Weekly Market Pulse - Week ending June 9, 2023

Market developments

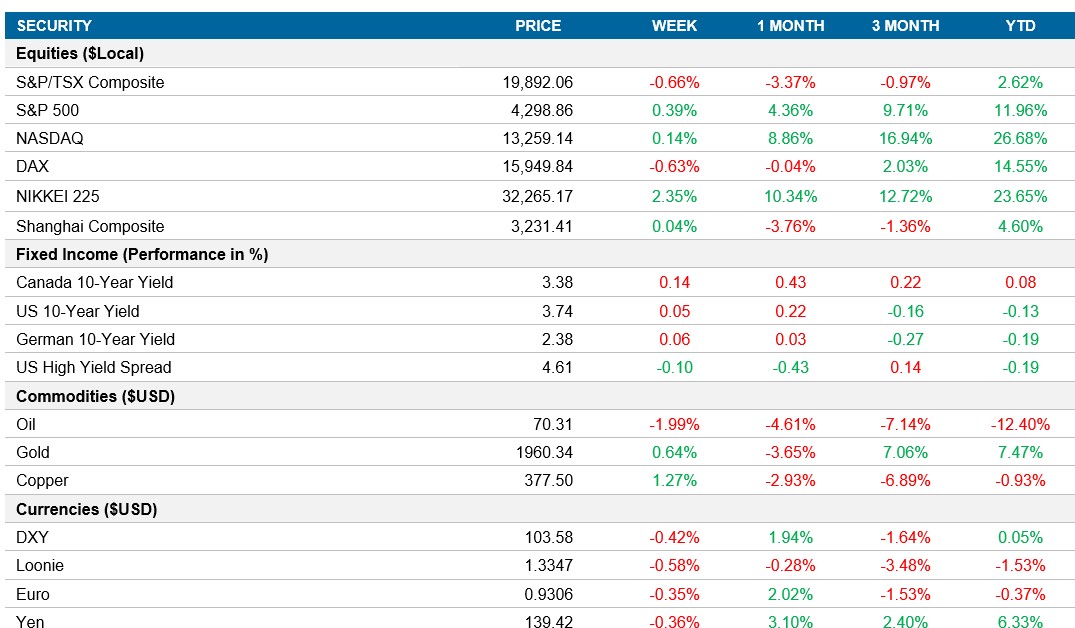

Equities: The stock market had a mixed week, with U.S. equities initially declining due to concerns about prolonged interest rate hikes by the Federal Reserve. However, stocks rebounded later in the week as economic data indicated a cooling labor market, boosting optimism that the Fed would pause its tightening campaign. The S&P 500 ended the week almost unchanged, while entering a technical bull market.

Fixed income: Canadian government bond yields went up because the Bank of Canada unexpectedly raised interest rates. However, US 10-year yields didn't change much. Investors were still interested in buying options that protect against interest rate increases, and there was also activity in Treasury options. Overall, it was a mixed week for bonds and interest rates.

Commodities: Oil prices experienced a mixed week of fluctuation. Initially, prices rose as a result of a weak U.S. dollar and high refinery runs in the U.S., indicating strong summer demand. However, prices dropped due to reports suggesting progress in US-Iran talks, potentially leading to increased Iranian crude exports. Despite Saudi Arabia's pledge to cut production, concerns about demand persisted, resulting in a weekly decline of 2% for oil prices.

Performance (price return)

As of June 9, 2023

Macro developments

Canada –Canada's Unemployment Rate Rises as Summer Hiring Slows

The unemployment rate in Canada rose to 5.2% in May, primarily due to reduced summer hiring among younger workers. Employment experienced a significant decline of 17,300 jobs, concentrated among 16–25-year-olds. Service sectors saw a fall in employment, while high contact services like accommodation and food services gained jobs. Despite a rise in the adult population, the labor force increased modestly, resulting in the first rise in the unemployment rate since August 2022.

U.S. – US Economy Shows Signs of Slowdown as ISM Services Index Falls

The U.S. economy's growth momentum appears to have slowed, with the ISM services index falling to a five-month low of 50.3 in May. The employment index also declined, contrasting the reported increase in non-farm payrolls. This data, along with other economic indicators, suggests modest GDP growth in the second quarter. In contrast, the S&P Global PMIs indicate positive growth.

International – Struggles in European Retail, Eurozone Recession, and Japan's Robust Q1 GDP

European retail sales continue to struggle, indicating subdued household consumption at the start of the second quarter. In April, retail sales remained unchanged, signaling a decline in consumption in the coming months due to persistently low levels of household confidence. The retail sector has performed poorly since the reopening of the economy following the pandemic lockdowns, with food, drinks, and tobacco sales continuing to fall.

The Eurozone economy has fallen into a technical recession, as GDP contracted by 0.1% q/q in Q1, following a contraction in the previous quarter. Household consumption has been significantly impacted by high inflation and rising interest rates, with consumption experiencing a further 0.3% decline. Government consumption also fell sharply, exports edged down, and imports decreased.

Japan's Q1 GDP has received a significant upward revision, indicating strong momentum in the economy. However, sustaining this performance may be challenging, as the output gap has narrowed, suggesting slower growth. Although Japan has not witnessed any monetary policy tightening and has room for catch-up in consumer spending, high rates of inflation are unlikely to persist due to subdued wage growth.

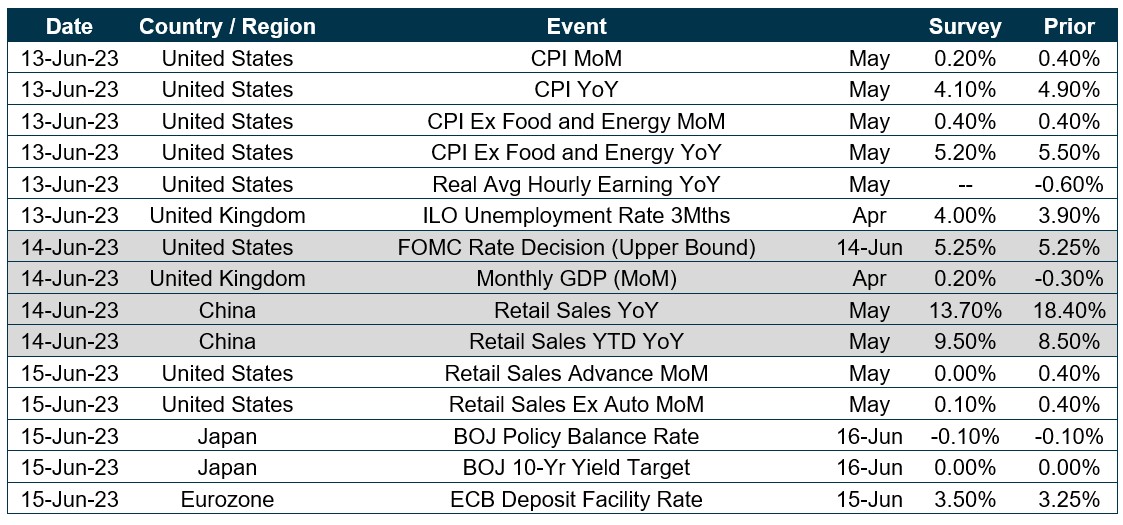

Quick look ahead

As of June 9, 2023