Monthly Market Insight - September 2022

The bear market intensifies

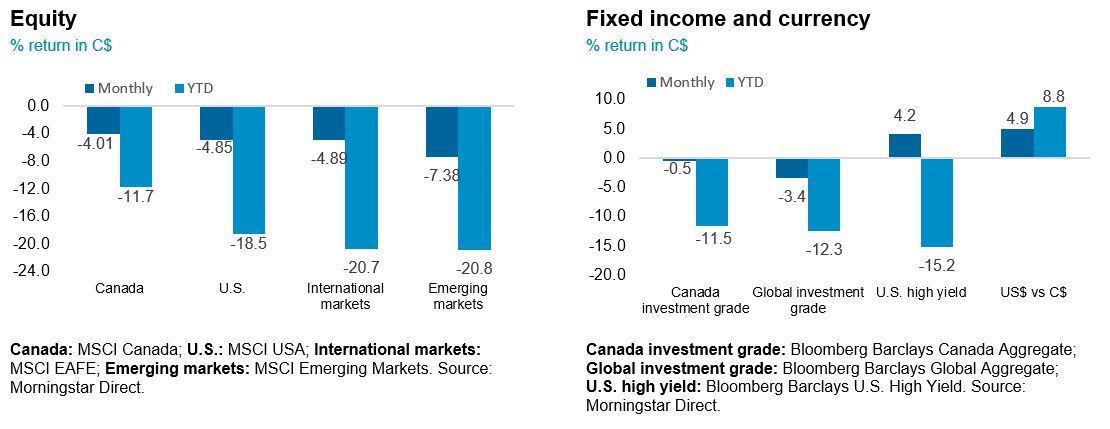

In September both equity and fixed income markets saw steep selloffs as global financial markets continue to factor in the synchronized policy tightening by central banks and weakening economic conditions. Global economic forecasts were revised lower, pointing to a slow second half of 2022 and to weaken further in 2023. Volatility was acute in the bond markets with rate hike expectations rising sharply. The latest inflation data remained hot which caused investors to reassess how much higher the peak policy rates will need to be to bring inflation back to the 2% range, and whether the economy can withstand these rates without going into a recession

The NEI perspective

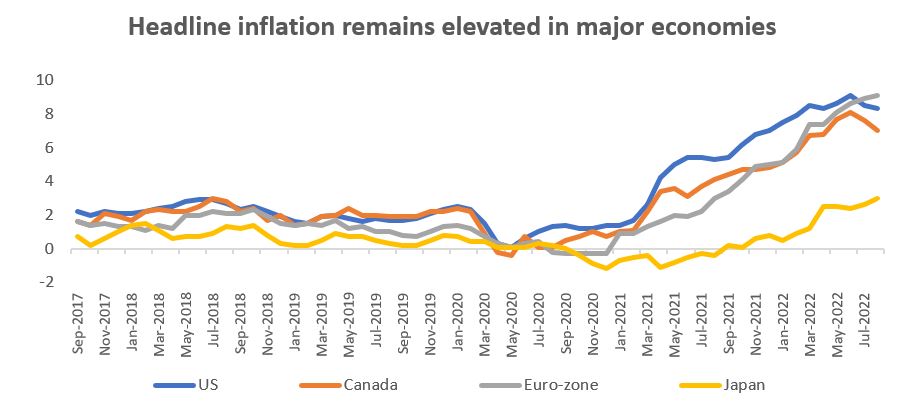

Central banks stay focused on inflation mandate as they continued to press forward with aggressive rate hikes to combat persistently high inflation. Synchronized monetary tightening is resulting in weaker economic forecasts for the rest of the year. Though easing commodity prices may present a silver lining, higher core inflation points to higher rates ahead.

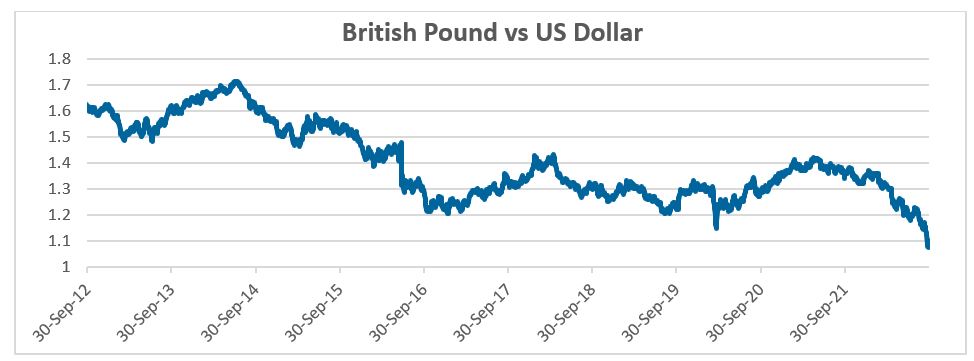

New UK economic program causes market chaos as aggressive tax cuts sent UK bond and currency markets into a panic. As a result, UK bonds experienced their worst quarterly drop ever and the Sterling hit a new low against the US dollar, causing the Bank of England to intervene.

