Weekly Market Pulse - Week ending October 6, 2023

Market developments

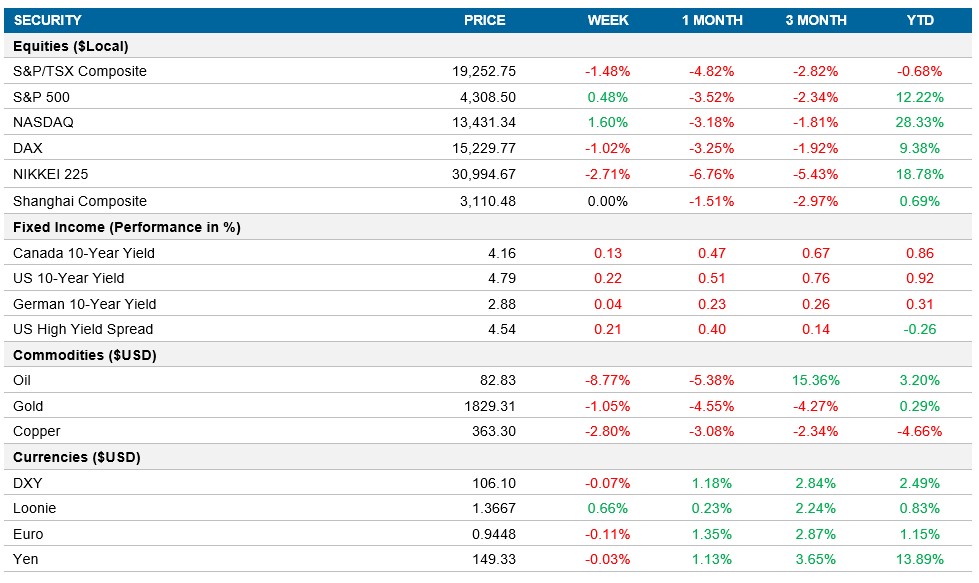

Equities: Mega-cap tech stocks, including Microsoft, Apple, and Nvidia, propelled U.S. stock benchmarks higher, with the S&P 500 gaining 0.5% and the Nasdaq climbing 1.6% on the week. This rally followed a stronger-than-expected nonfarm payrolls report for September, with 336,000 jobs added and a steady unemployment rate of 3.8%. However, market opinions on the outlook diverged, with some strategists suggesting it's the right time to buy global stocks while others predict a bond rally next year as higher interest rates may trigger a recession.

Fixed income: Credit markets faced their worst week since the global banking turmoil in March, as a strong jobs report pushed Treasury yields to their highest levels since 2007. The benchmark 10-year note saw yields spike up to 4.885%, causing pain for corporate borrowers. The primary junk-bond market saw no new issuance this week, and high-yield bonds had their worst weekly loss since February. The U.S. and Canadian 10yr government yields both ended the week 22bps and 13bps higher respectively.

Commodities: Oil futures saw a modest uptick on Friday, with U.S. prices gaining 0.6%, but they posted an 8.8% loss for the week. This drop was partly attributed to a weekly increase in gasoline inventories, signaling a correction in the oil market. However, strong employment numbers suggested that despite initial concerns about interest rates, the underlying economy remained robust, potentially supporting oil demand. Oil settled at $82.83 per barrel.

Performance (price return)

As of October 6, 2023

Macro developments

Canada – Canadian Manufacturing PMI Contracts Sharply, Canada’s labour market adds more jobs than expected

The S&P Global Canada Manufacturing PMI for September 2023 dropped to 47.5, marking the fifth consecutive contraction in Canadian factory activity and the sharpest decline since the pandemic-driven crash in 2020. Higher interest rates from the Bank of Canada appeared to be impacting demand for factory goods, with new orders contracting significantly, leading to a steep decline in production and job cuts. Input inflation remained, leading to higher output charges.

Canada's labour market outperformed expectations in September, adding 63,800 jobs and maintaining a 5.5% unemployment rate. Wage growth for permanent employees rose to 5.3%, showing strong job gains and wage growth despite higher interest rates. Bank of Canada is watching for signs of rebalancing in the economy. The strong jobs report may complicate efforts to control inflation. Population growth due to immigration continues to drive employment growth. Job gains were seen in various sectors and provinces, with some exceptions like finance and construction.

U.S. – U.S. Manufacturing PMI Shows Improvement, U.S. Services PMI Indicates Continued Expansion, U.S. labour market remains resilient

The ISM Manufacturing PMI for September 2023 in the U.S. rose to 49, reflecting the slowest contraction in the manufacturing sector in ten months, despite still indicating nearly a year of consecutive contractions. New orders declined at a slower pace, and production rebounded, supported by the depletion of backlogs. Employment also improved, while prices fell for the fifth straight month, potentially benefiting manufacturers' margins.

The ISM Services PMI for September 2023 eased slightly to 53.6, still marking the ninth consecutive expansion in the service sector. Business activity advanced sharply, but the backlog of orders contracted, and new order growth slowed. Prices continued to rise, mainly due to high labour costs and increased energy costs.

U.S. employment in September unexpectedly surged by 336,000 jobs, maintaining a strong labour market, and supporting the case for a Federal Reserve interest-rate hike. The unemployment rate remained at 3.8%, and wages saw modest growth. This robust job market indicates business confidence, though it could potentially contribute to inflationary pressures. The broad-based hiring included sectors like leisure, health care, and professional services. This news led to a surge in Treasury yields, a drop in stock futures, and a stronger dollar, increasing the likelihood of a rate hike by year-end. However, the surge in yields may have long-term economic consequences by raising borrowing costs for consumers and businesses, despite modest wage growth.

International – Eurozone Retail Sales Decline, Eurozone Unemployment Rate Hits Record Low

Retail sales in the Eurozone fell by 1.2% in August 2023, following a 0.1% decrease in July. Sales of automotive fuel and various products declined, including food, drinks, and non-food items. Online trade also saw a decline, contributing to the 11th consecutive month of contraction in yearly retail sales.

The Eurozone seasonally adjusted unemployment rate reached a record low of 6.4% in August 2023. Germany had the lowest jobless rate at 3%, while Spain, Italy, and France had higher rates. Youth unemployment also reached an all-time low of 13.8%. These figures indicated positive trends in the Eurozone labour market.

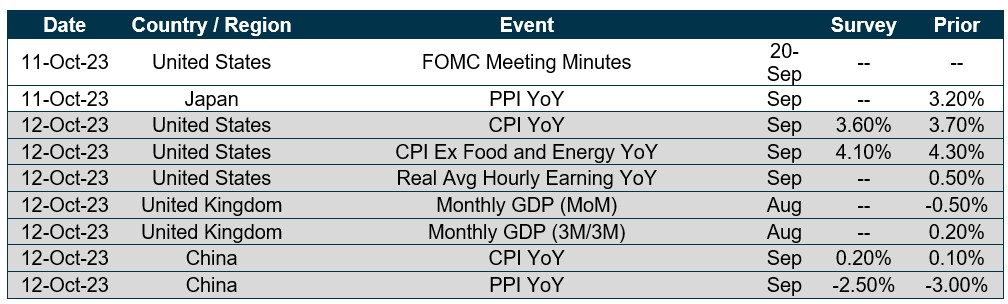

Quick look ahead

As of October 6, 2023