Weekly Market Pulse - Week ending May 12, 2023

Market developments

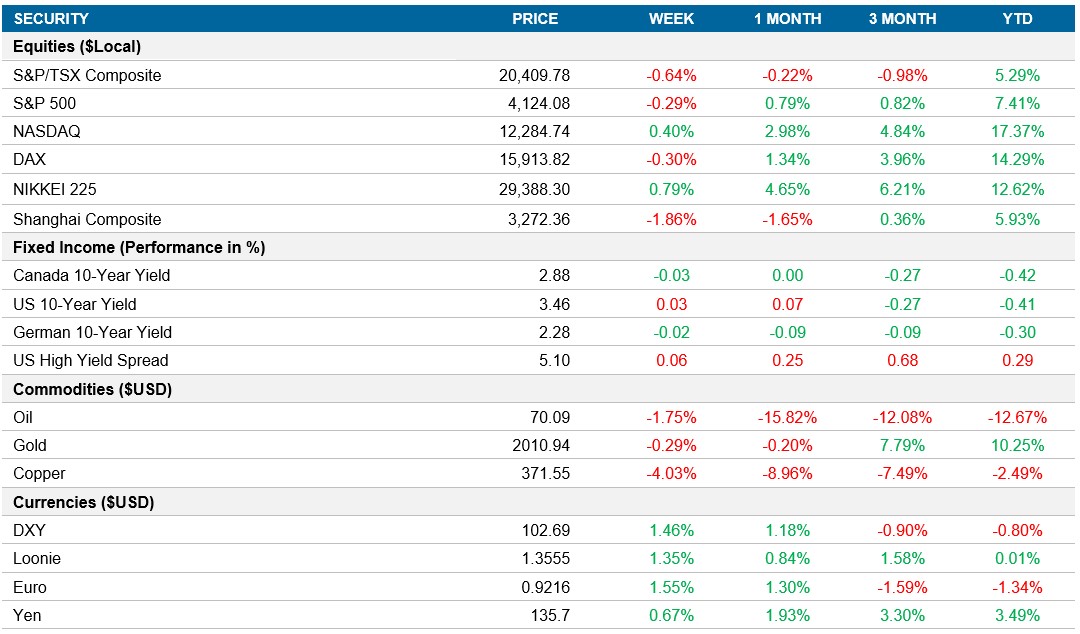

Equities: The stock market experienced a volatile week but was down only slightly from last week as investors eagerly awaited signs that the Federal Reserve's rate hiking cycle is approaching its end. Mixed economic data played a role, with Thursday's U.S. jobless claims hitting their highest level since October 2021, while producer prices rose less than anticipated, indicating that policy tightening measures might finally be taking effect. The market's sideways movement can be attributed to the high risk of a recession, yet a lack of concrete evidence in the hard data.

Fixed income Despite the Federal Reserve's aggressive tightening measures, inflation remains high, leading to a delicate balancing act for policymakers to avoid a recession. As a result, swap traders are now pricing in a higher chance of an interest rate hike at the next Federal Reserve meeting. This uncertainty contributed to the climb in yields, with the two-year reaching 4.00% and the 10-year rising to 3.45% on Friday.

Commodities: Oil futures settled lower on Friday, extending a four-week decline as concerns over the global economic outlook and uncertain demand weighed on prices. Additionally, doubts surrounding Asian economic growth, weaker refinery margins, and supply dynamics contributed to the negative sentiment. Analysts believe that resolving the debt ceiling crisis, increased activity in China, and improved inflation readings could potentially lead to a recovery in oil prices.

Performance (price return)

As of May 12, 2023

Macro developments

Canada – No Notable Releases

No notable releases in Canada this week

U.S. – U.S. Inflation Rate Drops to 4.9% in April, Modest Increase in U.S. Producer Prices in April

In April, the United States experienced a decline in its annual inflation rate, reaching 4.9%, the lowest since April 2021 and slightly below market predictions of 5%. Notably, food prices grew at a slower pace compared to the previous month, with a rate of 7.7% versus 8.5% in March. Energy costs also decreased further, including a notable decline in gasoline prices by 12.2% and fuel oil by 20.2%. Additionally, shelter costs, which constitute over 30% of the Consumer Price Index (CPI) basket, experienced a slowdown for the first time in two years, with a growth rate of 8.1% compared to 8.2%. Furthermore, prices for used cars and trucks continued to decline, dropping by 6.6% in April, a decrease from the previous month's 11.6% decline. On a monthly basis, the CPI rose by 0.4%, surpassing the 0.1% increase in March but aligning with market expectations. The largest contributors to the overall monthly increase in all items were shelter costs, followed by used cars and trucks, and gasoline.

