are also pointing to a slowdown in global growth. For example, the Fed’s latest Senior Loan Officer Opinion Survey (SLOOS) revealed that consumer and business loans weakened and that banks anticipate the ongoing tightening of lending standards to continue in the second half.

Labour market data pointed to a cooling but still strong jobs market in July, with payroll job gains of 187,000, slightly below consensus expectations for 200,000. Unemployment ticked down to 3.5%, while average hourly earnings were slightly stronger than expected at 4.4% year-on-year.

The resilience of consumers through 2023 surprised many investors, but there is growing evidence which suggests that many of the factors supporting consumer resilience are winding down. Consumer strength is likely to fade as factors supporting growth in income and spending are waning (labour market normalizing and excess savings are running out). Excess savings for U.S. households when adjusting for inflation are now fully exhausted from 2021 highs. In addition, although still at low absolute levels, credit card and auto loan delinquencies are beginning to pick up.

Source: Bloomberg data as of August 31, 2023

China’s contraction negatively impacting Europe

In China, activity data was much weaker than expected. Deteriorating trade data continued to deliver a pessimistic signal about the global manufacturing cycle. The recent export was marginally higher in August, exports have seen their sharpest drop since early in the pandemic in 2020. This is having a significant impact on Europe. On the manufacturing front, Europe's weak performance is interlinked with China's slowing growth momentum, significantly impacting countries like Germany that are heavily reliant on Chinese demand.