Weekly Market Pulse - Week ending October 18, 2024

Market developments

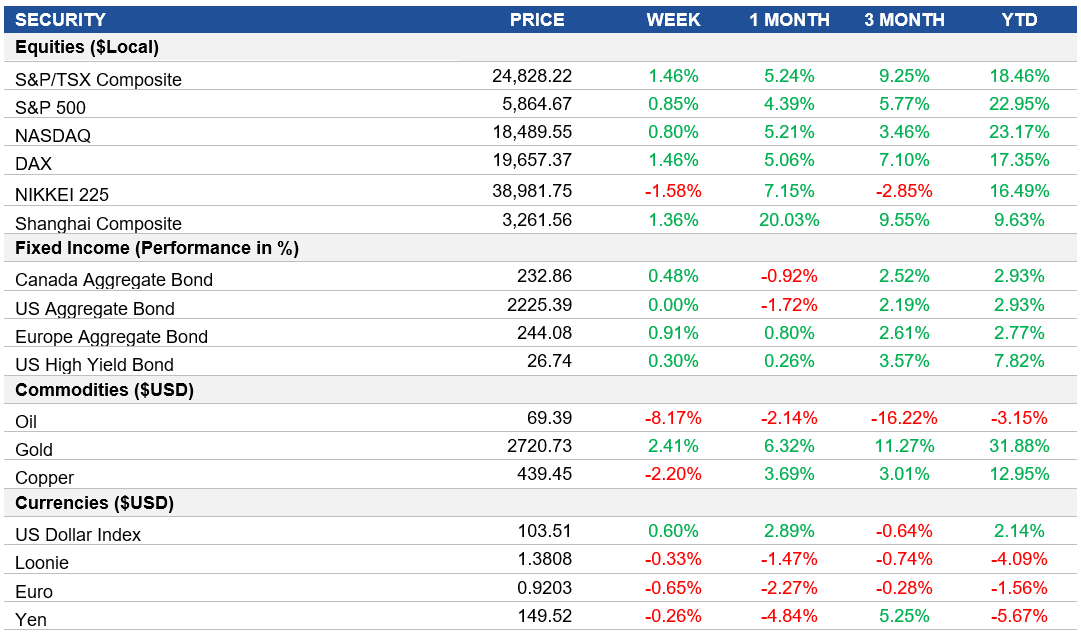

Equities: The S&P 500 and Nasdaq Index rose ~0.80%, while the TSX climbed nearly 1.5%. Netflix's stock surged 11%, marking its best session since January after it reported adding over 5 million new subscribers in Q3. U.S.-listed Chinese stocks rallied to close out the week following President Xi Jinping's commitment to support the tech sector, contributing to overall market optimism.

Fixed Income: Analysts suggest that strong economic data could complicate the Fed's decision-making regarding rate cuts. Some noted that a pause in rate cuts would require consistently strong economic reports leading up to November. The euro weakened as expectations grew for a significant rate cut from the European Central Bank, while the Japanese yen approached levels that may prompt intervention from Japan's authorities

Commodities: Oil had a weekly decline, influenced by geopolitical tensions in the Middle East following the death of Hamas leader Yahya Sinwar. Gold has surpassed $2,700 an ounce for the first time, as investors seek safe havens amidst escalating conflicts and a tight U.S. election environment.

Performance (price return)

Source: Bloomberg, as of October 18, 2024

Macro developments

Canada – Inflation Eases Sharply in September

Canada's inflation dropped to 1.6% in September, down from 2% in August, marking the lowest since February 2021. Lower gasoline prices drove the decrease, leading to deflation in transportation, while shelter costs slowed. However, food prices saw a slight increase.

U.S. – Retail Sales Surge in September

Retail sales increased by 0.4% in September, surpassing expectations. Growth was seen in clothing, health, and food-related sectors, while electronics and gasoline station sales dropped. Sales excluding specific sectors, key for GDP calculation, rose by 0.7%.

International – U.K. Inflation Hits Lowest Since April 2021, U.K. Unemployment Rate Drops to 4.0%, U.K. Retail Sales Surprise with 0.3% Growth in September, ECB Lowers Rates Again as Eurozone Inflation Falls Below Target, Japan’s Inflation Slows After Four Months of Growth, China’s Inflation Declines Amid Deflation Risks, China Retail Sales Accelerate in September

The U.K.’s inflation fell to 1.7% in September, largely due to declining transport and fuel costs. Housing and utilities prices also dropped, while food and beverage prices rose slightly. Services inflation eased, contributing to the overall decrease.

The unemployment rate in the U.K. declined to 4.0% from June to August, with 141,000 fewer unemployed people. Employment surged to a record high, with increases in both full-time and part-time jobs. Economic inactivity also decreased slightly.

U.K. retail sales unexpectedly rose by 0.3% in September, driven by strong performance in non-food stores, particularly in technology retail. However, supermarket sales dropped significantly due to poor weather and reduced luxury food purchases.

The European Central Bank cut its key interest rates by 25 basis points in October. This follows progress in reducing inflation, which fell below the ECB’s 2% target. The ECB expects short-term inflation spikes but aims for further reductions in 2025.

Japan’s core consumer price index rose 2.4% in September, slightly above expectations but marking a slowdown in inflation growth. The Bank of Japan remains cautious about further rate hikes, emphasizing a gradual approach given global uncertainties.

China’s inflation rate fell to 0.4% in September, the lowest in months. Declining transport and housing costs, coupled with slower growth in health and education, contributed to this drop. Food prices, however, saw the fastest rise in 20 months.

Retail sales in China grew by 3.2% year-on-year in September, the strongest rise since May. Key growth sectors included food, personal care, and household appliances. The decline in clothing and jewelry sales slowed, while automobile sales rebounded slightly.

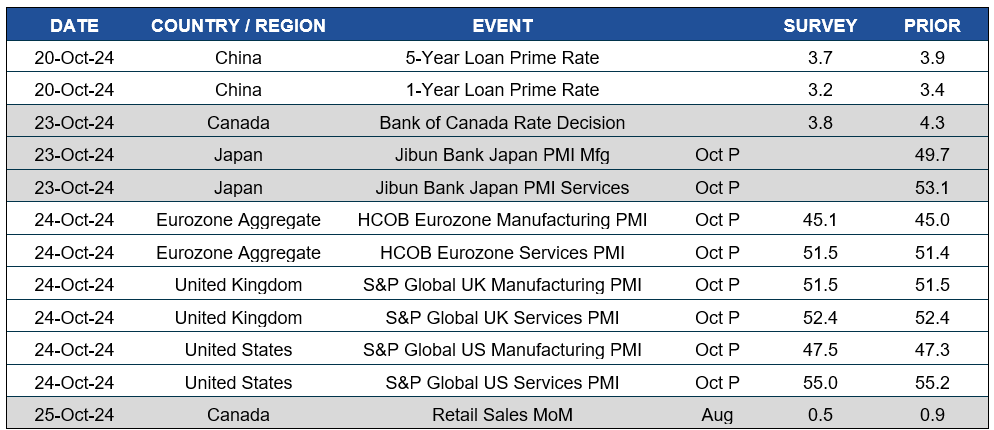

Quick look ahead

As of October 18, 2024