In April, producer prices for final demand in the United States recorded a 0.2% month-over-month increase, following a revised 0.4% decline in March, which was lower than market expectations of a 0.3% rise. The rise in prices was primarily driven by a 0.3% increase in services costs, the largest since November. Notable price increases were also observed in food and alcohol wholesaling, outpatient care, loan services, hospital inpatient care, and guestroom rental. Furthermore, goods prices rose by 0.2%, largely influenced by an 8.4% surge in gasoline prices. On an annual basis, producer inflation continued to ease for the tenth consecutive month, reaching 2.3%, the lowest since January 2021, while the core rate dropped to 3.2%.

International – Germany's April Inflation Rate at 7.2%, UK Economy Sees Modest 0.1% Expansion in Q1 2023, China's Inflation Rate Falls to 0.1% in April, Japan's Composite PMI Shows Steady Expansion

Germany's annual inflation rate in April stood at 7.2%, a slight decrease from March's 7.4%. Food prices saw a significant surge of 17.2%, while energy prices accelerated. Excluding energy and food, the inflation rate was notably lower at 5.8%. The Consumer Price Index (CPI) rose by 0.4% compared to the previous month

The British economy expanded by 0.1% in the first quarter of 2023, matching market expectations and maintaining the same growth rate as in Q4 2022. The services sector, driven by information and communication as well as administrative and support service activities, grew by 0.1%. The construction sector saw a growth of 0.7% and manufacturing increased by 0.5%, led by basic metals and computer-related products. However, there were declines in sectors such as education, health, public administration, and transport.

China's annual inflation rate dropped to 0.1% in April 2023, the lowest since February 2021. Both food and non-food prices eased, with food inflation reaching a 13-month low due to lower pork and fresh vegetable prices. Non-food prices also decreased, driven by declines in transport and housing costs. Core consumer prices remained steady, but overall consumer prices unexpectedly fell by 0.1% monthly for the third consecutive month.

Japan's Composite PMI for April 2023 was revised upward to 52.9, unchanged from March's nine-month high. The private sector output expanded for the fifth consecutive month, driven by strong service sector growth. New orders increased at the fastest pace since November 2021, and job creation remained positive. Input cost inflation slowed, but output charges rose, resulting in the highest overall inflation rate since September 2007.

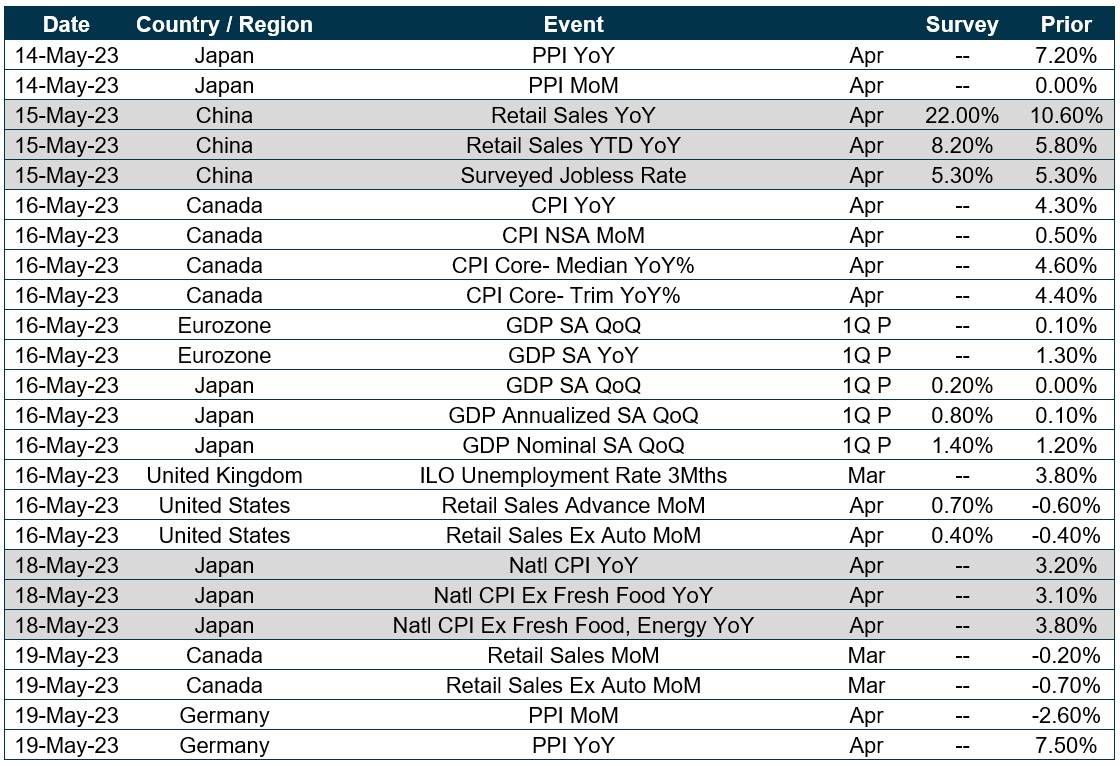

Quick look ahead

As of May 12, 2023