Weekly Market Pulse - Week ending August 4, 2023

Market developments

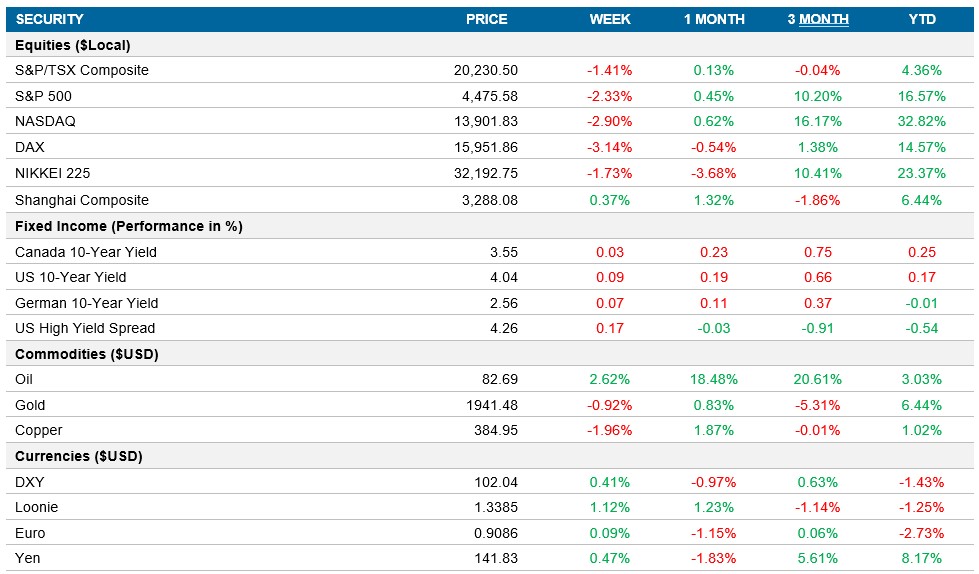

Equities: U.S. equities closed the week mixed as the S&P 500 oscillated. Tech giants reported mixed earnings, affecting market sentiment. Concerns over fiscal stability and rising bond yields weighed on investor confidence. A positive jobs report fueled speculation about the Fed's interest rate decision in September, adding to market uncertainty.

Fixed income: Treasury yields fluctuated throughout the week, reacting to refunding announcements and economic data. The long end of the curve faced pressure due to increased issuance and a widening budget deficit. Mixed jobs report failed to provide clear signals on Fed policy, leaving supply dynamics and positioning to guide the market.

Commodities: Oil prices soared as demand surged, OPEC+ cuts boosted sentiment. However, technical barriers and economic uncertainties caused pullbacks. Saudi Arabia's production cut lifted prices, while U.S. stockpiles hit record lows. Oil extended gains for a sixth week amid geopolitical tensions over Ukraine.

Performance (price return)

As of August 4, 2023

Macro developments

Canada – Labour Market Weakening Amidst Wage Surges

In July, Canada's labour market experienced a slight decline in employment by 6,400 jobs, contrary to the consensus estimate of a 21,000 gain. This resulted in a rise in the unemployment rate by 0.1%-point, reaching 5.5%, surpassing the pre-pandemic May 2019 low for the first time. Despite the rise in unemployment, wage growth surprisingly surged to 5.0% y/y, from 4.1%. However, with the labour market loosening, the sustainability of this wage growth remains uncertain.

U.S. – Employment Report and JOLTS Survey Reveals Mixed Signals in U.S. Labour Market Resilience. ISM Manufacturing Shows Decline While ISM Services Indicate Modest Growth

The latest U.S. employment report reveals a modest increase of 187,000 non-farm payroll jobs in July, signaling a tepid improvement compared to the previous month. However, it's worrisome that these two months mark the weakest gains in two-and-a-half years. The rise in employment was primarily driven by the healthcare and social assistance sector, along with government hiring. Meanwhile, cyclical sectors' contribution to job creation remains low, indicating a weaker real economy.

The JOLTS report shows a steady labour market in June, while variations persist across sectors. The job openings rate remained constant, but certain high-wage growth sectors, like leisure and hospitality, experienced a decline in vacancies. While the labour market remains tighter compared to pre-pandemic levels, the gradual loosening of labor conditions could be tapering off. The slower pace of hiring suggests that labour demand might be easing, potentially leading to weaker employment gains.

The ISM survey reveals a subdued manufacturing activity, indicating a possible bottoming out of the manufacturing downturn, but still projecting a significant decline in manufacturing output during the third quarter. The new orders component showed a modest improvement, signaling potential growth in the coming months, but the employment index's decline suggests weakening job growth in the sector.

The ISM services index fell in July, indicating a less robust economic performance for the rest of the year. The decline in various indices within the services sector implies limited economic expansion and continued low core inflation, suggesting no immediate need for the Fed to raise interest rates further.

International – Tight Labour Market, Record-Low Unemployment, and Economic Ambiguity in Euro-Zone. Bank of England Raises Policy Rate and Adjusts Inflation Estimates

Despite the euro-zone's labour market remaining incredibly tight, with a record low unemployment rate in June, there are indications of potential changes ahead. The number of unemployed individuals fell by 62,000 in June, but this was insufficient to alter the unemployment rate, which remained steady at 6.4% for the third consecutive month – the lowest rate ever recorded in the history of the euro-zone.

The euro-zone's 0.3% GDP increase in Q2 might initially appear promising, particularly as it marks the fastest growth in three quarters and aligns with the economy's potential growth rate. With business surveys suggesting deteriorating conditions in July and expectations of further tightening of monetary policy, the euro-zone's economic outlook remains uncertain.

The Bank of England took the anticipated step of raising its policy rate by 25 basis points to 5.25% during its recent meeting. The central bank adjusted its inflation estimates for 2023, 2024, and 2025, with services inflation now having a greater impact on headline inflation compared to energy and goods components. Labour market conditions will be critical in determining further tightening measures, and a potential shift towards policy easing may occur if wage growth moderates.

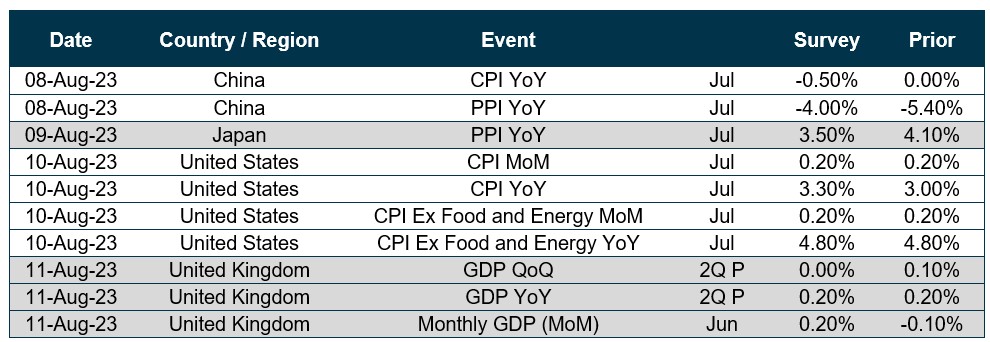

Quick look ahead

As of August 4, 2023