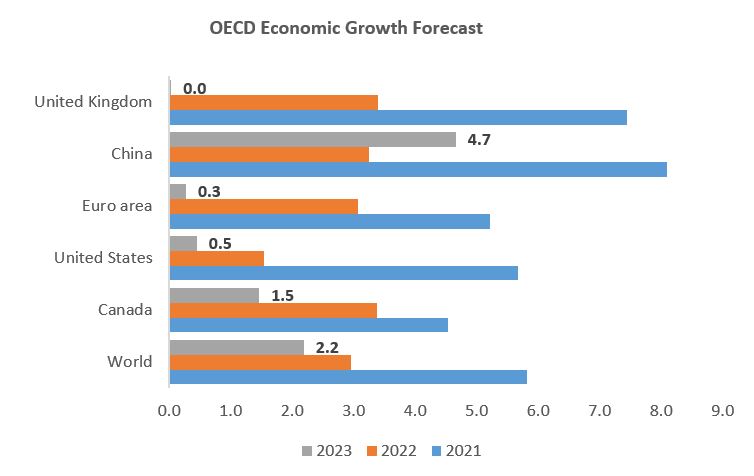

The OECD forecasts weaker economic growth for the remainder of the year and further weakness in 2023. The slowing growth is due to the many factors that have plagued markets throughout the year including rising energy and food prices, persistent inflation and tightening monetary policy. China appears to be the only country set to rebound in 2023

Performance (price return)

As of September 30, 2022

Central banks stay focused on inflation mandate

High gas prices are still driving Eurozone’s headline inflation higher, with prices up 10.0% year-over-year in the latest reading. By contrast, headline inflation in North America is starting to ease as commodity prices retreat, latest reading in August in Canada and the US both eased, to 7.0% and 8.3% respectively. Core inflation, which is a better indicator for policy rate decisions, are still getting upward pressure due to rising wages and shelter inflation in what continues to be an extremely tight labour market. Core inflation fared better in Canada, which eased to 5.2%, vs. the US which continued to rise to 6.3% y/y, from 5.9% in July.

Source: Bloomberg, data as of September 30, 2022

In September, central banks made it clear that they are focused on inflation and intend to follow through on their hawkish rhetoric, as many of them delivered outsized rate hikes. The BoC was first, raising rates by 75 basis points (bps) to 3.25%, a move that was widely anticipated by the market. The BoC re-iterated the need for rates to rise further, with the pace of hikes being guided by its ongoing assessment of the economy and the rate of inflation. The U.S Federal Reserve also delivered its third consecutive 75bps rate hike, while revising the inflation projections upwards for 2022, and revising economic growth projections downward for 2022, 2023, and 2024. Both central banks vow to stay hawkish, but given weakness in the housing market and softening of the jobs market, it is likely that the BoC could reach its terminal rate sooner than in the U.S.

New UK economic program causes market chaos

New UK Prime Minister Liz Truss unveiled a new economic program aimed at sparking economic growth that included aggressive tax cuts sent UK bond and currency markets into a panic. As a result, UK bonds experienced their worst quarterly drop ever and the Sterling hit a new low against the US dollar. The malaise resulted in a swift intervention by the BoE on September 28, where the central bank decided to suspend its quantitative tightening plans, but instead begin to temporarily buy long-dated bonds in order to calm the market. This resulted in a swift retreat of bond yields

Source: Bloomberg, data as of September 30, 2022

Global economic growth forecasts weaken in 2023

In the OECD interim economic outlook report in September 2022, the war between Russia-Ukraine was cited as a significant catalyst which exacerbated the prices of energy and food, at a time when cost of living was already rising around the world. As a result, Global growth is projected to remain subdued in the second half of 2022 and to weaken further in 2023. One key factor slowing global growth is also the ongoing tightening of monetary policy in most major economies in response to the greater-than-expected overshoot of inflation targets over the past year. In addition, the erosion of real disposable household incomes, low consumer confidence and high prices for some energy products, especially natural gas in Europe, will negatively affect both private consumption and business investment.

In China, fiscal support package worth up to 2% of GDP designed to strengthen infrastructure investment, plus the re-opening effect from COVID-related restrictions later this year, are expected to help growth in China to recover to 4.75% in 2023 after unusually weak growth of 3.2% in 2022.

Source: OECD (2022), OECD Interim Economic Outlook, September 2022,